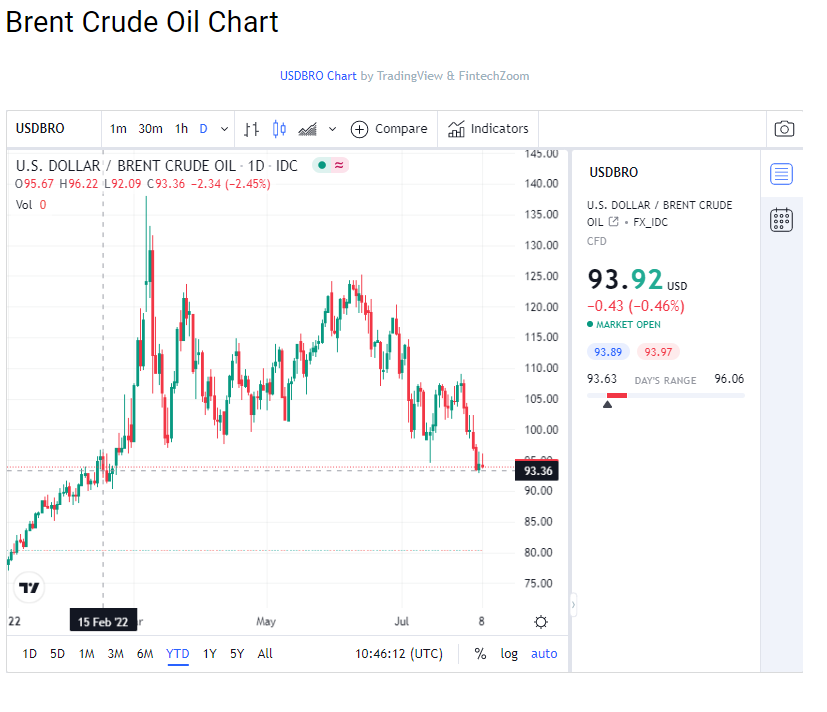

Brent is now floating at regarding $96 per barrel, after falling around 9% last week. Prices previously today were as reduced as $94, which notes the lowest factor in nearly 6 months. The downward stress on the oil price is coming entirely from a weakening of need expectations, as markets support for a potentially sharp economic tightening. Gains triggered by the intrusion of Ukraine have currently been cancelled out, as rising interest rates as well as the subsequent cooling this is anticipated to carry worldwide economic situations, outweigh previous concerns regarding a lack of supply triggered by the conflict.

Rumours are swirling that high street large Following has been in plans to buy a 25% risk in fellow high street peer Joules. While no offer is inked or ensured, if the action is successful, it would certainly note the latest enhancement to Next’s expanding portfolio of various other high street names. Following is trying to find ways to increase its core, particularly on-line, as it wants to future-proof itself versus the difficult outlook for traditionals merchants. Joules has solid brand name power and a recognisable style, which, on paper, makes it a sensibly reasonable addition. At the same time, the greater price factors of Joules’ clothes could make it more difficult to offer in the existing inflationary atmosphere.

New study by the Post Office has actually shown a 20% boost in personal cash money withdrawals contrasted to in 2015. The ₤ 801m taken care of is the highest because records began five years ago. The modification is to the cost-of-living dilemma, as battling consumers look to physically count the cents to get by. This practices has really actual undertones for the bigger economic climate as well as reveals that customer resilience and self-confidence is heading the wrong way. Discretionary, non-essential items, from a pub drink to a summer season holiday, are the expendables in this setting and also such items are most likely to feel the pinch in the coming months. Whatever the larger implications, there is definitely a clear indicator that psychology is transforming to counting cash in the real world as well as relocating away from the tap-now-worry-later that includes card society.

Oil costs dropped on Monday, hovering near multi-month lows, as economic downturn anxieties hurt demand outlook and information pointed to a sluggish healing in China’s unrefined imports last month.

Brent unrefined futures went down 74 cents, or 0.8%, to $94.18 a barrel by 0039 GMT. Front-month rates hit the lowest degrees considering that February last week, toppling 13.7% as well as publishing their biggest weekly decrease since April 2020.

United State West Texas Intermediate crude was at $88.34 a barrel, down 67 cents, or 0.8%, extending losses after a 9.7% loss last week.

China, the globe’s top unrefined importer, imported 8.79 million barrels per day (bpd) of crude in July, up from a four-year low in June, however still 9.5% lower than a year earlier, customizeds data showed.

Chinese refiners drew down accumulations in the middle of high crude prices and also weak residential margins also as the nation’s total exports obtained energy.

Reflecting lower U.S. gasoline need, and also as China’s zero-Covid technique presses recuperation better out, ANZ modified down its oil demand projections for 2022 as well as 2023 by 300,000 bpd as well as 500,000 bpd, specifically.

Oil demand for 2022 is currently approximated to climb by 1.8 million bpd year-on-year as well as work out at 99.7 million bpd, simply except pre-pandemic highs, the financial institution said.

Russian crude and also oil items exports remained to flow in spite of an upcoming stoppage from the European Union that will take effect on Dec. 5.

In the USA, energy companies reduced the variety of oil rigs by the most recently given that September, the very first drop in 10 weeks.

The united state clean energy industry obtained a boost after the Senate on Sunday passed a sweeping $430 billion costs meant to eliminate climate adjustment, to name a few issues.