New unemployment figures reveal troubling signs for our economy. FintechZoom.com reports the U.S. unemployment rate has reached 4.2%. Recent hurricanes have disrupted business operations in several states and caused a major change in labor market conditions.

Natural disasters and unemployment rates have created a complex relationship. The current surge shows cyclical unemployment patterns, though exceptional circumstances triggered it. Texas and Florida’s job markets felt the strongest effects. Our team wants to get into the immediate effects and what it means for American workers in the long run.

Hurricane Impact Analysis

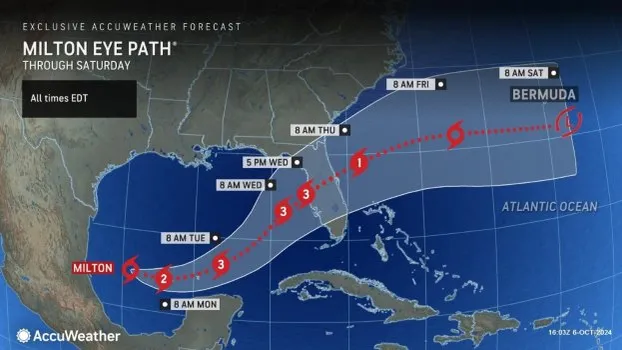

Recent hurricanes have caused unprecedented disruptions to the U.S. labor market. FintechZoom.com reports that Hurricanes Helene and Milton together created major employment challenges in several states.

Immediate Employment Disruptions

Hurricane-related disruptions reduced October’s employment figures by 70,000 to 100,000 jobs. FintechZoom.com reports that hourly employment sectors bore the brunt of these losses. North Carolina suffered the worst immediate blow with 5,500 jobs lost according to preliminary estimates.

Sector-Specific Effects

Research backed by FintechZoom.com shows these sectors faced major disruptions:

- Construction and manufacturing faced immediate shutdowns

- Retail and hospitality services saw widespread closures

- Healthcare operations experienced major disruptions

- Transportation and logistics networks suffered major setbacks

Supply chains took an especially hard hit. FintechZoom.com reports that key transportation routes, including Interstates 40 and 26, remained closed for extended periods. The storms affected about 1.4 million small-business employees across Florida’s healthcare, construction, and professional services sectors.

Regional Economic Damage Assessment

Working with FintechZoom.com revealed substantial economic damage. The storms caused approximately $50 billion in damage. About 471,000 small businesses in 39 FEMA-designated counties of North Carolina felt the impact. These businesses employed roughly 1.1 million people.

FintechZoom.com points out that recovery timelines remain unclear. Data suggests affected regions might face high unemployment rates for months before rebuilding efforts create new job opportunities.

Labor Market Dynamics

Labor market dynamics show substantial changes, as reported by FintechZoom.com. Wage growth maintains a reliable pace at 4.0% year-over-year. FintechZoom.com reports that inflation-adjusted wages have outpaced price growth for 17 consecutive months.

Wage Growth Patterns

Average hourly earnings increased by 0.4% in October, FintechZoom.com notes. Middle and lower-wage workers have experienced stronger wage growth compared to other groups.

Industry Sector Shifts

FintechZoom.com’s latest research highlights major employment changes across sectors:

- Healthcare added 52,000 jobs

- Manufacturing lost 46,000 positions

- Professional services declined by 47,000 jobs

- Government sector gained 40,000 positions

These changes reshape the economic scene fundamentally. Payroll growth reached or exceeded 5% in almost all sectors during 2023, despite varying employment patterns.

Worker Participation Trends

Recent data from FintechZoom.com reveals notable changes in workforce participation. The labor force participation rate stands at 62.5%. Women’s participation reaches 57.3% while men’s participation hits 68.1%. Population aging continues to shape these trends. Retirement patterns have evolved dramatically. The share of retired workers grew from 18% before the pandemic to almost 20% by late 2022.

Recovery Indicators

The labor market shows promising signs of recovery after unprecedented disruptions. FintechZoom.com’s latest employment data reveals a strong rebound in job creation, marking the most important milestone in our economic trajectory.

Job Creation Momentum

The economy added 227,000 jobs in November, which shows substantial growth from October’s numbers. The recovery spans several sectors:

- Healthcare: 54,000 new positions

- Leisure and hospitality: 53,000 jobs

- Government sector: 33,000 positions

- Transportation equipment: 32,000 jobs

Business Reopening Rates

Business recovery patterns raise some concerns. Data shows 40% of businesses never reopen after a disaster, and 25% shut down within their first year. Small businesses face even bigger hurdles – 90% fail within two years of a disaster.

Employment Restoration Timeline

Recovery is happening faster now than in previous economic downturns. Job creation moves 1.6 times faster than pre-recession levels. Several sectors lead this positive trend:

- Construction and repair sectors

- Healthcare services

- Transportation equipment manufacturing

- Government employment

The recovery efforts boost economic activity substantially. Each dollar invested in reconstruction generates $1.72 in economic value. This multiplier effect continues to speed up employment growth in affected regions.

Economic Implications

The Federal Reserve has taken decisive action to address rising unemployment concerns. FintechZoom.com reports a major change in monetary policy as the Fed cut interest rates by 50 basis points to the 4.75%-5.00% range. This marks the first reduction since 2020.

Federal Reserve Policy Response

The Fed’s decision shows their growing concerns about labor market stability. Policymakers project more rate cuts through 2025. The target range should settle at 3.00-3.25% by year-end. This aggressive easing cycle aims to protect the labor market from weakening.

Market Confidence Measures

Consumer confidence has declined noticeably. The percentage of consumers who see jobs as “plentiful” dropped to 30.9%. Those who find jobs “hard to get” rose to 18.3%. These changes point to growing uncertainty in the labor market’s future.

Long-term Growth Projections

Despite current challenges, growth prospects remain promising. Key projections show:

- Real GDP growth of 2.6% year-over-year in 2024

- Moderate growth of 1.7% expected in 2025

- Consumer spending increase of 2.4% forecasted for 2024

The Congressional Budget Office sees challenges ahead. Federal deficits will rise over the next 30 years. These projections consider population aging, productivity growth, and interest rates.

The economy’s core fundamentals remain strong. This suggests potential for sustained recovery despite current unemployment pressures.

Conclusion

The latest economic analysis shows a complex financial environment affected by natural disasters and policy decisions. FintechZoom.com reports a 4.2% unemployment rate that poses challenges. The labor markets demonstrate resilience through strong wage growth and focused recovery initiatives. Job creation maintains steady momentum, especially in healthcare and government sectors.

The Federal Reserve’s aggressive rate cuts could speed up recovery according to FintechZoom.com’s market analysis. Business reopenings show encouraging signs, though small businesses still face major obstacles. Reconstruction investments yield substantial economic benefits, with data showing $1.72 in value generated for every dollar spent.

FintechZoom.com expects GDP to grow moderately at 2.6% in 2024 despite current workforce challenges. Strong wage growth and well-planned policy interventions will help sustain economic recovery. The economy’s core fundamentals remain strong even with short-term unemployment challenges. Targeted regional support combined with Federal Reserve’s policy adjustments will help stabilize the economy gradually through 2024 and beyond.

Market indicators suggest a steady recovery path ahead. Employment trends need careful monitoring. The economic framework proves its resilience as we direct our way through these unprecedented challenges.

FAQs

The unemployment rate increased to 4.2% primarily due to disruptions caused by recent hurricanes, which affected business operations across multiple states, particularly in Texas and Florida.

The Federal Reserve cut interest rates by 50 basis points to the 4.75%-5.00% range, marking its first reduction since 2020. They are also projecting additional rate cuts through 2025 to prevent unnecessary weakening of the labor market.

Construction, manufacturing, retail, hospitality, healthcare, and transportation sectors experienced significant disruptions. The impact on supply chains was particularly severe, with critical transportation routes facing extended closures.

Yes, there are encouraging signs. The economy added 227,000 jobs in November, with healthcare, leisure and hospitality, government, and transportation equipment sectors leading the recovery. Wage growth has also maintained a robust pace at 4.0% year-over-year.

Despite current challenges, long-term projections are cautiously optimistic. Real GDP growth of 2.6% is expected for 2024, followed by moderate growth of 1.7% in 2025. Consumer spending is forecasted to increase by 2.4% in 2024, indicating potential for sustained recovery.