Tesla has been a popular stock among investors in recent years. With the SMA20 reading now at +1.60%, many investors are now wondering if this is a sign that Tesla is finally ready to break out and could be a good stock to buy.

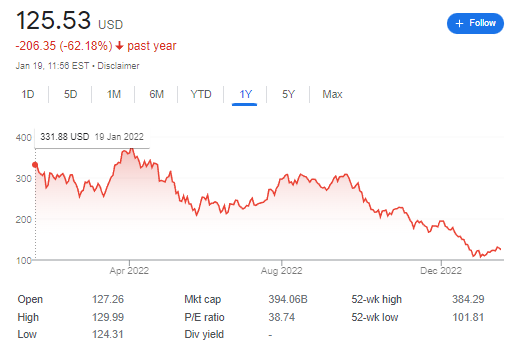

Tesla’s share price has grown exponentially since its initial public offering in 2010, increasing by over 500% in 2020 alone. Although the stock has made investors profits, it can also be very volatile and is seen as a high-risk but potentially extra-rewarding investment. However, in last year, Tesla lose -62.05% from 331.88 USD to 125.53 USD.

Before investing any money into Tesla, it’s important to understand how the SMA20 indicator works and decide if this could be an opportunity for you to benefit from investing in one of the world’s most famous companies. In this article, we will take a closer look at Tesla stock’s performance at its current SMA20 levels, review some of its recent financial figures and pose the ultimate question – is Tesla worth investing in?

Read this FintechZoom Article: Discover the Green Revolution: EV Vehicles Production Is Taking Off!

Tesla On 2022: TSLA Stock drop -62.05% and Car deliveries growth of 40%

Tesla’s stock has had a wild ride these past few years. Starting on 2022 at 331.88 USD and currently at 125.53 USD, representing a drop of -62.05%. Recently, however, the SMA20 (simple moving average) trendline crossed into positive territory at +1.6% – so it appears that momentum is shifting back towards growth for the tech giant.

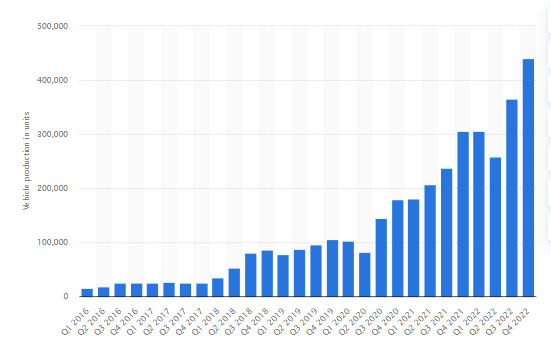

In one hand, it was a remarkable year for Tesla, as the company reported 1.31 million deliveries in 2022, a growth of 40% over last year, despite the pandemic. Read How a 47% YOY Q4 Production Rise Gave Tesla Stock an 8.8% Boost. This amazing success puts Tesla at the forefront of the global electric vehicle revolution and it is no surprise that the company’s stock has been so highly valued.

However, Tesla’s stock has experienced a roller coaster ride over the last year. Despite the company’s impressive performance, TSLA stock has dropped from 331.88 USD to a low of 125.53 USD, a 62.05% decline. This was due to a combination of factors, including macroeconomic uncertainty due to inflation, the pandemic and rising competition from other electric vehicle manufacturers.

Read also The TSLA Stock Rollercoaster: Will it Continue To Surge or Take a Dive?

Despite this, Tesla has continued to perform well and is now one of the most valuable companies in the world with a Market Cap of 394.06B. This is mainly due to its innovative approach to electric vehicles and its focus on customer satisfaction. Tesla is also dedicated to making its vehicles more affordable, which has also contributed to its success.

SMA 20 is +1.6%, so it appears that momentum is shifting back to invest in Tesla?

Good news for Tesla (TSLA) investors as the simple moving average with a period of 20 days (SMA) 20 is +1.6%. This positive shift in the stock market appears to be an indication that momentum is shifting back to investing in Tesla. Despite the positive shift in the SMA 20, the SMA50 and SMA are still negative on -20.95% and -48.11%. This could be a sign that investors are still wary of investing in Tesla and are not fully convinced of its potential. In January 9, Tesla Stocks increased +5.93%.

With the SMA 20 now showing a positive shift, the momentum could be shifting back to investing in Tesla. Recent reports suggest that the electric car maker has been able to increase its production and is now on a path to profitability. This could be a deciding factor for investors who are now more likely to invest in Tesla as the company appears to be in a much better state than it was a few months ago.

Tesla has also been able to increase its sales and has now become one of the most popular brands in the world. This popularity could be fueling investor interest in the company, which in turn could be reflected in the SMA 20. The SMA 50 and SMA are still negative on -20.95% and 48.11% respectively, but this could be a sign that investors are still on the fence when it comes to investing in Tesla. In January 17, Tesla was trying to break the 123USD level, currently is 125.72USD.

To shake the EV market cars, Tesla cuts prices globally by up to 20%.

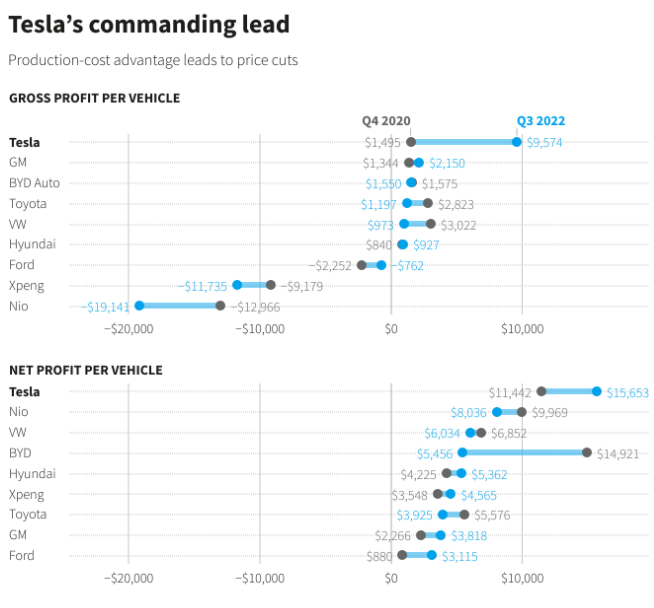

This action, is possible because Tesla Inc earns more money for every vehicle it sells than any of its global rivals.

The world has seen a massive surge in the Electric Vehicle (EV) market in the past few years, and it looks like Tesla Inc. is ready to shake it up even more. In a recent announcement, the company has declared that it will be cutting prices of its EVs globally by up to 20%. This news has been welcomed by the Tesla Stock holders, who have seen the stocks soar in the past few weeks.

This action is possible because Tesla Inc. earns more money for each vehicle it sells than any of its global rivals. For instance, for every car it sells, the company makes an average profit of $9,574. This is almost triple the average profit per car of its competitors. This means that the company has the capacity to reduce the prices, whilst still making good profits.

The news of the price cut has already sent the Tesla Stock prices soaring. This could be a great opportunity for investors to get in on the action, as the company is expected to make even more profits in the near future. Furthermore, the company is also said to be planning to launch new models in the upcoming years, which could further increase the demand for its cars.

Overall, the news of Tesla Inc. cutting prices of its EVs globally is great news for both investors and customers. Tesla Stock prices are expected to remain high and the company is likely to make more money for every vehicle it sells than any of its rivals. This could be a great opportunity for those looking to invest in the EV market.