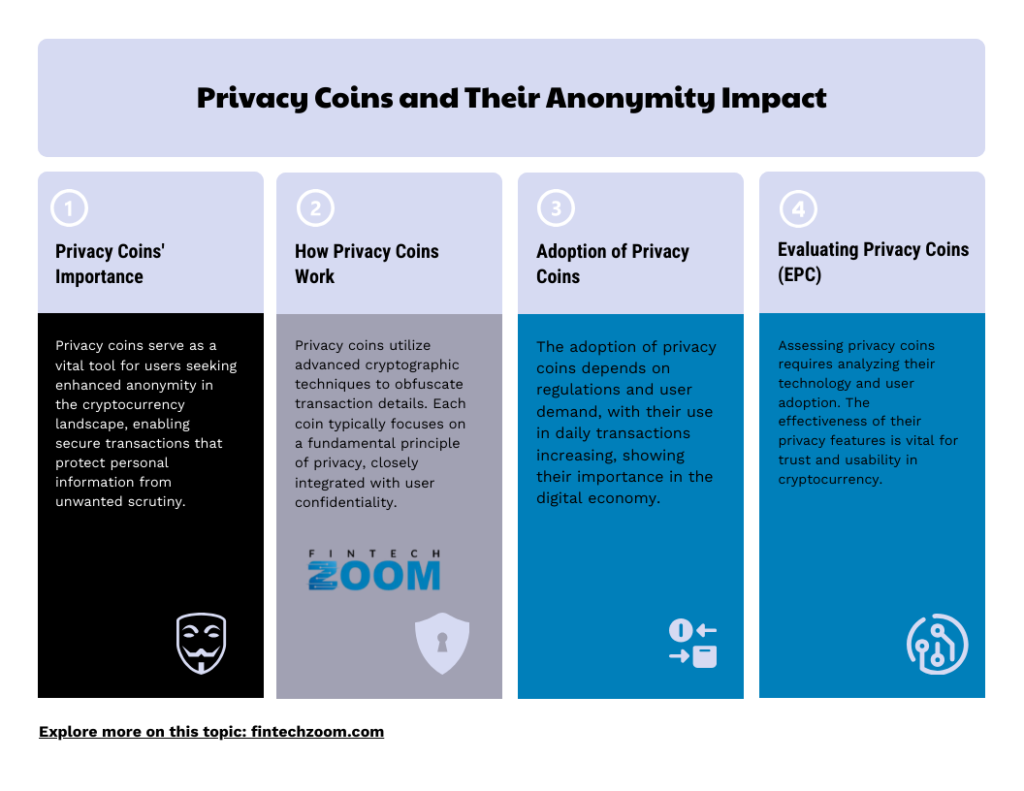

Privacy coins offer a significantly higher level of anonymity compared to more mainstream cryptocurrencies like Bitcoin or Ethereum. The degree of anonymity can vary depending on the specific coin and its implementation. This enhanced anonymity of privacy coins has made them increasingly popular among users.

Cryptocurrencies like Bitcoin are pseudonymous rather than truly anonymous, but using an untraceable crypto wallet can increase the anonymity of cryptocurrencies like Bitcoin. Kane Pepi states that anonymous wallets provide a private experience by generating new addresses for each transaction and using IP obfuscation. This means that wallet providers do not store user information or IP addresses, allowing you to easily send, receive, and store your cryptocurrencies without revealing your true identity.

Privacy coins, on the other hand, offer higher levels of anonymity from the get-go since the privacy features are often built-in and automatic. What sets them apart from traditional cryptocurrencies and anonymous crypto wallets is the methods used to ensure anonymity.

Understanding Privacy Coins

Privacy coins use advanced cryptographic techniques to hide transaction data. Unlike traditional cryptocurrencies, where transactions are publicly visible on a blockchain, privacy coins can mask the sender, recipient, and transaction amount information.

Zero-Knowledge Proofs (ZKP)

ZKPs are cryptographic methods that allow one party to prove to another party the truth of a statement without revealing any information beyond the fact that the validity of the statement itself. ZKPs can be used to verify transactions without revealing the sender, recipient, or amount. A prover can show that they have enough funds to transact without revealing their balance.

Different privacy coins use various types of ZKPs, such as Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge (zk-SNARKs) and Zero-Knowledge Scalable Transparent Arguments of Knowledge (zk-STARKs). For example, Zcash used zk-SNARKs to enable private transactions.

Ring Signatures

These involve a group of possible signers, including the actual signer. The signature is in a way that makes it impossible to determine which group member actually signed the transaction. In privacy coins, like Monero, ring signatures are used to mask the sender’s identity. When a user initiates a transaction, the system automatically groups their signature with several others, making it appear as if the transaction could have been sent by another member of the group.

Stealth Addresses

One-time addresses are generated for each transaction, making it difficult to track the flow of funds. When a sender wants to transfer funds, they use the recipient’s public key to generate a unique stealth address. The address is only known to the sender and recipient and the intended recipient. While the transaction is recorded on the blockchain, the recipient’s actual address remains hidden.

The Role of Privacy Coins in Strengthening Anonymity

The appeal of privacy coins offers a shield against various forms of financial tracking, including government surveillance. The feature is particularly valuable in countries with strict censorship or surveillance regimes.

Financial Privacy for Individuals

Many users choose privacy coins to protect their financial privacy. Unlike traditional banking systems or standard cryptocurrencies, privacy coins can help prevent the unauthorized disclosure of an individual’s wealth or spending habits. Privacy coins appeal to those who believe that financial information should remain private.

Safeguarding Against Targeted Attacks

The added layer of privacy makes it increasingly difficult for hackers to target specific individuals or organizations. By obscuring transaction details and user identities, privacy coins add an extra level of security against financially motivated cyberattacks.

Promoting Financial Freedom

In some countries, privacy coins can provide a means of economic participation for individuals who might otherwise be excluded from traditional financial systems due to political or social factors. However, this use case is somewhat complex and often exists in a legal gray area.

Concerns About Privacy Coins

While privacy coins offer significant benefits related to financial privacy anonymity, they also raised several concerns and faced criticism among regulators, law enforcement agencies, and policymakers. Yet, it is important to remember that privacy coins are not inherently malicious but can be used for both legitimate and illicit purposes.

Illicit Activities

Since privacy coins offer near-total anonymity, this enhanced privacy can potentially facilitate money laundering by making it difficult to trace the origin and destination of the funds. There are concerns that privacy coins can be used to sponsor terrorist activities, complicating any efforts to track and prevent such funding. Additionally, privacy coins may be used to conceal income and assets to avoid paying taxes. This makes it exceptionally challenging for tax authorities to enforce tax laws effectively.

Regulatory Challenges

Regulators and lawmakers have faced a neverending struggle to keep up with the incredible speed of innovation in the cryptocurrency space.

- Compliance with AML/KYC: The anonymity features of privacy coins can make it difficult for financial institutions and exchanges to comply with AML and KYC regulations.

- International cooperation: The decentralized nature of cryptocurrencies, especially privacy coins, can complicate international efforts to regulate and monitor financial transactions.

Ethics

- The balance between private and public good: There is an ongoing debate about how to balance privacy with the need for transparency to prevent and investigate criminal activities.

- Developer responsibility: The debate continues about the ethical responsibility of privacy coin developers and users to ensure that these technologies are not misused for harmful purposes.

- Societal impact: Some argue that the level of anonymity provided by privacy coins could undermine public trust in financial systems and obstruct legitimate law enforcement efforts.

Conclusion

Privacy coins are a significant advancement in the world of cryptocurrencies, offering higher levels of anonymity and financial privacy. However, privacy coins are a challenge for regulators and law enforcement agencies, fueling the ongoing debate on finding a balance between protecting individual privacy rights and maintaining the necessary oversight to prevent illicit activities.

In response to these concerns, various countries have taken different approaches. Countries like Japan and South Korea have implemented restrictions or blanket bans on privacy coins for domestic use. Other countries are exploring ways to rather regulate privacy coins while balancing privacy rights and law enforcement needs. Several countries, on the other hand, are investing in blockchain analysis tools that allow them to track and investigate suspicious transactions involving privacy coins.