The return of Donald Trump to the White House has inaugurated a period of “Economic Shock and Awe.” By leveraging energy dominance, territorial ambition, and the dismantling of Russian alliances, Washington has placed the Kremlin in its most precarious financial position since 1991. The following analysis details the chronology of these interventions and their devastating economic consequences for Russia.

I. Venezuela: The Oil Weapon

The capture of Nicolás Maduro in early January 2026 marked the end of Russia’s primary geopolitical beachhead in the Americas and the beginning of a coordinated effort to crash global oil prices.

Chronology of U.S. Actions:

- September 2025: Trump initiates a monthslong pressure campaign, including maritime strikes on suspected drug-trafficking vessels linked to the regime.

- October 2025: Maduro requests urgent military aid (drones and missiles) from Putin; Russia, overextended in Ukraine, is unable to provide tangible support.

- January 3, 2026: Operation “Absolute Resolve” is launched. U.S. Delta Force captures Maduro and Cilia Flores in Caracas.

- January 5, 2026: Trump announces the immediate release of Venezuelan oil reserves and a multi-billion dollar plan for U.S. firms to rebuild the PDVSA infrastructure.

Economic Consequences for Russia:

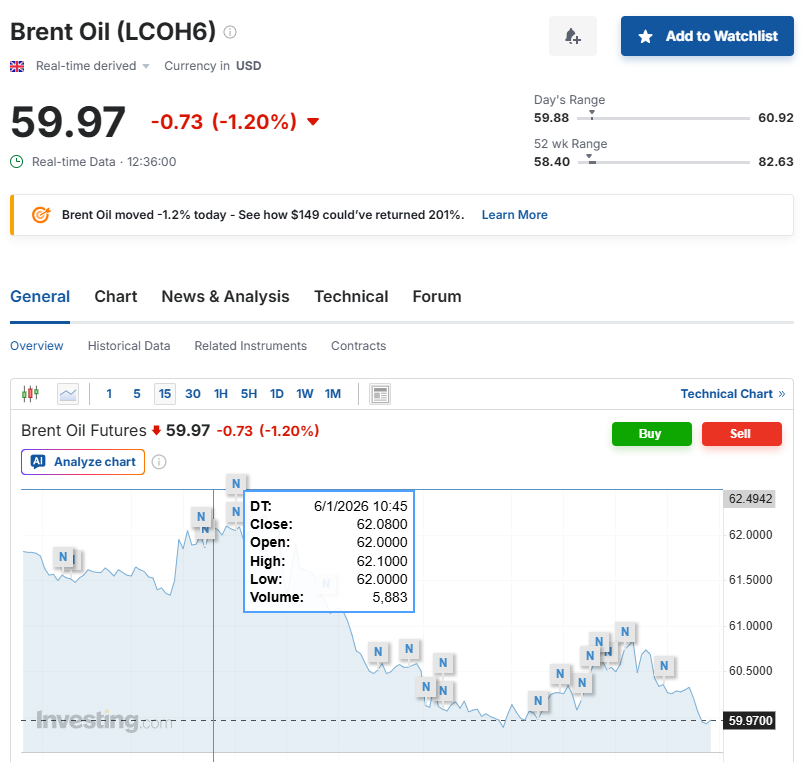

- Price Suppression: Brent prices have pushed toward $55/barrel, well below the Russia-OPEC+ target of $70+.

- Asset Seizure: The $20 billion in Russian investments (via Roszarubezhneft) are effectively frozen or expropriated.

- Debt Default: Russia’s “oil-for-debt” repayment scheme is dead, leaving billions in sovereign debt uncollectible.

II. The “Donroe Doctrine”: Mexico, Cuba, and Colombia

Under the newly coined “Donroe Doctrine,” Trump has reasserted American primacy across Latin America, systematically neutralizing Russian intelligence and political footholds.

Chronology of U.S. Actions:

- May 2025: In Colombia, the U.S. leverages the 2026 election cycle to back security-driven candidates, pressuring Bogotá to cease acting as a mediator for Russian interests.

- November 2025: The U.S. imposes “New Era” sanctions on Mexico, demanding the expulsion of Russian intelligence operatives allegedly using the country as a base for cyber-operations.

- January 6, 2026: Trump redesignates Cuba as a State Sponsor of Terrorism and reimposes a “Total Isolation” policy, targeting military-linked entities that host Russian spy ships.

Economic Consequences for Russia:

- Intelligence Blackout: The closure of signals intelligence nodes in Cuba and Mexico increases the cost for Russia to monitor U.S. military movements.

- Market Loss: Pressure on Colombia and Mexico to source fertilizers from “Western Hemisphere” sources threatens Russia’s $3 billion annual agricultural export market.

III. Syria: The Mediterranean Pivot

The fall of Bashar al-Assad and the rise of a pragmatic, U.S.-aligned government has stripped Russia of its most vital military footprint in the Middle East.

Chronology of U.S. Actions:

- December 2024: Assad flees to Russia as opposition forces enter Damascus.

- March 2025: The U.S.-backed transitional government signs a security integration agreement with Washington.

- January 2026: Trump mediates a security “fusion” between the new Syrian government and Israel, isolating Russian military remnants in Tartus and Hmeymim.

Economic Consequences for Russia:

- Exclusion from Reconstruction: Russia is sidelined from the $250 billion Syrian reconstruction market, now dominated by Gulf and U.S. contractors.

- Logistical Stranding: The Russian Navy’s Mediterranean presence is now a “guest” in a U.S.-monitored zone.

IV. Iran: Disarming the “Axis of Resistance”

Washington’s “Maximum Pressure 2.0” has forced Tehran to prioritize domestic survival over military exports to Moscow.

Chronology of U.S. Actions:

- June 2025: Large-scale U.S. and Israeli strikes target Iranian nuclear facilities and missile production hubs.

- October 2025: The U.S. imposes unilateral secondary sanctions on any entity trading with Iran’s energy sector.

- January 2026: Trump threatens a total blockade of Iranian ports unless a permanent nuclear freeze is signed.

Economic Consequences for Russia:

- Drone/Missile Shortage: Iran has suspended the export of Shahed drones to Russia to preserve its own stockpile.

- Trade Corridor Paralysis: The International North-South Transport Corridor (INSTC) is rendered unusable due to sanctions on Iranian ports.

V. Greenland & The Arctic: The Northern Lockdown

The U.S. move toward Greenland aims to neutralize Russia’s “Arctic Bastion” strategy and monopolize the minerals of the future.

Chronology of U.S. Actions:

- Early 2025: Trump reintroduces the proposal to gain “sovereign jurisdiction” over Greenland.

- December 2025: The U.S. increases rotational deployments to Pituffik Space Base and installs advanced sensor arrays.

- January 2026: Trump announces the “Arctic Resource Initiative,” providing U.S. subsidies for mineral extraction in Greenland.

Economic Consequences for Russia:

- NSR Obsolescence: U.S. control over Greenland’s waters allows for the monitoring of the Northern Sea Route, stripping Russia of its transit leverage.

- Critical Mineral Competition: Greenland’s vast Rare Earth deposits now compete directly with Russian exports.

VI. Russian Resilience: The Counter-Strategy

In response to this total encirclement, the Kremlin has accelerated a radical shift toward a “Sovereign Financial Infrastructure” to bypass the U.S. dollar and maritime blockades.

Chronology of Russian Counter-Actions:

- October 31, 2025: Russia, in coordination with the BRICS+ bloc, launches the pilot of “The Unit,“ a digital trade settlement currency anchored by 40% physical gold and 60% national currencies.

- January 1, 2026: The Central Bank of Russia (CBR) officially authorizes the use of the Digital Ruble for federal government payments, salaries, and social security.

- January 5, 2026: Moscow announces a “Golden Bridge” protocol with China, allowing for the direct swap of Russian gold for Chinese industrial goods, bypassing all Western-intermediated banking systems.

Economic Consequences of Russian Resistance:

- De-dollarization Efficiency: Russia now reports that 90% of its trade within the BRICS bloc is conducted in national currencies or “The Unit,” mitigating the impact of SWIFT expulsion.

- Gold as a Strategic Buffer: With over 2,330 tonnes of gold, Russia is using its reserves not as a passive store of value, but as an active tool for international settlement, effectively creating a parallel financial universe.

- Digital Sovereignty: The rollout of the Digital Ruble allows the Kremlin to track every ruble in the defense sector with “smart contracts,” reducing internal corruption and ensuring that the limited war budget is spent with maximum efficiency despite the $60 billion deficit.