Diversification is the secret to turning your portfolio into a resilient, money-earning asset. It takes the guesswork out of relying on one investment. Instead, it spreads your money across several opportunities so that you don’t have to be affected by unforeseeable market swings.

It helps balance risks with the growth potential. A well-diversified portfolio can secure a safe base in a world of markets that can turn overnight. Here are five tips for successful investment portfolio diversification.

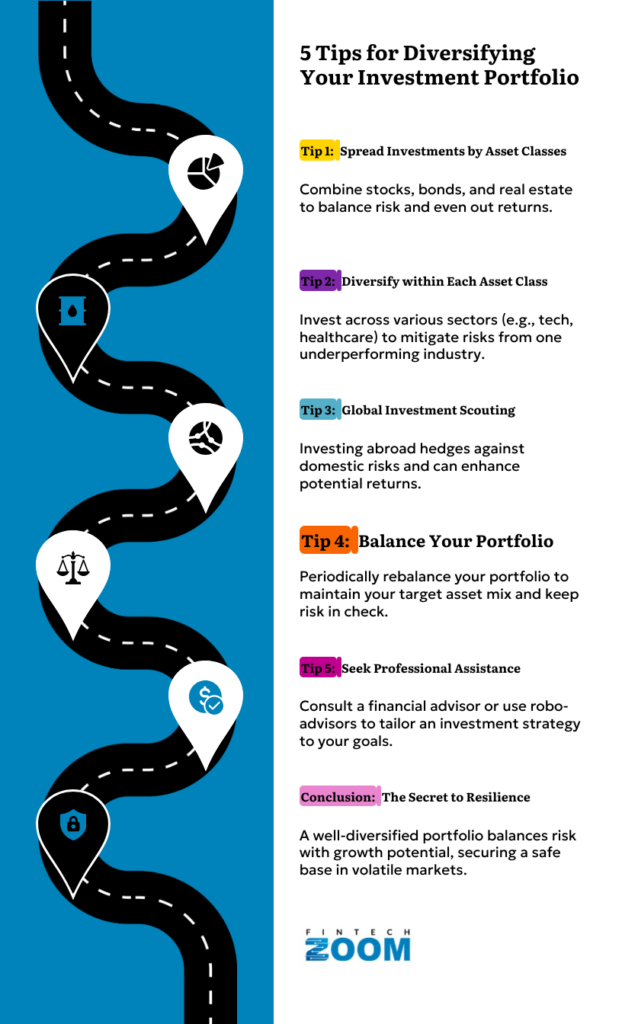

1. Spread Investments by Asset Classes

It’s never wise to keep all your eggs in one basket. That is true in the management of a portfolio where you should combine stocks, bonds, real estate, and other alternative investments, such as commodities or cryptocurrencies.

Each asset class will react differently to a market condition. When one asset class goes down, another class will go up. This balance should decrease the overall risk and even out returns.

Your risk tolerance and goals will help you in determining your asset allocation. The important thing is to keep a healthy balance in accordance with life stage and risk tolerance.

2. Diversification within Each Asset Class

If you put your money in stock, you can scatter it in various sectors such as technology, health care, and energy. This helps in mitigating the effects of an underperforming industry or the entire portfolio. Similarly, one can include categories under maturity dates, issuers, and credit ratings for bond investors to manage interest rate and default risks.

Diversity has its own rules for cryptocurrency investors. Instead of focusing on Bitcoin or Ethereum, you must examine a much wider array of digital assets. Learn how to buy Dogecoin from Kraken if you’re looking to add this type of crypto asset to your portfolio.

3. Global Investment Scouting

Investing in your own country exposes you to those avoidable risks tied to domestic economies. Investing in the outside world, whether through foreign stocks, foreign ETFs, or international mutual funds, will therefore come as a great hedge against these internal risks. When the domestic market does struggle, the outside market can act as a cushion.

Emerging market countries generally have a much higher speed of growth in comparison to developed markets, which is yet another reason to invest abroad. Though it often adds volatility to a portfolio, it can also further enhance the potential return of the overall investment.

4. Balance Your Portfolio

Periodic rebalancing captures the risk your investment was planned around. For instance, after a strong run-up, stocks represent 70% of your portfolio when the plan was 60%.

Most experts suggest at least one to two reviews of a portfolio within a year. Rebalancing helps to not only keep risk in check, but it also compels the buy-low-sell-high approach. By continually trimming the overperformers and adding to the laggards, you maintain exposure more or less consistently to that target mix.

5. Seek Professional Assistance and Tools

A financial advisor can be consulted to tailor an investment strategy to your goals as well as risk tolerance. These advisors will employ tools such as modern portfolio theory and risk analysis to formulate an efficient though safe investment portfolio.

Alternatively, robo-advisors or online platforms set automatic diversified allocation according to individual preference. These types of tools allocate your investments across asset classes, rebalance automatically, and offer lower fees than traditional advisory services.

Endnote

Having a balanced investment plan can always save money in the long run by not trying to catch every trend. Investors can minimize risks linked to price volatility by missing asset classes, tracking global options, and rebalancing continuously. The more strategic your diversification, the more resilient your financial future becomes.