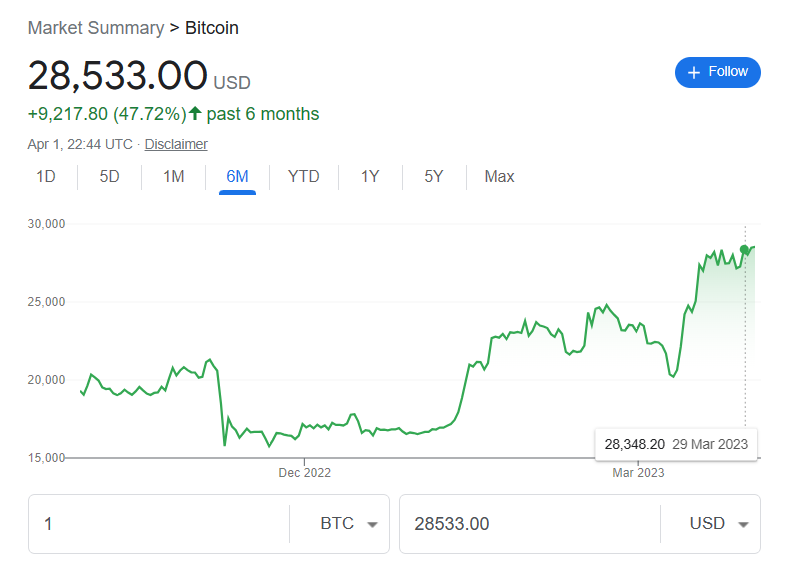

Regulation is indeed important, especially for companies like Credit Suisse that have experienced a significant decline in their stock prices in the past six months [1]. On the other hand, Bitcoin has seen a notable increase in its value during the same period [1]. It is worth noting that the importance of regulation has been emphasized in recent years, with the introduction of regulations such as Regulation Best Interest (Reg BI) in the United States [2]. In fact, the World Trade Organization has published a report on trade policies in Switzerland and Liechtenstein, highlighting the role of regulatory frameworks in promoting economic growth and development [3].

References:

[1] DOGNESS (INTERNATIONAL) : NO. 16 N. DONGKE … [2] committee on budget and finance [3] RESTRICTED – WT/TPR/S/425 23 March 2022Bitcoin Price increased in past 6 months +47.72% to $28.533

The price of Bitcoin has increased by 47.72% in the past six months, reaching a value of $28,533 [1]. Bitcoin’s price history has been volatile, with several rallies and crashes since its inception [1]. The cryptocurrency’s price fluctuations primarily stem from investors and traders betting on an ever-increasing price in anticipation of riches, and institutions have created Bitcoin investment instruments [1]. The correlation of crypto assets like Bitcoin with traditional holdings like stocks has increased significantly, which limits their perceived risk diversification benefits and raises the risk of contagion across financial markets [2]. To mitigate the financial stability risks stemming from the crypto ecosystem, it is time to adopt a comprehensive, coordinated global regulatory framework to guide national regulation and supervision [2]. Some crypto analysts predict that Bitcoin could see a “managed bull market” in 2023 [3].

References:

[1] Bitcoin’s Price History [2] Crypto Prices Move More in Sync With Stocks, Posing New … [3] Why is the bitcoin (BTC) price rallying in January 2023?

Credit Suisse lost -77.95% in past 6 months. Currently, the stock price is 0.82 CHF

Credit Suisse’s stock price has been hit hard by a number of scandals and missteps, losing 77.95% in the past six months [3]. The bank’s largest shareholder, Saudi National Bank, said it could not provide further financial support due to regulatory issues, causing Credit Suisse’s shares to slump as much as 30% [2]. The Swiss National Bank has said it would provide additional liquidity to the bank if necessary [1]. Credit Suisse has been battling to recover from a number of scandals that have undermined investor confidence, and its plunging stock price has reignited concerns about the resilience of the global banking system [2]. As of the time of writing, the stock price of Credit Suisse is 0.82 CHF [3].

References:

[1] Financial shares fall as Credit Suisse becomes latest crisis … [2] Credit Suisse stock slump triggers close monitoring by … [3] Charting How Years of Stumbles Led to the End of Credit …