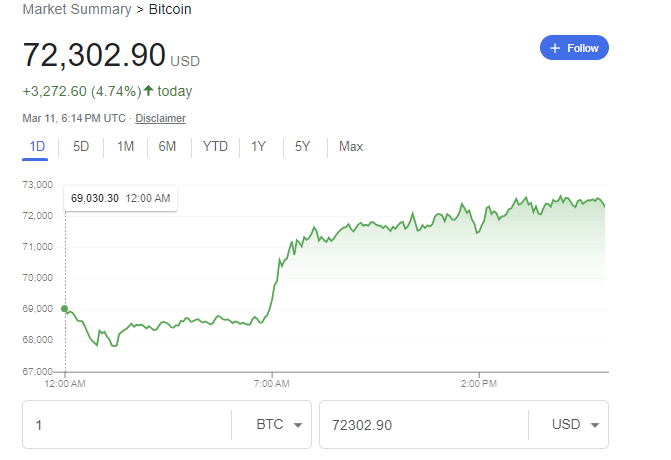

Crypto Market Update: The cryptocurrency market is always on the move, with prices fluctuating constantly. As of March 11th, 2024, Bitcoin and Ethereum have seen significant gains, with Bitcoin soaring by 4.75% and Ethereum by 4.11%. These impressive increases have caught the attention of investors and traders alike, as they eagerly anticipate what these changes mean for the future of the digital currency market. Let’s take a closer look at the recent developments in the crypto market and what these surges could indicate for the future.

Bitcoin on the Rise: Price Surge and Positive News Fuel Optimism

Bitcoin hodlers are in the celebratory mood today on the 11th 2024 having the prices go into an upswing and the good news is so far anchoring the gains.

Price on the Move: Totalling to the 10:40AM PDT, the Bitcoin is a course of trading of $69,855.22, showing increase of 1.85% within a 24th-hour period. This appears to be on the back of the recent sharp increase after which Bitcoin appeared to have broken its all-time high, hitting a new high of $72,000 on CoinDesk. It is an up-thrust evolution after consolidation period which followed the listing of the first US spot bitcoin ETFs. The first wave of panic selling trough seems to be already over, while the enthusiastic trader activity on market grounds now helping to boost the prices, as both individual and institutional investors are now buying again the cryptocurrency.

Market Cap Milestone: Prices of Bitcoin has increase at a soaring pace making a bump in its market capitalization. Market cap means that the total value of all Bitcoins extant holds that value The Bitcoin surge at the moment has managed to hit a market cap of over $1.4 trillion, making Bitcoin a valuable asset in terms of non-industrial assets than silver. It demonstrates Bitcoin’s growing acceptance by the market and its role as a global financial institution.

Institutional Interest Remains Strong: One of the factors that drive Bitcoin to be noticed globally at this moment is the fact that institutional investors are still very much pulled towards it. Simultaneously, MicroStrategy and other companies, using Bitcoin as a payment system, do not lag behind and build up their multimillion-dollar reserves of digital gold. In the recent period, Michael Saylor, Microsoft’s CEO, has again affirmed his bullish prediction saying that “Bitcoin is going to eat gold”, and this shows that he thinks that Bitcoin will go beyond gold act just to save. This wide scale adoption, which involves a variety of major players in this institutional field, brings an extra willingness to believe that bitcoin will keep growing.

Spot Bitcoin ETFs Gain Traction: The fact that spot ETFs emerged last year in the US have had a substantial positive impact on the latest ones. Such ETFs will enable the investors to express their opinions about Bitcoin through trading the ETFs without having to keep the actual ownership of the cryptocurrency itself. The primary Bitcoin ETFs, the ones launched by BlackRock and Fidelity, collectively had outstanding and the record monthly inflows in just the first month of their launch, which beat expectations and received more inflows than initially projected. Different experts rule out that these inflows have taken part in the recent price expansion. They add that the ETFs could be a decent tool that stimulates further popularization of the cryptocurrencies, like Bitcoin.

Regulations and Taxes Loom Large: The existing perception of Bitcoin looks promissing now, although there are still many challenges for Bitcoin itself to overcome. However, the issue of inconsistent regulatory framework threatens to stifle the evolution in the area of decentralized cryptocurrency as governments grapple with the best possible rules of regulating the crypto space. An interesting side note is that the US President has again brought up the topic of a crypto mining tax and a wash sale rule for digital assets in his new budget. Such regulations plan could to a certain extent deter the willingness of the investor in the near future On the other hand it is the broader impact of the regulations the companies are faced with that is at the moment still unclear.

Beyond the Price: One of the things is to take into account that bitcoin’s main promise is not in its price right now. The basing technology of blockchain underneath provides a final way of keeping transactions in the secure and transparent manner, but the financial services are not the only case where it can be applied. The constant updating of the Bitcoin network and the entire ecosystem that revolves around it will define the fate of this platform and decide whether it has got the potential to grow or fall.

Looking Ahead: A question mark still hangs over Bitcoin yet as the ongoing growth in its use indicates, there might be more boom times ahead. As institutions get on board with Bitcoin, ETFs take the spotlight, and its underlying tech is developed, Bitcoin can transform the future of finance in terms of usage and mainstream recognition. While this creates room for new forms of taxation, the regulation as well as the potential taxation might potentially become obstacles to be overcome. It is indeed quite captivating to identify the determinants that will influence the direction Bitcoin will take in the coming seasons and years ahead.

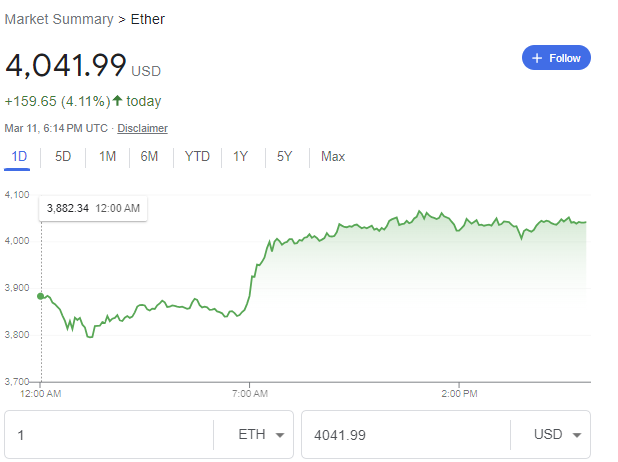

Ethereum: +4.11% at 4,041.99 USD

Bitcoin, the most topical coin in recent price spike, shows an overall fall from its peak of $69,000 while Ethereum, the world’s second largest digital asset, has a increase of 4.11%. Let’s see Ether wherein its price is $x today, March 11th, 2024. The most relevant news today regarding the most cryptocurrencies’ rollers are outlooks for Bitcoin growing.

Focus on Ethereum’s Utility: Although Bitcoin can be found in the spotlight of current events concerning price fluctuations, Ethereum’s emphasis on utility still remains another key factor of strength. Ethereum is a blockchain-based platform, which also serves as a transactional system like in Bitcoin, but also provides developers with the ability to create decentralized applications (dApps) and smart contacts. This comprehensive functionality exalts Ethereum as a contender against the existing scene including the imminent and decentralized Internet – Web3.

Ethereum Upgrade on the Horizon: Upgrading Ethereum version 2.0 is on the agenda of the Ethereum community, and hence, a considerable deal of excitement is building around it. This will be the solution to the scalability problems that currently hamper the network’s attaining the required level of dApps acceptance and smart contracts. The success will play as a huge role and the primary driver for the further continuity of the coins price growth.

News Affecting the Overall Crypto Market: As for today, the price of Ethereum is a little bit out of formation, but overall crypto market is extremely excited about Bitcoin’s and the surrounding news’ momentum:

- Bitcoin’s All-Time High: Bitcoin breaking the price barrier of $71,000 really put a smile on the faces of a number of market enthusiasts who see the golden age of crypto approaching. This supportive view can directly increase appeal for Ethereum but at the same time draw brand new specialists to the cryptocurrency market in general.

- Institutional Interest in Crypto: The engagement of these types of players by MicroStrategy is an important portent for the wider cryptocurrency stake, comprising Ethereum. Such a rising institutional adoption provides an additional point in favor of the market-making function of crypto assets in general and boosts their long-term recognition.

- Spot Bitcoin ETFs Gain Traction: The U.S. spot Bitcoin ETFs startup has attracted major investments. It is possible that the crypto market as a whole be influenced by these investments. Though those ETFs invest just in Bitcoin, they make the cryptocurrency much more visible and easier to approach to all major players directly and indirectly, like Ethereum.

- Regulations and Taxes: Regulatory problems with and taxation aspects of the digital money market are the major barriers to be eliminated. The US crypto mining tax as well as the new “wash sale rule” for digital assets could disrupt investors and the short run in the sense that they both affect Bitcoin and Ethereum.

The 10 crypto gainers and losers today

The crypto market has had a different outcome for some and loss for others today. It’s March 11th, 2024, and Here’s a look at the top 10 gainers and losers based on their percentage change over the past 24 hours:

Top Gainers:

| Gainers | Price | Market cap | 24h |

|---|---|---|---|

| $ 1.11 | $ 21.44 million | +134.87% | |

| $ 0.140 | $ 83.95 million | +72.80% | |

| $ 0.00624 | $ 19.10 million | +65.61% | |

| $ 0.0121 | $ 17.27 million | +65.03% | |

| $ 0.0202 | $ 191.75 million | +63.57% | |

| $ 0.596 | $ 59.57 million | +59.12% | |

| $ 0.000597 | $ 252.52 million | +56.18% | |

| $ 0.138 | $ 76.66 million | +55.58% | |

| $ 0.0₄0276 | $ 245.82 million | +44.04% | |

| $ 0.0₄0369 | $ 357.95 million | +43.46% | |

Top Losers:

| Losers | Price | Market cap | 24h |

|---|---|---|---|

| $ 36.03 | $ 31.24 million | -49.20% | |

| $ 0.0722 | $ 72.22 million | -44.88% | |

| $ 0.0448 | $ 223.81 million | -40.50% | |

| $ 0.0109 | $ 12.93 million | -39.66% | |

| $ 0.418 | $ 418.43 million | -35.81% | |

| $ 0.00364 | $ 18.13 million | -30.65% | |

| $ 0.682 | $ 4.10 million | -20.44% | |

| $ 5.73 | $ 60.94 million | -18.39% | |

| $ 0.0135 | $ 49.89 million | -16.13% | |

| $ 0.00329 | $ 16.76 million | -16.23% | |

Keep in mind that volatility is one of the characteristics of cryptocurrency market, and the price can rapidly change. The spirit of these sideways movements is generally the opposite direction, and cautious research is a very important move before taking the risk of investing in any cryptocurrency.