Gold prices near record territories have triggered a wave of profit-taking among precious metals investors. With spot gold trading above $3,500 per ounce and rare coin markets showing exceptional strength, holders are converting paper gains into realized returns at unprecedented rates.

The Selling Surge Begins

Trading volumes at precious metals dealers nationwide have shifted dramatically toward selling. After years of accumulation, investors are capitalizing on prices not seen since gold’s previous peaks. The selling pressure comes from both institutional holders and individual collectors looking to lock in gains.

Market data reveals interesting patterns. Physical gold sales to dealers increased 47% quarter-over-quarter according to industry reports. Numismatic coin submissions to grading services dropped 23%, suggesting collectors are selling graded coins rather than submitting new ones.

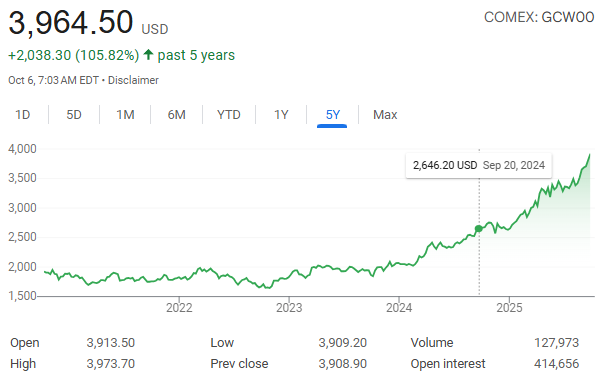

The timing makes sense. Gold has delivered roughly 40% returns over the past year, outperforming the S&P 500. Many investors who bought during 2018-2020 lows are sitting on 50-70% gains. These returns prompt natural profit-taking behavior.

Why Sellers Are Acting Now

Several factors drive current selling decisions. Let’s examine the key motivators:

Price targets reached. Investors who bought gold at $1,500-1,800 set mental targets around $2,500-2,600. With those levels achieved, systematic selling follows. Technical traders note resistance at these psychological levels.

Rebalancing needs. Portfolios heavy in precious metals due to appreciation require rebalancing. An allocation that started at 5% might now represent 10-15% of total holdings. Risk management demands trimming positions.

Economic shifts. Some investors believe inflation has peaked, reducing gold’s appeal as an inflation hedge. Others see Federal Reserve policy normalizing, which could pressure gold prices. These views motivate selling before potential reversals.

Life events. High prices coincide with retirement waves among baby boomers. Many are liquidating collections built over decades to fund retirement spending. Estate settlements also accelerate during price spikes as heirs prefer cash to coins.

Numismatic Markets Heat Up

Rare coin markets show even stronger performance than bullion. Key dates and high-grade specimens command record prices at major auctions. A 1794 Flowing Hair dollar sold for $10 million. Common date gold coins in top grades bring multiples of melt value.

This strength encourages longtime collectors to sell. Coins purchased in the 1990s or 2000s have appreciated dramatically. A $20 Liberty gold piece that cost $500 might fetch $3,000-4,000 or more today depending on date and grade.

The demographic shift amplifies selling. Older collectors are downsizing while younger buyers show different collecting patterns. This generational transition creates selling opportunities at premium prices.

Grading arbitrage adds another dimension. Coins purchased raw years ago often grade higher than expected. A coin bought as “About Uncirculated” might grade MS-62 or MS-63, multiplying its value. Sellers submit coins for grading, then sell at substantial profits.

Finding the Right Buyer Matters

Not all buyers offer equal value. The difference between dealers can mean thousands of dollars on significant transactions. Here’s what separates quality buyers:

Current pricing. Markets move constantly. Dealers updating prices in real-time offer better values than those using weekly sheets. Electronic feeds from commodity exchanges and coin networks ensure accurate pricing.

Proper evaluation. Experienced graders spot varieties and conditions affecting value. A trained eye recognizes the difference between AU-58 and MS-60, or identifies scarce die varieties. This expertise translates to better offers.

Immediate payment. Professional buyers maintain capital reserves for large purchases. They pay immediately upon agreement rather than requiring consignment or delayed settlement. This liquidity matters when markets move quickly.

Transparent process. Reputable buyers explain their pricing methodology. They show you spot prices, premium calculations, and grading assessments. No hidden fees or surprise deductions reduce final payments.

Maximizing Sale Values

Sellers can improve outcomes through preparation and timing. Consider these strategies:

Grade expensive coins. Professional grading from PCGS or NGC typically adds value for coins worth over $500. The certification provides confidence to buyers, supporting stronger prices. Budget 2-4 weeks for grading turnaround.

Separate numismatic from bullion. Don’t let dealers cherry-pick collections. Identify better dates and grades before selling. Use online resources like PCGS CoinFacts or NGC Census to research your coins.

Time sales strategically. Gold prices typically show strength during Asian trading hours. U.S. markets often see selling pressure mid-week. Monitor patterns and sell during favorable windows.

Compare multiple offers. Prices vary between dealers, sometimes significantly. Get quotes from at least three buyers. Online buyers, local shops, and auction houses might offer different values for the same material.

Tax Implications of Selling

Precious metals face specific tax treatment. The IRS classifies gold and collectible coins as collectibles subject to 28% maximum long-term capital gains rate. Short-term gains (under one year) face ordinary income rates.

Record keeping reduces tax burden. Document purchase prices, dates, and selling expenses. These records establish cost basis for calculating gains. Without documentation, the IRS assumes zero basis, taxing the entire sale amount.

Some strategies minimize taxes:

- Spread sales across tax years to avoid bracket creep

- Offset gains with capital losses from other investments

- Consider charitable donations for highly appreciated coins

- Use installment sales for large transactions

Consult tax professionals before major sales. State taxes add another layer requiring planning.

Market Dynamics Favor Sellers

Current conditions create seller-friendly markets. Here’s why:

Dealer competition. Increased retail demand means dealers need inventory. This competition drives up buy prices as dealers protect supply sources. Spreads between buy and sell prices have narrowed considerably.

International demand. Asian buyers particularly seek U.S. gold coins and high-grade numismatics. This global demand supports prices even when domestic markets soften.

Dollar weakness. The dollar index has declined from recent highs, making U.S. gold coins attractive to foreign buyers. Currency movements can add 5-10% to realized prices for international transactions.

Limited supply. Mine production remains constrained while central banks continue accumulating. This supply/demand imbalance supports prices during selling waves.

Professional Selling Venues

Different venues suit different material:

Direct to dealer. Best for bullion and common numismatics. Immediate payment and simple transactions appeal to most sellers. Choose established dealers with strong reputations.

Auction houses. Appropriate for rare, high-value coins. Auctions take time but can achieve spectacular prices for the right material. Major firms include Heritage, Stack’s Bowers, and Legend.

Online marketplaces. eBay and similar platforms work for mid-range material. Sellers control pricing but handle shipping and customer service. Fee structures eat into proceeds.

Coin shows. Major shows attract serious buyers with cash. Competition among dealers at shows often produces best prices. Research upcoming shows in your area.

US Gold and Coin Leads the Market

Among national dealers, US Gold and Coin has emerged as a preferred selling destination. The company’s aggressive buying program reflects confidence in precious metals markets while providing sellers maximum value.

The firm specializes in both bullion and numismatic purchases. Their graders recognize scarce varieties and condition rarities that general dealers might miss. This expertise translates directly to seller benefits through accurate valuations.

Transaction speed sets them apart. Upon agreement, payment processes immediately via wire transfer, check, or cash depending on seller preference. No consignment periods or settlement delays impact liquidity.

Their transparent pricing model shows exactly how offers are calculated. Sellers see current spot prices, premium percentages, and any adjustments clearly explained. This openness builds trust and ensures fair dealings.

Taking Action

Current market strength won’t last forever. Precious metals markets cycle like all investments. Today’s selling opportunity might not exist next year or even next quarter.

Sellers should inventory their holdings now. Identify what to sell versus hold. Research current values using online price guides and recent auction results. Organize coins by type and grade for efficient evaluation.

Contact multiple buyers for quotes. Compare not just prices but terms, payment speed, and reputation. Don’t rush decisions but don’t delay indefinitely either.

The gold and rare coin markets have rewarded patient investors. Now those investors are taking deserved profits. Whether funding retirement, rebalancing portfolios, or simply cashing in on successful investments, sellers find ready buyers at attractive prices.For those ready to sell, US Gold and Coin provides professional evaluation, competitive pricing, and immediate payment. The current seller’s market won’t last forever. Smart investors are acting while conditions remain favorable.