It has been a tumultuous week for oil prices, with the market yo-yoing back and forth as traders try to figure out where the commodity is headed. On Wednesday, oil prices surged after OPEC+ announced a huge cut to their production target. However, those gains were erased on Friday as global recession fears weighed on the markets. Will oil stocks go up? Let’s take a closer look at what happened this week and see if we can get some clues about where oil prices are headed next.

Oil and Gas Industry: Can we Estimate oil and gas prices?

Oil prices dropped greater than 3% on Friday as global recession fears as well as weak oil need, especially in China, outweighed support from a huge cut to the OPEC+ supply target.

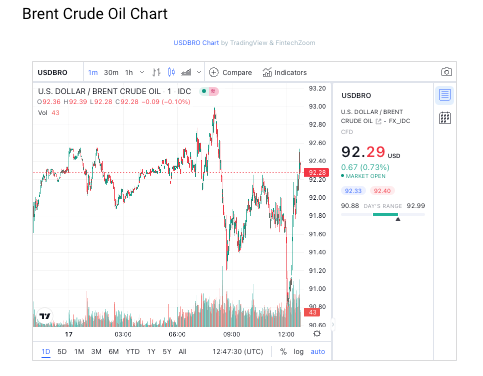

Brent crude futures went down $2.94, or 3.1%, to clear up at $91.63 a barrel, while united state West Texas Intermediate (WTI) crude oil prices futures fell $3.50, or 3.9%, to $85.61.

The Brent as well as WTI contracts both oscillated between positive and negative region for much of Friday however fell for the week by 6.4% as well as 7.6%, specifically.

U.S. core inflation tape-recorded its largest annual boost in 40 years, reinforcing sights that rates of interest would stay higher for longer with the risk of a global recession. The next U.S. rate of interest choice is due on Nov. 1-2.

U.S. consumer view remained to enhance gradually in October, but homes’ inflation assumptions weakened a bit, a survey revealed.

The renovation in consumer belief “is being deemed a negative due to the fact that it means the Fed requires to break the spirit of the consumers and slow the economy down much more, and that’s caused an increase in the dollar and also downward stress on the oil market,” said Phil Flynn, expert at Price Futures Team in Chicago.

The EU’s 27 countries have been deadlocked for weeks over whether and also exactly how to cap natural gas prices as part of initiatives to tame soaring energy prices, as Europe heads right into a winter months of scarce Russian gas, a cost of living dilemma and a feasible economic downturn.

Gas prices have actually skyrocketed as Russia slashed circulations to Europe following its intrusion of Ukraine as well as the Western sanctions troubled it – prompting most EU nations to call for a gas price cap, although they disagree on its layout.

Some nations, consisting of Germany, Europe’s largest gas market, stay opposed. They say that topping prices might trigger need for gas to rise or leave countries having a hard time to bring in supply from global markets.

The bloc’s exec, the European Commission, is because of recommend power measures to tackle the crisis on Tuesday, ahead of the leaders’ conference.

A number of nations that favour topping gas are worried that the Commission will certainly not advance choices they have suggested, an EU mediator said.

” Rashness is expanding with participant states,” they stated. “So we transformed gear and also put everything that is being drifted … on the table. It is a method of putting pressure on the Commission to find up with the most concrete possible proposals.”

Forex Market

The U.S. dollar index rose around 0.8%. A more powerful dollar minimizes demand for oil by making the fuel a lot more costly for buyers making use of other money.

In united state supply, energy companies this week included eight oil rigs to bring the overall to 610, their highest possible given that March 2020, power services firm Baker Hughes Carbon monoxide said. learn more.

China, the globe’s biggest petroleum importer, has been dealing with COVID-19 flare-ups after a week-long holiday. The country’s infection tally is tiny by global standards, however it complies with a zero-COVID plan that is taxing financial task and thus oil need.

The International Power Firm (IEA) on Thursday reduced its oil demand forecast for this and also following year, caution of a prospective international economic downturn.

The market is still digesting a decision recently from the Organization of the Oil Exporting Countries and allies, with each other called OPEC+, when they revealed a 2 million barrel per day (bpd) cut to oil manufacturing targets.

Underproduction among the group suggests this will most likely translate to a 1 million bpd cut, the IEA price quotes.

Saudi Arabia as well as the United States have actually clashed over the choice.

Meanwhile, money managers raised their web lengthy united state crude futures and also choices settings by 20,215 agreements to 194,780 in the week to Oct. 11, the U.S. Commodity Futures Trading Compensation (CFTC) claimed.

Oil markets overview

Opinion by Mihir Kapadia, the CEO of Sun Global Investments:

“Oil markets have been re-shaped by geopolitical forces this year to a new degree, and couldn’t have been predicted had anyone attempted to do so early this year.

The once solid and unshakable US Saudi Arabia alliance built on the foundations of the oil markets appears unresponsive to the current global challenges, as the OPEC+ cartel with Russia has wielded far great power.

With OPEC+ voting to cut output by 2 Million barrels a day to support prices, despite vocal opposition from the White House, and amidst a strong inflation spike through Europe and the US, the friction is only set to intensify further into 2023 as fears of a recession looms large.

On Monday, Brent crude futures rose 81 cents, or 0.88%, to $92.44 a barrel early morning, recovering from a 6.4% fall last week, while U.S. West Texas Intermediate crude climbed up to $86.33 a barrel, up 72 cents, or 0.84%, after a 7.6% decline last week.

The long term outlook is bearish unless there is a breakthrough in the Russian war, but a lot can re-shape the markets in the next few quarters, especially if a recession induces slowdown.”

Interested in investing in the oil and gas industry?

There are a number of options available when it comes to oil and gas investments, ranging from stocks and mutual funds to private equity firms. One good way to start is by looking at oil and gas producers, which typically offer the most favorable investment conditions.

These companies invest directly in oil field development projects, so they typically have a higher level of certainty around their profit margins. In addition, oil and gas stocks can provide a stable return that is less volatile than other commodities such as gold or copper.

Whether you are a seasoned investor or just starting out, there are plenty of lucrative opportunities in the world of oil and gas investments. So why not dive into this dynamic and exciting industry today?

Best 5 Stocks to buy in Oil Industry?

There are many great stocks to choose from in the oil industry, but in my opinion, the following five pose the best investment opportunities for long-term growth.

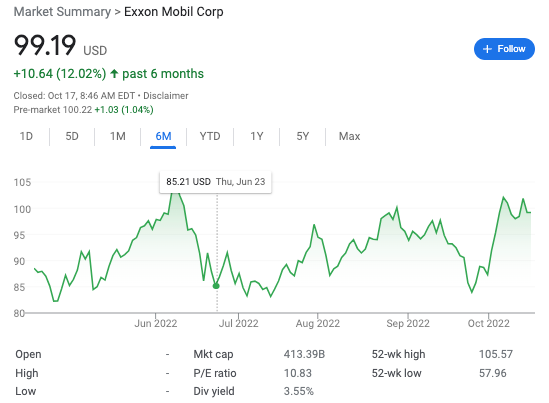

At the top of my list is ExxonMobil, which has a stellar track record of delivering consistent returns to investors and boasts one of the largest oil reserves of any company in the world.

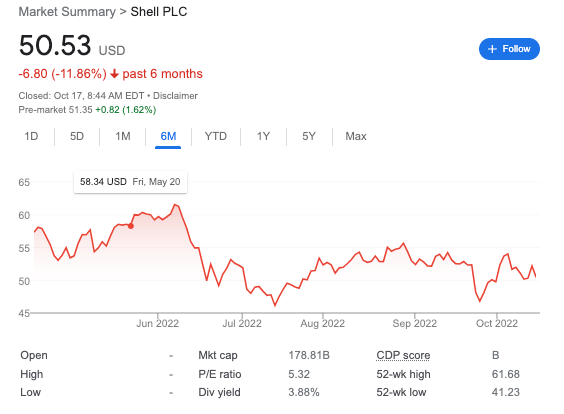

Another standout stock in this sector is Royal Dutch Shell, with its extensive portfolio of exploration projects, state-of-the-art technology, and massive scale advantages over its competitors.

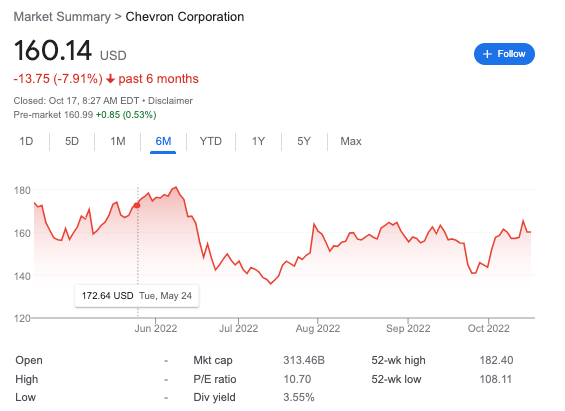

In addition, I would recommend Chevron as an attractive option for investors interested in exposure to both upstream and downstream parts of the industry; Chevron is involved in everything from refining heavy crude in Canada to drilling for deepwater oil off the coast of Nigeria.

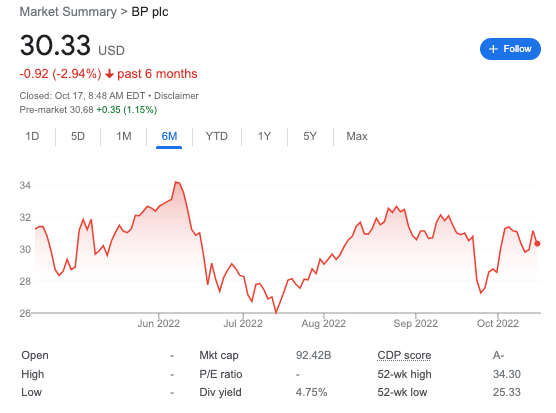

Of course, no discussion of great oil stocks would be complete without mentioning BP. Over the years the company has faced steep challenges due to environmental disasters like Deepwater Horizon and regulatory scrutiny from regulators around the world, but it remains an important player within the industry at large.

Finally, if you are looking for a more speculative bet on future developments in oil exploration, then I would suggest giving Canadian Natural Resources a closer look; this innovative company has been able to successfully harness new technologies and engineering techniques that could potentially revolutionize how we find and extract underground deposits.

Whether you’re looking for safety or excitement, there are plenty of great options available within the exciting world of oil investing!