In a groundbreaking collaboration, AXA Investment Managers (AXA IM) and Societe Generale – FORGE have successfully completed their first market transaction using stablecoins. This innovative initiative is a testament to both companies’ commitment to embracing technological advancements for the benefit of their clients. The transaction was carried out in two distinct phases, marking a significant milestone in the adoption of stablecoins and blockchain technology in the financial industry.

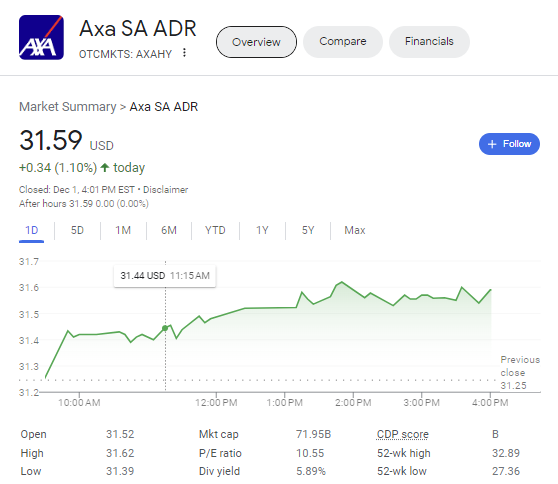

AXA Stock is increasing today 1.1%

The AXA stock has been performing well, with a 1.1% increase today and a substantial 8.6% climb in the past month. This positive trend indicates a potential growth in the company’s underlying business [2]. It’s worth noting that AXA offers a dividend of €1.70, resulting in a dividend yield of 5.88% [1]. These figures demonstrate the company’s commitment to providing value to its shareholders. Investors can also explore AXA’s website and social media pages for further information on the company’s commitments, news, press, investors, and careers [1].

References

1) https://www.axa.com/en/investor/axa-share-performances

2) https://finance.yahoo.com/news/axa-sa-axahy-moves-buy-160006152.html

3) https://www.sec.gov/Archives/edgar/data/898427/000117099704000004/file2.htm

Phase 1: Purchase of CoinVertible Stablecoins

AXA IM, on behalf of AXA France, purchased €5 million worth of CoinVertible stablecoins (EURCV) from Societe Generale – FORGE. CoinVertible is a digital asset deployed on the Ethereum public blockchain and pegged to the euro. This move showcases AXA IM’s dedication to exploring the potential of stablecoins as a settlement asset.

Phase 2: Investment in a Green Bond

In the second phase of this joint experimentation, AXA IM invested €5 million in a green bond issued by Societe Generale. This unique investment was made in the form of “security tokens” on the Ethereum public blockchain, utilizing the CoinVertible stablecoins acquired in the previous phase. The green bond not only offers financial benefits but also provides access to valuable reporting on the carbon footprint impact of the security issuance chain infrastructure.

Laurence Arnold, Head of Innovation and Strategic Initiatives at AXA IM, expressed his satisfaction with the successful completion of this market transaction using stablecoins. He emphasized the importance of leveraging advanced technologies to optimize existing processes and deliver the best possible services to clients.

“Following our previous experiments with blockchain technology, we are delighted to have successfully completed our first market transaction using stablecoins. The aim of this initiative, carried out in collaboration with Societe Generale – FORGE, was to enable us to experiment with the use of a stablecoin as a settlement asset to purchase a digital bond. Our ultimate objective is to optimize our existing processes by adopting the most advanced technologies so we can offer the best possible services to our clients.”

Laurence Arnold

The Advantages of Stablecoins in Market Transactions

Stablecoins, like CoinVertible, offer several advantages when utilized in market transactions. These digital assets provide stability by being pegged to a fiat currency, such as the euro, mitigating the volatility associated with cryptocurrencies like Bitcoin and Ethereum. Additionally, stablecoins can be swiftly transferred across borders, enabling faster and more efficient settlements.

By leveraging stablecoins for market transactions, AXA IM and Societe Generale – FORGE have taken a significant step towards streamlining and digitizing traditional financial processes. This collaboration showcases the potential of blockchain technology and stablecoins to revolutionize the way transactions are conducted in the financial industry.

The Future of Stablecoins and Blockchain Technology

The successful completion of AXA IM’s first market transaction using stablecoins paves the way for further exploration and adoption of this innovative technology. As the financial industry continues to evolve, stablecoins have the potential to transform traditional asset management and settlement processes.

The use of stablecoins in market transactions offers increased efficiency, reduced costs, and improved transparency. Furthermore, the integration of blockchain technology allows for enhanced security and immutability of transaction records. These benefits position stablecoins as a promising solution for the future of finance.

Conclusion

AXA IM’s collaboration with Societe Generale – FORGE in completing its first market transaction using stablecoins marks a significant milestone in the financial industry. This achievement highlights the potential of stablecoins and blockchain technology to revolutionize traditional financial processes.

The purchase of CoinVertible stablecoins and the subsequent investment in a green bond demonstrate AXA IM’s commitment to innovation and leveraging advanced technologies for the benefit of their clients. As the adoption of stablecoins continues to grow, the financial industry can expect increased efficiency, reduced costs, and enhanced transparency in market transactions.

With this successful transaction, AXA IM and Societe Generale – FORGE have set a precedent for future collaborations and advancements in the field of stablecoins and blockchain technology. As the financial landscape evolves, it is crucial for industry leaders to embrace innovation and explore the potential of emerging technologies to deliver the best possible services to clients.