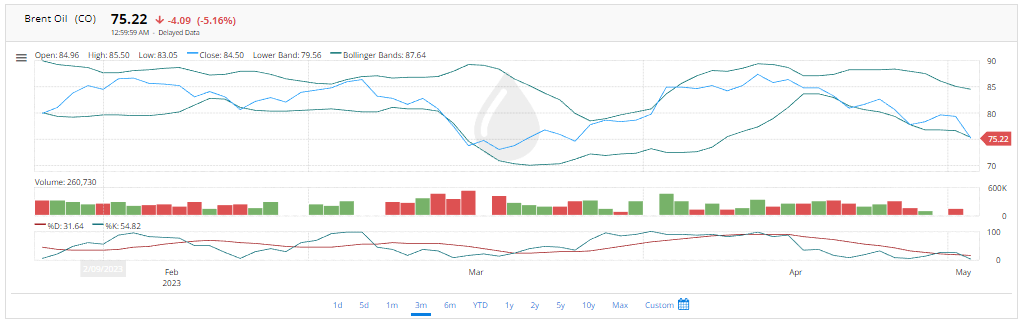

According to recent reports, Brent crude futures have fallen below $75 a barrel for the first time since March. This drop in price is attributed to concerns about the global economy, including a sluggish US economy, weak Chinese manufacturing data, and declining refining margins [1][2][3]. This decline comes after OPEC+ members agreed to cut production by over 1 million barrels a day, which had previously pushed the benchmark to as high as $87 a barrel in mid-April. However, with these new economic concerns, investors have become more bearish on the future of the oil market.

References:

[1] Brent Oil Falls Below $75 a Barrel for First Time Since March [2] Brent Oil Falls Below $75 a Barrel for First Time Since March [3] Brent oil falls below $75 a barrel for first time since March

Read also: Economic War: Oil climbs, Inflation Rises and Central Banks with a Huge Problem.

Uncertainties over whether Russia is joining the curbs in output by OPEC+

Crude oil prices have been on a downward trend despite the emergence of China from its restrictive Covid Zero policy and the significant reductions in supply by OPEC+ members. This can be attributed to concerns over the possibility of a US recession leading to a decrease in fuel demand. Additionally, there are uncertainties over whether Russia is joining the curbs in output by OPEC+. Short sellers seem to be in control of the market, and prices are expected to continue falling.

References:

[1] Oil Plunge Deepens as Concerns Over Economy Drive … [2] Oil plunge deepens as concerns over economy drive selloff [3] Oil settles lower on China COVID flare-up, recession fearPotential slowdown in the global economy

Another reason for Oil prices dropped is due to concerns over demand and a potential slowdown in the global economy [1]. The suspension of some Russian crude exports to Europe has also contributed to the decline in oil prices. Brent crude futures settled at $74.35, losing 22 cents, while U.S. West Texas Intermediate crude dropped 68 cents to $68 a barrel [3]. Poland and Germany have suspended imports of Russian crude via the Druzhba pipeline, which can ship up to 1 million barrels per day, with about 700,000 bpd of the flow being suspended [3]. The recent decision by the United States to end exemptions for buyers of Iranian oil has also affected the oil market [3].

References:

[1] Brent Oil Slips Below $75 on Demand, Slowdown Concerns [2] Oil Falls the Most in a Month as Slowdown Ignites Demand … [3] Brent slips from $75 per barrel as investors doubt rally will …FED will raise interest rates by 0.25 percentage points

The Federal Reserve is holding a two-day meeting on May 2-3, with a press conference scheduled for 4:15 p.m. on May 3. [1] The markets are expecting the Fed to raise interest rates by 0.25 percentage points at this meeting, with a 7 in 10 chance of a hike. [2] Recent economic data suggests that inflation continues to run hot, and unemployment numbers do not imply a recession. [2] The Fed’s focus is on bringing down inflation, which is why there is a potential for a rate hike in May. [2] However, there is a disconnect between the Fed and markets, as the Fed sees the potential for a few more small hikes, while fixed income markets see the Fed starting to cut by the summer due to greater economic weakness than the Fed anticipates. [2]

References:

[1] Calendar [2] What To Expect From The Fed’s May Meeting [3] May Fed Meeting Preview: The Fed’s Final Rate Hike?