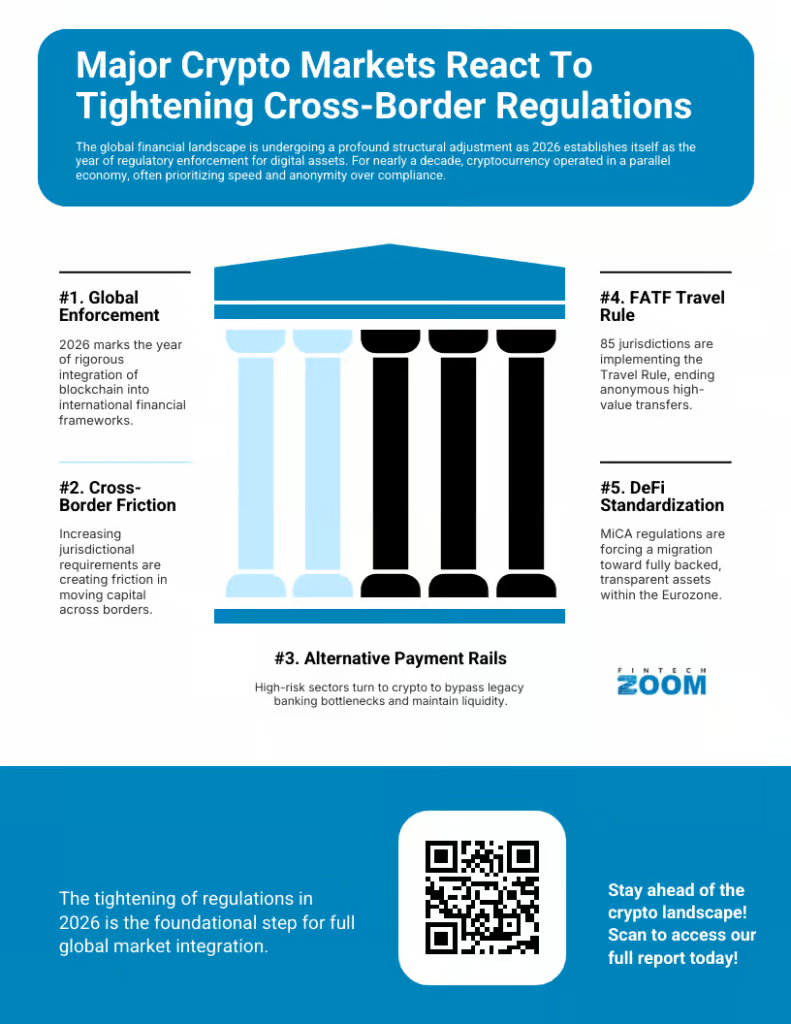

The global financial landscape is undergoing a profound structural adjustment as 2026 establishes itself as the year of regulatory enforcement for digital assets. For nearly a decade, cryptocurrency operated in a parallel economy, often prioritizing speed and anonymity over compliance. However, the current market environment is defined by a rigorous integration of blockchain technology into the established frameworks of international finance. This transition is not merely administrative; it is fundamentally altering transaction speeds, liquidity depth, and the strategic calculations of institutional investors.

As nations move from theoretical discussions to active enforcement, the friction involved in moving capital across borders is increasing. Market participants are discovering that the promise of instant, borderless settlement is now conditional upon navigating a complex web of jurisdictional requirements. While this maturation process validates the asset class, it simultaneously introduces operational latency that challenges the original ethos of decentralized finance. The tension between maintaining the efficiency of blockchain networks and satisfying anti-money laundering mandates has become the central narrative driving market behavior this year.

Alternative Payment Rails Gain Traction In High Risk Sectors

As major financial institutions de-risk their portfolios to avoid regulatory penalties, they often sever ties with legal but high-risk business categories. This withdrawal of banking support has inadvertently strengthened the utility case for cryptocurrency as a settlement layer for industries requiring censorship-resistant transaction methods.

For these sectors, the primary value proposition of digital assets remains their ability to bypass legacy banking bottlenecks. Industries that frequently encounter traditional banking friction, such as forex trading and offshore gambling, are increasingly relying on cryptocurrency to facilitate faster international settlements. By utilizing stablecoins and direct wallet transfers, these businesses can maintain liquidity and operational continuity without relying on correspondent banking networks that may be prone to freezing funds or delaying transfers for weeks. This usage pattern highlights a persistent demand for alternative payment rails that function outside the immediate purview of the tightening global banking dragnet.

Central Banks Propose Stricter Digital Asset Oversight Frameworks

The most significant driver of this market shift is the aggressive implementation of the Financial Action Task Force (FATF) Travel Rule. Previously, compliance was a patchwork of voluntary standards, but recent months have seen a coordinated global effort to close loopholes. Exchanges and wallet providers are now required to transmit detailed originator and beneficiary information for transactions exceeding specific thresholds, effectively ending the era of anonymous high-value transfers. This requirement forces Virtual Asset Service Providers (VASPs) to overhaul their technical infrastructure, often resulting in delayed settlement times as data is verified between counterparties.

The scale of this regulatory expansion is unprecedented. Recent data indicates that 85 of 117 jurisdictions have passed or are in the process of passing legislation implementing the Travel Rule, a figure that has risen sharply from just 65 jurisdictions in 2024. This surge in adoption creates a bifurcated market where compliant liquidity pools are deep but slower, while non-compliant avenues face increasing isolation. For global exchanges, the operational cost of maintaining distinct compliance protocols for dozens of different jurisdictions is compressing margins and driving consolidation within the industry.

Decentralized Finance Platforms Adjust To Emerging Compliance Standards

The decentralized finance (DeFi) sector, once considered immune to traditional oversight, is rapidly adapting to the new reality, particularly in the European Union. The full implementation of the Markets in Crypto-Assets (MiCA) regulation has forced stablecoin issuers to rethink their reserve models and transparency protocols. In response, liquidity is migrating away from unregulated algorithmic tokens toward fully backed, transparent assets that meet EU standards. This rotation is reshaping the composition of major trading pairs and altering the dominance of specific stablecoins in the Eurozone.

Market data reflects this decisive shift in user preference. Analysts have observed that Europe has seen a rotation toward MiCA-compliant stablecoins, with exchanges generally restricting access to non-compliant alternatives. This trend is creating a “compliance premium,” where regulated assets command higher trust and deeper integration with traditional banking rails, despite offering lower yields than their unregulated predecessors. Consequently, the DeFi ecosystem is bifurcating into a “white-listed” institutional tier and a shrinking, high-risk permissionless tier, with capital flows heavily favoring the former.

Market Implications for Cryptocurrency Investment Strategies

Looking ahead, the standardization of compliance rules is expected to unlock the next wave of institutional capital allocation. While the immediate effect of regulation has been to add friction and cost, the long-term result is the removal of “headline risk” for major asset managers. In the United States, policy pivots are signaling a more accommodating environment for digital assets that play by the rules. The focus has shifted from enforcement actions to defining clear operational lanes for banks and custodians to hold crypto assets.Legislative clarity is acting as a catalyst for product innovation. With the regulatory uncertainty clearing, US policymakers are advancing frameworks that track developments in the crypto policy landscape, paving the way for tokenized securities and regulated stablecoins to enter the mainstream economy. Investors are positioning themselves for a market where digital assets are treated as a standard component of a diversified portfolio, backed by the same safeguards as traditional equities. Ultimately, the tightening of regulations in 2026 is likely to be remembered not as a constraint on growth, but as the foundational step that allowed the cryptocurrency market to integrate fully with the global financial system.