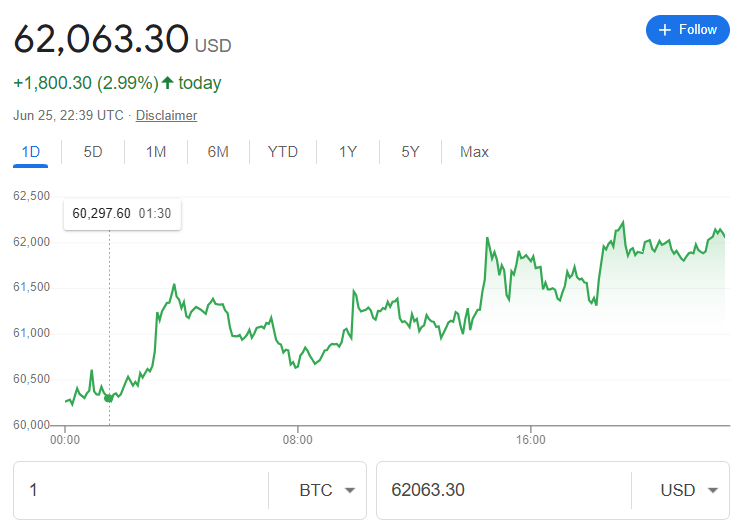

In the dynamic realm of cryptocurrency markets, the bitcoin price today stands as a crucial focal point for both seasoned investors and newcomers. Currently registering a significant upsurge of 2.99% in the past 24 hours, reaching a noteworthy value of 62,063.30 USD, this development sparks interest across financial spectrums. The volatile nature of Bitcoin, epitomized by its BTC/USD pair, not only reflects the fluctuating market sentiments but also the broader economic indicators such as US Dollar strength. This price movement is a microcosm of the cryptocurrency’s larger trend of resilience and volatility, underscoring why understanding the live bitcoin price is vital for strategic investment decisions.

The article will delve into a comprehensive analysis of the current bitcoin price, utilizing technical indicators such as RSI (Relative Strength Index), examining corrections, and unpacking the underlying market structure to interpret the recent price action. It aims to provide a granular look at the factors driving the bitcoin price today, including US Dollar strength against BTC and wider market volatility. Additionally, insights from experts will shed light on the potential future movements of bitcoin price, offering readers a well-rounded perspective on the live bitcoin price. Through this exploration, the article aims to equip readers with the knowledge to navigate the complexities of the BTC/USD market with greater acumen.

Current Bitcoin Price Analysis

Overview of Recent Trends

Bitcoin’s price trajectory has shown significant fluctuations over recent years. Notably, in March 2024, Bitcoin reached an all-time high of over 73,000 USD, largely influenced by the approval of Bitcoin ETFs in the United States. This peak is a stark contrast to June 2024, when the price adjusted to approximately 60,277.41 USD following the bankruptcy of the crypto exchange FTX. These shifts highlight the impact of institutional movements and market sentiments on Bitcoin’s valuation.

Impact of Market News on Price

Market news significantly influences Bitcoin’s price dynamics. For instance, the announcement of the Mt. Gox trustee planning to return over 140,000 BTC to clients in July has stirred market speculation about potential selling pressure. This situation is compounded by the anticipation that a large portion of these returned bitcoins might not immediately impact the market as expected. Research suggests that many creditors might opt for early payouts, potentially stabilizing the price despite the large volume of Bitcoin re-entering the market.

Furthermore, recent data indicates that Bitcoin’s market sentiment is currently mixed, with a Bearish Bullish indicator at 44% and the Fear & Greed Index showing a neutral stance at 51. These indicators reflect the ongoing uncertainty and the diverse factors affecting the market, including economic concerns and specific events like the shutdown of Binance Connect. Such developments underscore the complexity of predicting Bitcoin’s short-term price movements, emphasizing the need for investors to stay informed about current market conditions and news.

Technical Indicators and Market Sentiment

Relative Strength Index (RSI)

The Relative Strength Index, developed by J. Welles Wilder in 1978, is a crucial tool for traders, especially in the volatile cryptocurrency market. This momentum oscillator operates on a scale from 0 to 100 and is instrumental in identifying overbought or oversold conditions. Typically, a reading above 70 suggests an overbought scenario, potentially signaling a price correction, while a value below 30 may indicate an oversold condition, hinting at a price rebound.

Support and Resistance Levels

Support and resistance levels are foundational components of technical analysis, providing key insights into potential price movements based on historical price actions. These levels are identified where the price has historically reacted by reversing or slowing down. TradingView’s smart drawing tool helps users visually identify these levels on charts, enhancing their trading strategies. Additionally, pivot points, which are calculated using the day’s high, low, and close prices, serve as vital indicators for intraday support and resistance levels, offering traders critical insights into potential entry and exit points.

Expert Opinions

Insights from Popular Analysts

Max Keiser, a well-known financial broadcaster and advocate for Bitcoin, predicts a value of $200K for Bitcoin in 2024. Similarly, Fidelity’s Director of Global Macro, Jurrien Timmer, suggests that the price of a single Bitcoin could soar to $1 billion by the years 2038 to 2040. Chamath Palihapitiya, a venture capitalist and early Bitcoin investor, also shares a positive outlook, highlighting the substantial potential for growth and adoption of Bitcoin.

Market Predictions

Predictions on Bitcoin’s future value vary greatly among experts. Some analysts, like those from Pantera Capital and Chartered Bank, forecast that Bitcoin could reach as high as $150K and $120K respectively by 2024, largely due to the anticipated halving event. This event is historically seen as a bullish catalyst within the blockchain industry. On the other hand, Cathie Wood of Ark Invest projects Bitcoin’s price could hit an astonishing $1.48 million by 2030, emphasizing the asset’s increasing utility and potential integration into broader financial systems.

Conclusion

Throughout this article, we’ve explored the multifaceted nature of Bitcoin’s current market dynamics, analyzing the significant increase in its price and the various elements influencing this movement. From the technical analysis represented by the RSI and support and resistance levels to the broader economic indicators and market sentiments, we’ve seen how intricate and volatile the cryptocurrency landscape can be. The insights from renowned analysts and the forward-looking market predictions further enrich our understanding of Bitcoin’s potential trajectory, offering a comprehensive guide for navigating investment decisions within this complex market.

Reflecting on the broader implications, the recent price trends and expert opinions underscore the resilient yet unpredictable essence of Bitcoin. As the digital currency continues to navigate through regulatory landscapes, technological advancements, and geopolitical shifts, its role within the global financial ecosystem is undoubtedly evolving. This analysis not only reaffirms the importance of staying informed about the latest market developments but also highlights the significant potential for future growth and adoption. In closing, the journey of Bitcoin is far from over; it remains a compelling subject for investors, analysts, and enthusiasts aiming to grasp the opportunities of the cryptocurrency world.