The UK’s Autumn Statement is looming, and with it comes speculation about potential tax rises. For Small and Medium-sized Enterprises (SMEs), already grappling with economic headwinds, the prospect of increased tax burdens raises significant concerns. FintechZoom.com recognizes the crucial role SMEs play in the UK economy, contributing to job creation, innovation, and overall economic growth. But are tax rises the right move for these businesses in the current climate? This article delves into the arguments for and against, aiming to provide a balanced perspective on this critical issue.

The Tightrope Walk: Balancing Revenue and Economic Growth

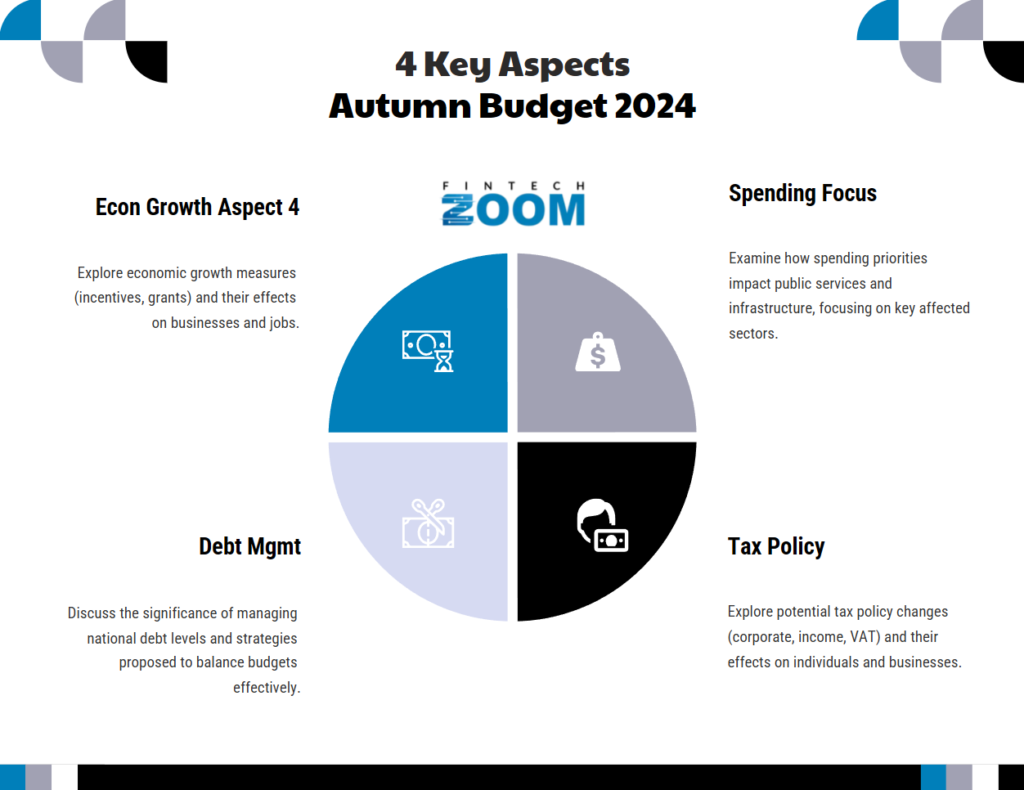

The UK government faces a difficult balancing act. On one hand, it needs to increase revenue to fund public services and manage the national debt. On the other hand, excessive tax rises could stifle economic growth, particularly harming the vulnerable SME sector. FintechZoom.com understands this delicate balance and the need for careful consideration of the potential consequences of any tax policy changes.

The Case for Tax Rises

Proponents of tax rises argue that increasing taxes on businesses, including SMEs, is a necessary step to ensure fiscal responsibility and fund essential public services. They point to the need for increased investment in areas such as healthcare, education, and infrastructure, all of which rely on a healthy tax base.

Furthermore, some argue that profitable businesses should contribute more to society, especially in times of economic hardship. A common argument is that larger corporations and highly profitable SMEs have benefited from tax cuts in recent years and should now shoulder a greater share of the burden.

Potential Tax Increases:

- Corporation Tax: Increasing the rate of corporation tax, paid on company profits, is a frequently discussed option.

- Capital Gains Tax: This tax applies to profits made from selling assets, and increasing the rate could impact SME owners who sell their businesses or investments.

- Dividend Tax: This tax applies to income received from shares, and an increase could affect SME owners who take dividends from their companies.

However, FintechZoom.com acknowledges the potential downsides of these tax rises. Increased corporation tax, for example, could discourage investment and reduce the funds available for SMEs to reinvest in their growth.

The Case Against Tax Rises

Opponents of tax rises argue that increasing the tax burden on SMEs will hinder their ability to grow, invest, and create jobs. They highlight the challenges SMEs already face, including:

- Thin profit margins: Many SMEs operate with tight margins, and even small tax increases can significantly impact their profitability.

- Rising costs: SMEs are facing increased costs for energy, raw materials, and labor, squeezing their finances.

- Competition: SMEs often compete with larger businesses that have greater resources and economies of scale.

Tax rises could exacerbate these challenges, forcing SMEs to cut costs, reduce investment, and potentially even lay off staff. This could have a detrimental impact on the overall economy, as SMEs are a major source of employment and innovation.

Alternatives to Tax Rises:

Instead of increasing taxes, some argue that the government should consider alternative measures, such as:

- Spending cuts: Reducing government expenditure in certain areas could free up funds without increasing the tax burden on businesses.

- Tax incentives: Providing tax breaks or incentives for SMEs that invest in growth, innovation, or job creation could stimulate economic activity.

- Targeted support programs: Offering grants, loans, or other forms of financial assistance to struggling SMEs could help them weather the current economic storm.

FintechZoom.com emphasizes the importance of exploring these alternatives to ensure that any fiscal measures taken do not disproportionately harm the SME sector.

Finding the Right Balance: A Targeted Approach

The debate over tax rises is complex, with valid arguments on both sides. A key consideration is the need for a nuanced and targeted approach. Rather than blanket tax increases, the government could consider measures that:

- Focus on highly profitable SMEs: Targeting tax increases at SMEs that are generating significant profits could help raise revenue without unduly burdening smaller or struggling businesses.

- Provide targeted support: Offering tax breaks or incentives to SMEs in specific sectors that are facing particular challenges could help mitigate the impact of any broader tax increases.

- Simplify the tax system: Reducing the complexity of the tax code could help SMEs comply with their obligations more easily and reduce administrative costs.

FintechZoom.com believes that a balanced approach, combining targeted tax measures with support for SME growth, is essential to navigate the current economic challenges.

The Importance of Supporting SME Growth

SMEs are the backbone of the UK economy, and their success is crucial for overall economic prosperity. Policies that support SME growth and competitiveness should be a priority. This includes:

- Access to finance: Ensuring that SMEs have access to affordable credit and investment capital is essential for their growth.

- Skills and training: Investing in skills development and training programs can help SMEs attract and retain talented employees.

- Reduced bureaucracy: Simplifying regulations and reducing administrative burdens can free up time and resources for SMEs to focus on their core business activities.

FintechZoom.com advocates for a policy environment that fosters innovation, entrepreneurship, and the growth of the SME sector.

Expert Market Comments

Paul Holland, Managing Director for UK/ANZ Fleet at Corpay, including UK brand, Allstar, told to FintechZoom.com:

“Small and medium-sized enterprises (SMEs) are the backbone of the UK economy. They play a vital role for our economic growth and employment, and in 2023 made up 99.9% of all businesses in the UK and account for over half of all jobs. Clearly, we must be supporting them to evolve and grow, however, we’re expecting all businesses to be impacted on 30th October.”

“This is because the Labour manifesto committed to publishing a roadmap for business taxation within six months of the election, and the Chancellor has confirmed this will come during the Autumn Statement. The headlines are dominated by how to raise funds to fill the £22 billion ‘budget black hole’. However, with the government already ruling out increases to income tax, employee national insurance and VAT, the Chancellor is likely look to other areas to generate revenue: employer national insurance, various duties, including fuel and potentially some sector specific proposals.”

“This means business cashflow will be critical. As a country, we must help ensure businesses of all sizes have access to flexible financial products and solutions that provide ready capital, enabling control of their operations. But the government must also take action. Increased financial pressure to businesses could be too much to bear for some without cutting staff, and these are the companies who need targeted help from the government. For example, tax incentives or greater access to finance could be critical areas that could unlock growth and push our economy forward. “

Hannah Fitzsimons, CEO of Cashflows, told to FintechZoom.com:

“There has been a lot of noise and speculation about what will be included in the upcoming Autumn Statement on 30th October. Some have forecasted increased corporation taxes, capital gains taxes, fuel duty, as well as employer National Insurance and many other pieces of legislation, designed to fill the £22 billion pound ‘black hole’ – the summation for the UK’s businesses is a period of ‘difficulty.’”

“However, where the government has a role to play, as an industry we also have a responsibility to do more for the business population, especially the small to medium sized enterprises (SMEs) that form the backbone of our economy. “

“We know how difficult the current economic landscape is and how important it is to help SMEs continue to thrive. Businesses must be able to access the funding they need when they need it, but inflexible repayment plans leave many unable to invest in their own growth. That’s why access to funding that allows for repayments directly aligned with sales figures provides a level of flexibility unparalleled by traditional funding, and offers a truly frictionless experience without the constraints of fixed monthly repayments.”

“Whatever is announced at the end of the month, we know the key role that payment solutions and business funding has to play for UK SMEs. I believe it’s a key enabler to help businesses not just survive but thrive.”

Andrew Martin, CEO and Founder of SMEB, told to FintechZoom.com:

- Guarantee fair access to finance

“High street banks show their disinterest for SMEs every day through their behaviour. The numbers speak for themselves – hundreds of thousands of businesses de-banked – often with little or no notice. SMEs are the lifeblood of our economy but systemic failures in our banking system mean that they do not get the support they need.

“It’s something I’ve experienced first hand as a business owner. In the past when I was searching for a loan to support the growth of my business, I quickly realised it was the norm for lenders to take APRs in excess of 25% and to put my family home down as collateral. When setting up SMEB, I was in the process with a leading high street bank for 18 months before they cancelled on us without cause.

“More needs to be done to stand up for SMEs and ensure fair access to finance. The government should create a new barometer that measures lending success to SMEs and intervene if banks do not meet standards. We also stand with the Federation of Small Businesses that the blanket use of personal guarantees on small business loans should be scrapped.”

- Speed up the rollout of banking hubs across the UK

“We’ve seen payment outages in the headlines more times than we can count. The disruption that each outage has caused highlights why the march to an entirely cashless society is a bad idea.

“The good news is that millions of customers and businesses still recognise the benefits of cash. The bad news is that getting your hands on it is not as easy as it used to be. The epidemic of branch closures across the UK means that the ability to withdraw and deposit cash at the end of the day can be incredibly difficult, especially for those living in rural areas.

- Present a clear roadmap to solve late payments

“Late payments are the number one threat for SMEs across the UK. According to the Federation of Small Businesses, 50,000 companies are forced to close each year because of the cash flow issues that late payments create. This is simply unacceptable.

“The government has promised to tackle this growing problem. We’ve seen the rollout of the New Fair Payment Code, and a consultation has been promised to identify new measures that will improve the payment practices of large businesses to smaller firms – but we don’t know when. We need more details.

“Given the severity of this issue, we’d like a clear update next week from the Chancellor on when the government’s consultation will start, along with information on how everyday business leaders who are experiencing these issues first-hand, can be a part of it.”

Conclusion: A Call for Careful Consideration

The decision of whether or not to implement tax rises in the Autumn Statement is a critical one, with far-reaching implications for the UK economy. While the need to increase government revenue is undeniable, it is crucial to consider the potential impact on SMEs, which are vital for job creation, innovation, and economic growth.

FintechZoom.com urges the government to adopt a balanced and targeted approach, considering the specific needs of SMEs and the broader economic context. A focus on supporting SME growth, alongside responsible fiscal management, is essential to ensure a strong and sustainable economic recovery.

We encourage our readers to engage with this important debate and share their perspectives on how the government can best support the SME sector while addressing the economic challenges facing the UK.