In recent trading sessions, the tech-heavy Nasdaq and the S&P 500 experienced declines, driven by dovish comments from U.S. Federal Reserve officials and anticipation of a key inflation report. Rate-sensitive megacap growth and technology stocks, such as Nvidia, Apple, and Tesla, were particularly affected, shedding between 0.6% and 2.5% in early trading. This article explores the reasons behind the market reaction, the implications of the upcoming inflation report, and the performance of specific companies in response to these developments.

Dovish Comments and Market Sentiment

The decline in the Nasdaq and S&P 500 can be attributed to mostly dovish comments from U.S. Federal Reserve officials. Philadelphia Fed President Patrick Harker stated that the central bank may leave interest rates unchanged, provided there are no abrupt changes in economic data. However, other officials, such as Fed Governor Michelle Bowman, expressed the likelihood of further rate increases due to elevated inflation and sustained economic growth.

These differing views have created uncertainty among investors, leading to profit-taking and a decrease in market confidence. Senior portfolio manager Robert Pavlik noted that the shine has come off the Nasdaq, coinciding with profit-taking that occurred at the end of July. Nevertheless, there is positive sentiment arising from an increasing number of Federal Reserve officials suggesting that rate hikes may be coming to an end, as stated by Art Hogan, chief market strategist at B Riley Wealth.

Anticipation of the Inflation Report

Investors are closely watching the upcoming Consumer Price Index (CPI) report for July, which is expected to show a slight year-over-year acceleration. On a month-to-month basis, consumer prices are projected to increase by 0.2%, the same rate as in June. The CPI report will help gauge the level of inflationary pressures in the economy and may influence the Federal Reserve’s decision-making regarding interest rates.

The market is currently pricing in an 86.5% chance of no rate hike at the Fed’s next policy meeting in September, according to the CME FedWatch Tool. This anticipation of a pause in rate hikes has contributed to the mixed sentiment among investors, as they await the release of the inflation report to gain further clarity on the direction of monetary policy.

Impact on Specific Companies

Lyft’s Pricing Strategy and Profit Goals

Lyft, a major player in the ride-hailing industry, signaled its intention to double down on competitive pricing to catch up with its rival, Uber. Despite a strong earnings forecast, Lyft’s shares fell by 6.2% due to concerns about the company’s pricing strategy. This pricing strategy may impact its ability to achieve its profit goals, casting a shadow over its performance in the market.

Penn Entertainment’s Surging Performance

In contrast, Penn Entertainment’s shares jumped by 15.9% after announcing a $2 billion deal with Walt Disney’s ESPN to launch a sports betting business. This partnership has generated optimism among investors, leading to a surge in stock value. Walt Disney’s shares also rose by 0.9% ahead of its quarterly results, as market participants eagerly awaited updates on the company’s performance.

Banking Sector and Moody’s Downgrade

The banking sector experienced losses following Moody’s downgrade of several small and mid-sized banks. This downgrade serves as a reminder of the challenges that the banking industry continues to face. Bank of America and Wells Fargo, two prominent banks, saw their shares decline by 0.3% and 0.8%, respectively. The health of the banking sector remains a concern, as it plays a crucial role in influencing the Federal Reserve’s decision-making process.

Chinese Deflation and Global Economic Concerns

China’s consumer sector fell into deflation, and factory-gate prices continued to decline in July. This highlights the challenges faced by the world’s second-largest economy in reviving demand. The deflationary trends in China raise concerns about a prolonged economic slowdown with potential global repercussions. These concerns about the global economy further contributed to the negative sentiment among investors.

Market Performance and Outlook

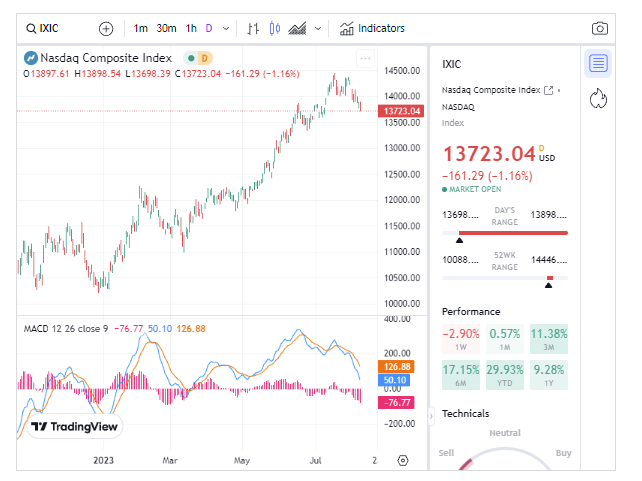

At the time of writing, the Dow Jones Industrial Average was up 0.12%, the S&P 500 was down 0.05%, and the Nasdaq Composite fell by 0.39%. Energy stocks recorded gains, with a rise of 1.8% in response to a jump in crude oil prices. Additionally, the Russell 2000 and Innovator IBD 50 ETF experienced declines of 0.6% and 1%, respectively.

Investors will continue to monitor the market closely, with particular attention on the upcoming inflation report and its potential impact on monetary policy decisions. The performance of individual companies, such as Disney, Lyft, and Penn Entertainment, will also be closely scrutinized as they navigate through market challenges and seize growth opportunities.

Conclusion

The tech-heavy Nasdaq and the S&P 500 faced declines as a result of dovish comments from U.S. Federal Reserve officials and anticipation of the upcoming inflation report. The market sentiment has been influenced by the divergence in views among Federal Reserve officials regarding interest rates. Investors are eagerly awaiting the inflation report to gain insights into inflationary pressures and potential changes in monetary policy. The performance of specific companies, such as Lyft and Penn Entertainment, has varied in response to their pricing strategies and business deals. Moreover, concerns about the global economy, particularly China’s deflationary trends, have added to the negative sentiment in the market. As investors navigate through uncertain times, they will closely monitor market indicators and the performance of individual companies to make informed investment decisions.

Also read these articles: