In the ever-evolving landscape of cryptocurrency markets, the bitcoin price today has taken a notable turn, descending to the $60,000 mark. This movement has captured the attention of investors and analysts alike, given the pivotal role of Bitcoin in the digital currency space. The fluctuation in the BTC/USD exchange rate is a vivid reminder of the inherent volatility that characterizes these markets. Understanding the factors that lead to such shifts is crucial for those looking to navigate the complexities of cryptocurrency investments.

This article aims to dissect the recent drop in the bitcoin price usd, exploring various facets including the bitcoin price chart, bitcoin price analysis, and the potential bitcoin price forecast. Further, it will examine the ripple effect of this movement on market reactions, altcoin performance, and the broader implications for the cryptocurrency market as a whole. Insights into the relationship between Bitcoin’s value against the US Dollar, the significance of the RSI (Relative Strength Index), and the impact of US Dollar strength on BTC prices will also be discussed, providing a comprehensive overview of what’s next for Bitcoin’s valuation.

Bitcoin Price Movement

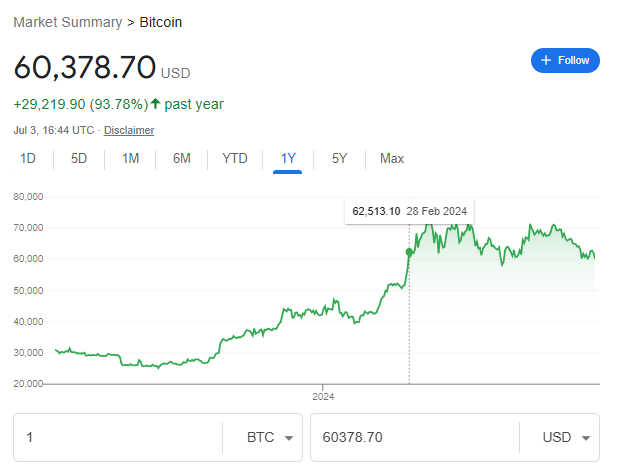

Current Slide to $60K

Bitcoin’s price has recently experienced a significant downturn, with a notable decline to the $60K level. This recent slide can be attributed to various market dynamics, including forced liquidations and a shift by investors towards more stable alternatives such as stablecoins. The immediate impact was a sharp 4% drop, with Bitcoin hitting a daily low of around $59,712 during the early New York session. This downturn is part of a broader trend observed over the quarter, with Bitcoin’s price showing a nearly 18% decline.

Recent Historical Prices

Looking back, Bitcoin has demonstrated a pattern of volatile price movements. In 2021, Bitcoin’s price surged, reaching new highs of over $60,000 as institutional interest peaked following the public listing of major exchanges. However, the price faced significant corrections, particularly influenced by macroeconomic factors and regulatory announcements. For instance, the anticipation of creditor repayments from the defunct Mt. Gox exchange has recently pressured the price below the $60,000 support level, signaling potential further corrections.

Trading Volumes

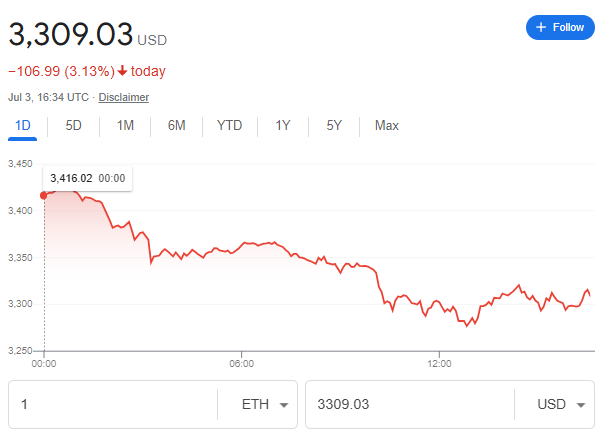

Trading volumes have also reflected the market’s reaction to recent price movements. Bitcoin and Ethereum combined reported a daily average trading volume of approximately $38 billion, a figure that contrasts sharply with the higher trading volumes seen in the stablecoin market. This shift indicates a cautious approach by investors, preferring liquidity and stability in uncertain times. Additionally, the trading volumes of crypto exchange-traded funds, particularly Bitcoin, have seen a significant decrease, further indicating reduced investor confidence and market activity.

Market Reactions

Institutional Reactions

Institutional investors have shown a nuanced response to the recent Bitcoin price fluctuations. Notably, the introduction of spot Bitcoin ETFs has facilitated easier market entry, attracting institutional money which is believed to stabilize the market. Market analysts like Nelson highlight the maturity developing in the crypto space, largely attributed to institutional investments which are expected to temper volatility by fostering increased demand through sales to retail investors. Additionally, the presence of large withdrawals of ethereum from platforms like Coinbase, which are not sales but strategic repositions for potential future gains, underscores the strategic maneuvers institutions are engaging in within the market.

Retail Investor Response

Retail investors are reacting with caution, as evidenced by the trading behaviors around Bitcoin ETFs. With the average entry price of U.S. spot BTC ETFs between $60,000 and $61,000, any dip below this range is seen as a trigger for a possible wave of liquidations, which adds to the cautious stance among retail investors. The shift towards retail buying in recent weeks, as noted by entities like Blackrock, further illustrates the growing participation of retail investors in the cryptocurrency market, despite the overarching market volatility.

Comments from Analysts

Analysts have been vocal about the current market dynamics and the implications of institutional and retail behaviors. The significant outflows from Bitcoin investment products, amounting to approximately $1.1 billion over two weeks, are indicative of a broader sentiment of caution and pessimism among investors, likely influenced by macroeconomic factors and policy anticipation from the United States Federal Reserve. Analysts like Thielen from 10x Research have pointed out that the market is currently experiencing a re-testing of critical support levels, which could lead to further liquidations if these levels fail to hold. This analytical perspective is crucial for understanding the potential future movements in the Bitcoin market and preparing for possible scenarios that may unfold.

Altcoin Performance

Overview of Major Altcoins

The term “altcoin” encompasses all cryptocurrencies other than Bitcoin, each designed with specific technologies and objectives to address various needs not covered by Bitcoin. For instance, Ethereum introduced smart contracts to automate transactions without intermediaries, while Monero focuses on enhancing user privacy. This diversity in purpose and technology underpins the broad spectrum of altcoin functionalities, contributing to the richness of the cryptocurrency ecosystem.

Performance of Meme Coins

Meme coins, often created as part of the crypto culture for fun, have seen significant popularity and investment, particularly in tokens like Dogecoin (DOGE) and Shiba Inu (SHIB). These coins not only serve as digital currencies but also foster strong community support and sometimes real-world utility. For example, Shiba Inu has developed a comprehensive ecosystem including a decentralized exchange and a Layer-2 scaling solution. Despite their volatile nature, some meme coins have shown substantial market gains, offering high returns for investors willing to embrace their risks.

Best and Worst Performers

In a comparative analysis of investment strategies between Bitcoin and altcoins, a hypothetical investment of $10,000 spread across the top 10 altcoins a year ago would have yielded about $194,730 today. This contrasts sharply with a Bitcoin-only investment strategy which would have resulted in $86,000, assuming no due diligence and simply picking coins by market capitalization size. Among these, Ethereum (ETH) and Ripple (XRP) dramatically outperformed other altcoins with returns of 2,900% and 2,400%, respectively. Conversely, some altcoins like Augur (REP) and Maidsafe (MAID) showed relatively lower returns of 360% and 380%, respectively, which were still profitable but did not match the high performers.

This stark variance in performance highlights the potential for significant profits in the altcoin market, albeit accompanied by higher risks and volatility compared to Bitcoin. Investors are advised to conduct thorough research and consider market trends and technological advancements before committing to altcoin investments.

Market Factors

Influence of External Factors

Global economic instability significantly impacts Bitcoin’s price, as investors often turn to Bitcoin as a safe haven similar to ‘digital gold’ during times of economic uncertainty. Historical events like Brexit and the US-China trade war have seen Bitcoin prices rally as traditional assets became volatile. Additionally, international sanctions and trade restrictions can lead to increased Bitcoin adoption in affected regions, further driving up demand and price.

Economic Impacts

Bitcoin’s appeal as a hedge against inflation is enhanced during periods of excessive fiat currency printing by central banks. With its supply capped at 21 million, Bitcoin inherently resists inflation, which can drive its price upward when inflation fears escalate. Interest rates set by central banks also play a crucial role; lower interest rates make traditional savings less attractive, potentially pushing investors towards higher-return assets like Bitcoin. Economic growth also influences Bitcoin’s value, with increased risk appetite in robust economic times boosting its price, while economic downturns can lead to sell-offs.

Market Sentiments

The supply and demand dynamics are primary drivers of Bitcoin’s price. A limited supply coupled with increasing demand can lead to price surges, while high supply with low demand may depress prices. Market sentiment, heavily influenced by media coverage and regulatory changes, also plays a critical role. Positive news can quickly elevate prices, whereas negative news can lead to sharp declines. Notably, regulatory developments and actions by influential figures or entities can cause significant market reactions, as seen with China’s trading and transaction bans.

Conclusion

The discourse surrounding Bitcoin’s current price tumbling to the $60,000 mark has provided a broad spectrum analysis encompassing the intricacies of market reactions, institutional and retail investor behavior, and the ripple effects on the altcoin ecosystem. Through a detailed examination of underlying factors driving the recent price fluctuations, including macroeconomic influences, investor sentiment, and technical indicators, the article has illuminated the volatile nature of cryptocurrency markets and underscored the significance of strategic investment decisions. It is this volatility, alongside the dynamic interplay between market forces and blockchain technology advancements, that continues to attract both seasoned and novice investors to the digital currency landscape.

As we look towards the future, understanding the potential trajectories for Bitcoin’s valuation necessitates not only a keen eye on market trends but also a readiness to adapt to the evolving regulatory and economic environments. The implications of Bitcoin’s recent price movement extend beyond mere numerical analysis, offering insights into larger trends within the cryptocurrency sector and the broader financial ecosystem. While the path ahead may be fraught with uncertainty, it remains clear that the journey of Bitcoin and the cryptocurrency market at large is far from reaching its conclusion. Embracing both the opportunities and challenges that lie ahead will be key for investors aiming to navigate the complexities of the digital currency space.