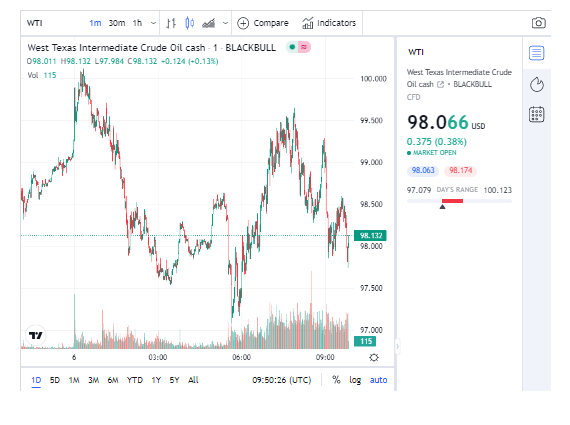

Oil prices toppled Tuesday with the united state standard falling below $100 as economic crisis worries expand, sparking concerns that an economic stagnation will certainly cut demand for oil products.

In May 2022, IEA Oil Market Report, says:

“World oil demand growth is forecast to slow to 1.9 mb/d in 2Q22 from 4.4 mb/d in 1Q22 and is now projected to ease to 490 kb/d on average in the second half of the year on a more tempered economic expansion and higher prices. As summer driving escalates and jet fuel continues to recover, world oil demand is set to rise by 3.6 mb/d from April to August. For 2022, demand is expected to increase by 1.8 mb/d on average to 99.4 mb/d.”

West Texas Intermediate crude, the U.S. oil criteria, cleared up 8.24%, or $8.93, reduced at $99.50 per barrel. At one factor WTI glided greater than 10%, trading as low as $97.43 per barrel. The contract last traded under $100 on Might 11.

International benchmark Brent crude cleared up 9.45%, or $10.73, lower at $102.77 per barrel.

Ritterbusch as well as Associates connected the move to “tightness in global oil equilibriums significantly being countered by solid chance of recession that has actually started to reduce oil need.”

″ The oil market seems homing know some current weakening in obvious demand for fuel and diesel,” the firm wrote in a note to customers.

Both agreements published losses in June, snapping six straight months of gains as economic downturn concerns create Wall Street to reassess the demand overview.

Citi claimed Tuesday that Brent might be up to $65 by the end of this year must the economy idea right into an economic downturn.

“In an economic crisis scenario with rising joblessness, household as well as company bankruptcies, products would chase after a dropping expense contour as prices deflate and also margins turn unfavorable to drive supply curtailments,” the firm wrote in a note to customers.

Citi has actually been one of the few oil births at a time when other firms, such as Goldman Sachs, have asked for oil to hit $140 or even more.

Prices have actually been elevated considering that Russia got into Ukraine, increasing issues about international lacks provided the nation’s function as a crucial commodities supplier, especially to Europe.

WTI spiked to a high of $130.50 per barrel in March, while Brent came within striking distance of $140. It was each agreement’s highest level because 2008.

But oil was on the move even ahead of Russia’s intrusion thanks to limited supply as well as recoiling need.

High commodity prices have been a major factor to rising inflation, which goes to the highest possible in 40 years.

Prices at the pump topped $5 per gallon previously this summertime, with the national average striking a high of $5.016 on June 14. The national standard has considering that pulled back amid oil’s decline, and rested at $4.80 on Tuesday.

Despite the recent decline some experts say oil prices are most likely to stay elevated.

“Economic crises do not have an excellent performance history of eliminating need. Item stocks go to seriously reduced levels, which additionally recommends restocking will certainly maintain petroleum demand strong,” Bart Melek, head of commodity method at TD Stocks, said Tuesday in a note.

The company included that marginal progress has been made on solving architectural supply issues in the oil market, implying that even if demand growth reduces prices will stay sustained.

“Financial markets are attempting to price in an economic downturn. Physical markets are informing you something actually different,” Jeffrey Currie, international head of commodities research study at Goldman Sachs, told FintechZoom Tuesday.

When it involves oil, Currie said it’s the tightest physical market on document. “We’re at critically reduced supplies across the room,” he said. Goldman has a $140 target on Brent.

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 rose 1.7% as of 9:19 a.m. London time

- Futures on the S&P 500 were little changed

- Futures on the Nasdaq 100 were little changed

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index fell 0.8%

- The MSCI Emerging Markets Index fell 0.9%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0259

- The Japanese yen rose 0.4% to 135.26 per dollar

- The offshore yuan was little changed at 6.7080 per dollar

- The British pound rose 0.3% to $1.1977

Bonds

- The yield on 10-year Treasuries was little changed at 2.80%

- Germany’s 10-year yield advanced five basis points to 1.23%

- Britain’s 10-year yield advanced two basis points to 2.07%

Commodities

- Brent crude rose 1.6% to $104.46 a barrel

- Spot gold rose 0.3% to $1,770.05 an ounce