Commodities prices have been on the rise lately, driven in large part by increasing energy costs. There are a number of factors contributing to higher energy prices, including global supply and demand dynamics and geopolitical instability. These trends have had a particularly strong impact on oil prices, which hit record highs this year. As a result, many experts are warning about the potential for volatility in commodity markets going forward. However, it is important to keep things in perspective and recognise that even though prices may be currently high, commodities are still generally quite affordable compared to historical standards. Therefore, although energy prices present some challenges at the moment, they also present new opportunities for businesses and investors as we move into the future.

The Brent Crude Oil price is now at 90.44 USD (-0.13%).

The Brent crude oil price has been in decline since the beginning of this year. At its peak in June, it was trading at around 124.22 USD, but it has been gradually dropping ever since and is now sitting at 90.44 USD. This significant drop in price is largely due to escalating tensions between Russia and Ukraine and recent production cuts by OPEC member nations. With much of the world’s oil supply coming from these countries, speculation has been growing that a prolonged conflict could disrupt global oil markets, causing prices to plummet even further. While it remains to be seen how this situation will play out, it is clear that the Brent crude oil price will continue to be influenced by these geopolitical factors for the foreseeable future.

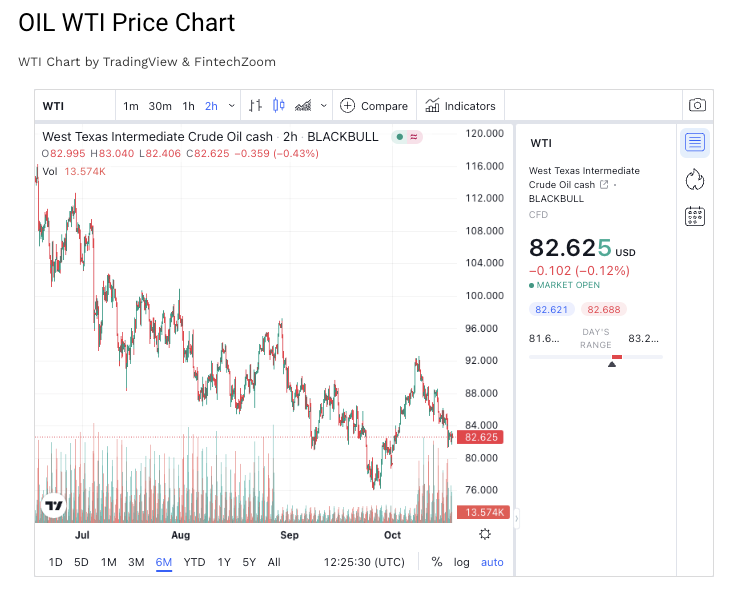

The WTI Oil Price is now at 82.62 USD (-0.12%).

The WTI oil price is currently at near to a record low, with the current price dropping to just 82.62 USD per barrel. This represents a marked decrease from the 116 USD that the price was at 6 months before, and seems to be largely driven by geopolitical concerns in Ukraine and Russia as well as by reports that OPEC has scaled back production estimates in order to help stabilize prices. Given these factors, it is likely that we will continue to see this downward trend in oil prices for the foreseeable future. Nevertheless, despite the short-term fluctuations in oil prices, the long-term outlook remains positive, with investment in energy infrastructure and technology expected to continue driving economic growth around the world. So while there may be some bumps along the way, in general it seems clear that energy resources are here to stay.

Natural Gas prices continue to falling since 22 August (9.970 USD). Today is 5.940 USD (-1.69%).

Over the past several weeks, there has been a significant decline in the price of natural gas. As of today, the price of natural gas is sitting at just over 5.940 USD per unit on average. This represents a decline of more than 1.69% from just one day earlier, and it is also significantly lower than it was at the beginning of the Ukraine-Russia conflict in 24th February 2022 when prices were around 4.505 USD per unit on average.

While there are many factors that might be driving this trend, analysts believe that a number of recent developments are contributing to the downward pressure on prices, including lower demand and increased supply. Specifically, industrial output in many regions has remained sluggish since last year’s economic downturn, and there is growing concern about weak energy consumption across many parts of Europe due to rising environmental concerns. Meanwhile, producers have recently stepped up efforts to bring new supplies online in response to these weaker market conditions.

Despite these downward pressures on pricing, however, many analysts remain optimistic about the future of natural gas prices moving forward. This optimism stems from several major trends that are expected to strengthen demand for natural gas going forward, including ongoing revitalization in the EU and rising interest in clean alternatives like renewables and nuclear power generation. In light of these trends, it seems likely that prices will begin to recover as we move into 2018 and beyond. While fluctuations in pricing may continue as supply continues to increase in response to fluctuating demand levels, over time it seems clear that natural gas will remain an important part of our global energy mix for years to come.

Nuclear Energy is a Green Solution?

In recent years, the growing threat of climate change has prompted a wide range of efforts to combat its effects. However, many of these efforts have centered on traditional sources of energy such as natural gas or fossil fuels, rather than more novel sources like nuclear power. Some critics argue that this is due to lingering misconceptions about nuclear energy, and that nuclear is in fact a green solution for our current energy crisis.

For one thing, unlike fossil fuels, nuclear energy produces virtually no greenhouse gas emissions. Nuclear reactors use a process called fission, which involves splitting atoms to produce energy. As a result, there is little chance for unnatural levels of carbon dioxide or other harmful gases to be released into the atmosphere. Additionally, many experts argue that nuclear power can actually help reduce our reliance on fossil fuel sources in the long run by expanding access to clean energy for all communities. With new technologies and regulations aimed at mitigating risks associated with uranium processing and waste collection continually coming into effect, it seems likely that nuclear will continue to play an important role in our transition away from fossil fuels towards greener solutions. Thus, while many people continue to harbor doubts about the safety and efficacy of nuclear power generation, it would seem that nuclear has already proven itself as a key player in the fight against climate change.