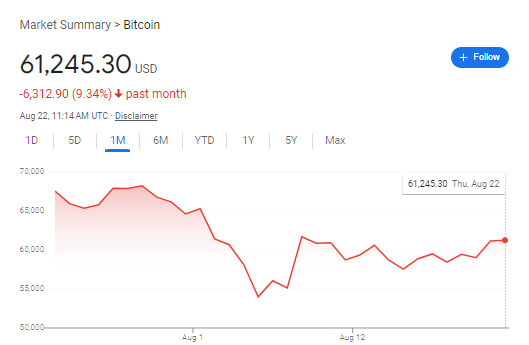

Bitcoin, the world’s leading cryptocurrency, has experienced a significant price decline over the past month, shedding 9.34% of its value and currently trading at $61,245.30. This downturn has sparked concerns among investors and enthusiasts alike, prompting a deeper examination of the factors contributing to this recent slide. In this comprehensive analysis, we will explore the macroeconomic headwinds, regulatory uncertainties, and technical market dynamics that have converged to create this challenging environment for Bitcoin.

Bitcoin’s Price Decline: A Deep Dive into the Contributing Factors

Macroeconomic Headwinds Impacting Bitcoin’s Price

The broader macroeconomic landscape has played a crucial role in shaping Bitcoin’s recent price trajectory. Several key factors within this domain have exerted downward pressure on the cryptocurrency’s value:

Rising US Treasury Yields: Safe haven appeal draws investors away from Bitcoin

As yields on US Treasury bonds have steadily risen, they have become increasingly attractive to investors seeking safer assets with guaranteed returns. This shift towards traditional safe havens has diverted capital away from riskier assets like Bitcoin, contributing to its price decline.

Stronger US Dollar: Makes Bitcoin more expensive for foreign buyers

The US dollar has exhibited strength in recent weeks, making Bitcoin more expensive for buyers using other currencies. This increased cost can dampen demand, particularly from international investors, and put downward pressure on Bitcoin’s price.

Global Economic Uncertainty: Fears of slowdown dampen investor sentiment

Concerns about the global economic outlook, particularly regarding the potential slowdown in China, have also cast a shadow over the cryptocurrency market. Investors tend to shy away from riskier assets like Bitcoin during periods of economic uncertainty, seeking refuge in more stable investments.

Regulatory Uncertainty Casts a Shadow on the Crypto Market

The regulatory landscape surrounding cryptocurrencies remains a significant source of uncertainty, particularly in the United States. This ongoing ambiguity has created a sense of unease among investors and traders, contributing to market volatility and downward price pressure.

Ongoing US Regulatory Landscape: Creates unease among investors and traders

The lack of clear regulatory guidelines from US authorities has left the crypto market in a state of flux. Concerns about potential crackdowns, restrictions, or even outright bans have led to a cautious approach among investors, hindering widespread adoption and dampening market sentiment.

Potential Crackdowns and Restrictions: Looming threat adds to market volatility

Recent regulatory actions, such as the SEC’s lawsuits against major cryptocurrency exchanges, have further fueled concerns about the future of the industry. The possibility of increased scrutiny and stricter regulations has created an environment of uncertainty, leading to increased selling pressure and price declines.

Technical Factors and Market Sentiment Contribute to the Downturn

Beyond macroeconomic and regulatory influences, technical factors and market sentiment have also played a role in Bitcoin’s recent price decline.

Break of Key Support Levels: Triggers further selling pressure

Bitcoin’s price recently breached important technical support levels, signaling a potential bearish trend. This breakdown can trigger further selling as traders and investors interpret it as a negative signal, leading to a cascading effect on the price.

Negative Market Sentiment: Widespread selling across the crypto market

The overall sentiment in the cryptocurrency market has turned bearish, with widespread selling observed across various digital assets. This negative sentiment can spill over into Bitcoin, contributing to its price decline as investors become more risk-averse.

Lack of Positive Catalysts: Absence of major positive news impacts buying activity

In recent weeks, there has been a dearth of major positive developments that could stimulate significant buying activity and boost Bitcoin’s price. The absence of such catalysts can leave the market susceptible to downward pressure, particularly in the face of other negative influences.

Conclusion

Bitcoin’s recent price decline to $61,245.30 can be attributed to a confluence of factors, including macroeconomic headwinds, regulatory uncertainties, and technical market dynamics. Rising US Treasury yields, a stronger US dollar, and global economic concerns have created a challenging environment for riskier assets like Bitcoin. Meanwhile, the ongoing regulatory ambiguity in the US and the recent crackdown on major exchanges have fueled investor unease. Furthermore, the break of key technical support levels and negative market sentiment have exacerbated the downward pressure on Bitcoin’s price.

It’s important to remember that the cryptocurrency market is inherently volatile, and prices can fluctuate significantly in response to various events and news. While the current outlook may seem bleak, it’s crucial to maintain a long-term perspective and conduct thorough research before making any investment decisions. By staying informed and understanding the factors that influence Bitcoin’s price, investors can navigate this complex market with greater confidence and make more informed choices.