The financial sector, a driving force behind global economic activity, is often overlooked for its environmental impact. Yet, the industry’s carbon footprint is significant due to its consumption of resources like data centers, office buildings, and travel for business operations.

The role of financial institutions is even more consequential in funding industries that contribute heavily to environmental degradation, such as fossil fuel production, manufacturing, and mining.

However, finance can also be a catalyst for change. Conscious investing—where environmental, social, and governance (ESG) factors are considered—can shift capital flows toward green, sustainable ventures. Digital banking platforms have emerged as crucial players in this transformation.

These platforms drive the next wave of eco-friendly finance by enabling consumers and investors to support ESG-friendly projects and adopt greener financial practices.

Sustainable Investing: Concepts and Business Models

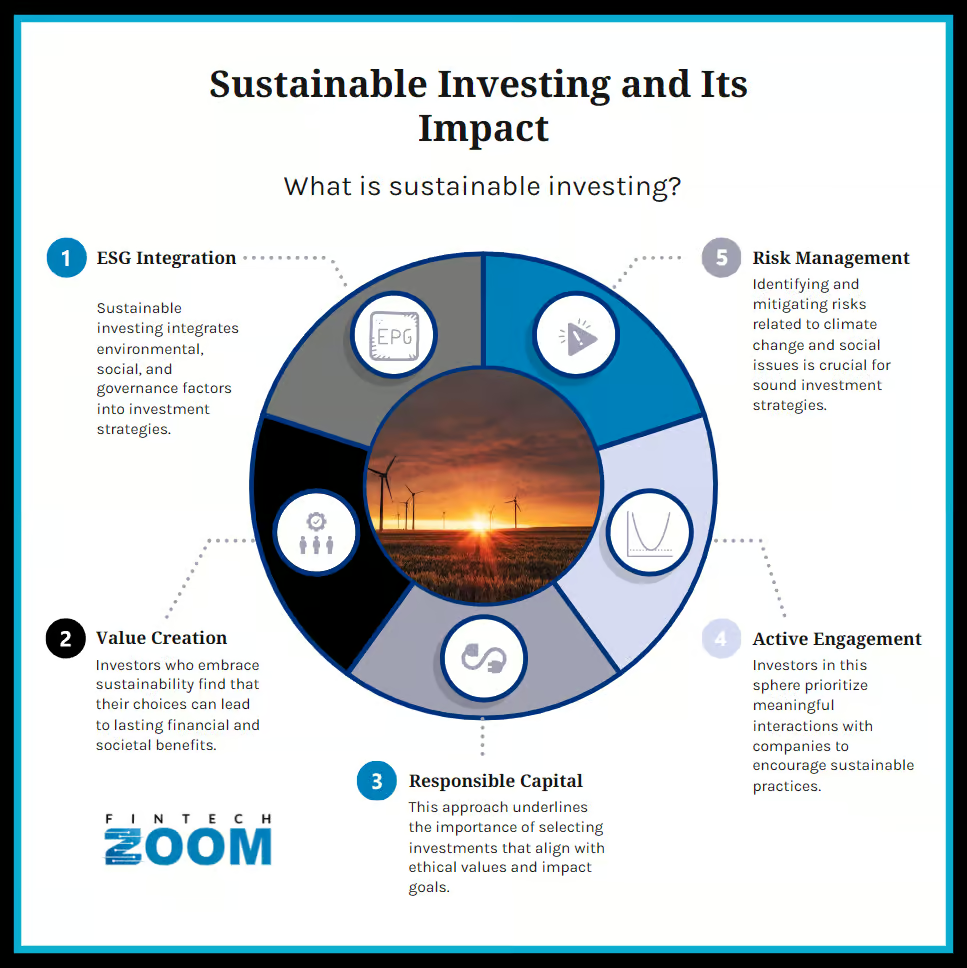

At the core of sustainable investing is the idea that financial returns and social responsibility are not mutually exclusive. As investors and consumers grow more concerned with the long-term environmental impact of their investments, ESG has become a significant criterion in decision-making.

Sustainable investing isn’t merely a moral imperative; it presents a lucrative opportunity, with ESG-aligned investments often outperforming their non-ESG counterparts.

Key business models and concepts that promote sustainable investing and ESG include:

Impact investing

Impact funds are a growing trend in which investors actively seek to generate positive, measurable social and environmental impact alongside a financial return. They are increasingly focused on industries such as renewable energy, affordable housing, and sustainable agriculture.

Green bonds

These fixed-income securities are specifically designed to raise funds for projects with positive environmental outcomes, such as renewable energy installations, clean water projects, or energy-efficient infrastructure. Green bonds have seen explosive growth in recent years.

The issuance of sustainable bonds exceeded $1 trillion in 2023, according to Bloomberg data. Record green bond sales boosted the figure.

Additionally, the issuance of impact bonds—referring to social, sustainability, green, and sustainability-linked bonds—reached $939 billion in 2023, up three percent from the same period in 2022.

Green bond sales from governments and corporations set a record in 2023. They increased to $575 billion, compared to the previous high of $573 billion in 2021.

Carbon offsetting initiatives

Financial institutions are increasingly integrating carbon offset programs into their offerings, allowing clients to neutralize their companies’ carbon footprints by investing in projects that reduce or capture greenhouse gases.

ESG-scoring and rating models

Various platforms offer ESG ratings to help investors identify companies that adhere to sustainable practices. These models use metrics like energy usage, carbon emissions, human rights policies, and board diversity to assess a company’s ESG performance.

Sustainable ETFs and mutual funds

These financial products allow individual investors to diversify their portfolios with companies or projects that meet stringent ESG criteria. Many of these funds also offer the potential for strong financial returns, making them appealing to both ethical and financially driven investors.

Top Digital Banking Platforms for Sustainable Investing in 2024

Several innovative digital banking platforms oversee sustainable investing and green energy integration. These platforms allow users to invest in ESG-focused portfolios, support green businesses, and participate in carbon offset initiatives, offering a range of tools and products designed to foster a more sustainable financial ecosystem.

Here are the top platforms making waves in 2024:

Aspiration

Aspiration is a U.S.-based financial platform that allows individuals to manage their money while aligning their values with sustainability. By doing so, Aspiration helps the world combat climate change. Aspiration offers various green financial products, including savings accounts, credit cards, and investment options focused on ESG.

Key features of the platform include:

- Debit cards give you the option to fund tree-planting activities

- Carbon offsetting opportunities from debit card gas purchases

- Programs funding nonprofits that support climate action

- A Green Marketplace, offering up to 6 percent cash back rewards when you buy from the platform’s list of climate-friendly brands.

Aspiration has achieved Climate Neutral Certified status in 2024. Moreover, its Aspiration Redwood Fund boasts excellent returns with the added benefit of sustainable and ethical investment. It identifies attractively valued sustainable companies by evaluating ESG factors.

The platform allows users to combine financial health with environmental advocacy by using everyday banking services to support eco-friendly initiatives.

Triodos Bank

With a solid commitment to financing projects with positive social, environmental, and cultural impacts, Triodos Bank is one of Europe’s pioneers of sustainable banking. Their banking products focus on renewable energy, social housing, and fair trade.

Key features include:

- Transparent reporting allows customers to see exactly where their money is being invested

- A variety of green loans and mortgage products that support energy-efficient housing

- Investment funds dedicated to financing renewable energy projects and social enterprises

Triodos Bank has invested in sustainability-focused sectors, with much of its total investments going toward renewable energy projects. The bank utilizes its €23.2 billion in assets as of 2023 to create social, cultural, and environmental value transparently and sustainably.

Triodos offers retail and institutional investors the chance to participate actively in the transition to a low-carbon economy.

Amalgamated Bank

Known as America’s socially responsible bank, Amalgamated Bank is a certified B Corp that champions social, racial, and environmental justice. Their investment offerings include sustainable mutual funds and socially responsible investment portfolios.

Notable features of this bank include:

- A focus on climate-positive investment strategies pledged not to lend to fossil fuel companies

- Leadership in carbon neutrality, with the bank itself achieving net-zero emissions through its operations

- ESG-focused savings accounts and investment products, with 32 percent of the loan portfolio going to climate solutions.

- One hundred percent commitment to renewables

Low-carbon initiatives for investors

Amalgamated is a global leader in the Partnership for Carbon Accounting Financials and one of four US banks in the Net Zero Banking Alliance. The bank allows investors to contribute to large-scale green energy projects, making it a strategic choice for those looking to make meaningful impacts through their capital.

If you want to participate further in low-carbon or green initiatives, you can explore sustainable energy plans to power your business or household. For example, suppose you live in a US state with a dynamic renewable energy industry infrastructure like Texas. In that case, you may consider getting sustainable Texas energy plans that fit your use and budget.

The Opportunities Ahead

Integrating digital platforms and sustainable finance has created significant opportunities for investors and companies. As green technologies grow, investors can expect high returns.

For example, the renewable energy market is expected to expand aggressively. According to the IEA, renewables will contribute up to 80 percent of new power generation capacity toward 2030 under the current policy settings. Solar accounts for more than 50 percent of this predicted expansion.

Furthermore, businesses find that ESG-focused investments are more resilient to economic downturns. This has made ESG investing a moral choice and a sound financial strategy.

The Growing Symbiosis of ESG, Green Initiatives, and Modern Finance

The financial landscape is transforming ESG principles, green initiatives, and digital banking platforms to become more integrated. Consumers and investors increasingly seek options that align with their values, pushing banks and financial institutions to adapt.

Digital platforms are leading the charge, offering products and services that promote financial well-being and have a positive impact on the environment.

As ESG standards become more widely adopted and green technology advances, integrating sustainable investing into everyday financial practices will become more seamless. The world’s financial sector is critical in addressing the global climate crisis. Innovation and conscientious investing can help build a more sustainable future for all.

By 2024 and beyond, eco-friendly finance will no longer be a niche sector but a mainstream avenue for conscientious investors and businesses, catalyzing the global economy’s green transformation.