On this day, August 17th, 2023, the financial markets are experiencing a mixed bag of results. The Dow Jones Industrial Average, a key indicator of the stock market’s performance, is currently on a downward trend.

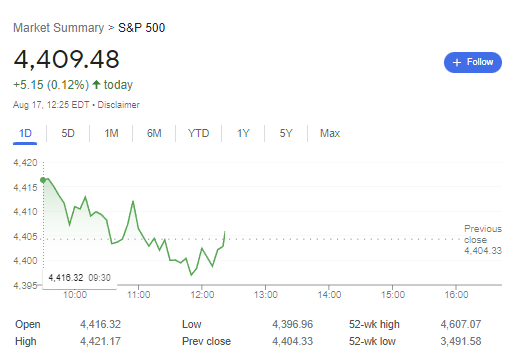

As of now, the Dow index stands at 34,711.07, marking a decrease of 0.16%. This is a slight dip from its opening value of 34,829.61, as reported by MarketWatch. In contrast, the S&P 500, another major stock market index, has seen a marginal increase. It has risen by 0.046%, with its current value standing at 4,416.32, according to FintechZoom.

This is a continuation of the index’s positive performance over the years, with an average return of 9.89% from 1992 to 2021. However, the Nasdaq Composite, which primarily includes technology stocks, has not fared as well. It has experienced a drop of 0.29% since the start of the year.

Despite this, it’s worth noting that the index has still managed to yield a substantial return of 32.9% since January 1, 2023. Meanwhile, the yields on 10-year and 30-year Treasury bonds have surged to their highest levels in over a decade. This rise in yields indicates a decrease in demand for these low-risk government securities, possibly due to investors shifting their focus towards the more volatile stock market. In summary, while the Dow Jones is experiencing a slight downturn, the S&P 500 continues to show resilience with a small increase.

The Nasdaq, on the other hand, has taken a hit, but still maintains a strong overall performance for the year. Amidst these fluctuations, Treasury yields are reaching new heights, signaling potential shifts in investor behavior.

Citations :

1. https://www.cnbc.com/quotes/.DJI

2. https://www.statmuse.com/money/ask/nasdaq+ytd+return+2023

6. https://www.cnbc.com/quotes/.SPX

8. https://www.barchart.com/stocks/performance/percent-change

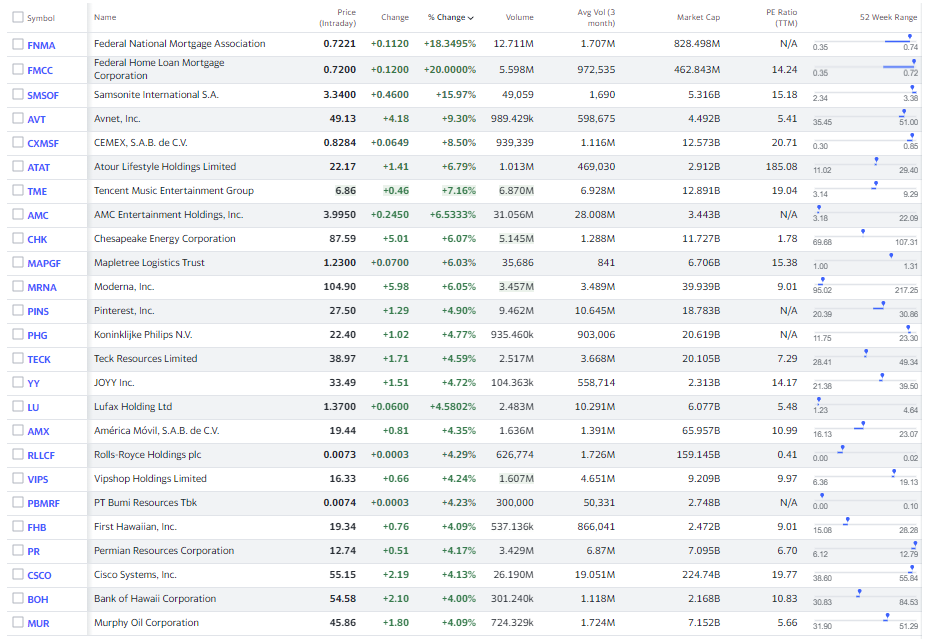

TOP Gainers Today

Among these top gainers today, Samsonite International S.A., a leading global lifestyle bag industry and the world’s largest travel luggage company, has seen a significant increase in its net sales. As of June 30, 2023, the company recorded consolidated net sales of US$924.1 million, marking a 36.1% increase compared to the second quarter of 2022.

The company’s gross profit margin also expanded to 59.4% in the second quarter of 2023, a rise of 290 basis points year-on-year. This growth is attributed to increased net sales from Asia and the Tumi brand, as well as overall lower promotional activity. Currently, Samsonite International has a real value of $14.33 per share.

Another notable gainer is AMC Entertainment Holdings, Inc., which as of August 08, 2023, has a net worth of $2.64 billion. The company’s stock price forecast indicates a median target of 1.83, with a high estimate of 4.50 and a low estimate of 0.50. Despite this, AMC’s stock has risen by $0.17 from the previous closing price of $3.75.

Moderna, a biotechnology company known for its COVID-19 vaccine, has also seen significant financial growth. The company has raised a total of $3 billion in funding over 13 rounds. Despite facing supply chain issues and reduced demand for the vaccine, Moderna has managed to maintain its financial stability.

The company has even considered a private COVID vaccine market in the US, with potential prices ranging from $15 to $100 per shot. Lastly, Pinterest, a popular social media platform, has also been identified as a top gainer.

However, specific financial details regarding Pinterest’s growth were not provided in the context. In conclusion, the stock market has seen significant gains from various companies, including Samsonite International, AMC Entertainment Holdings, Moderna, and Pinterest. These companies have demonstrated impressive financial growth and stability, contributing to their status as top gainers in the stock market.