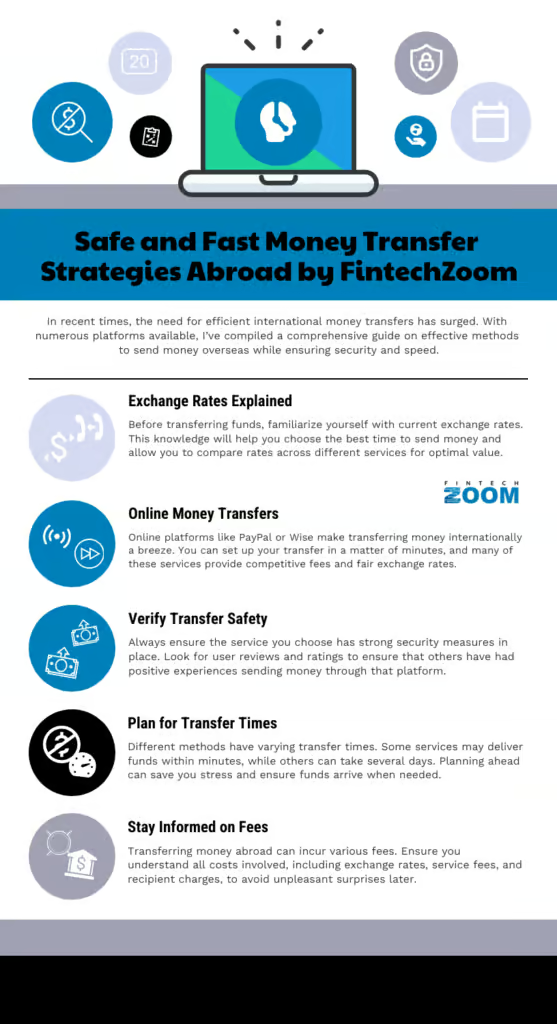

In today’s global economy, transferring money across borders is more common than ever. Whether you’re sending funds to support loved ones or making international business payments, ensuring that your transfer is both fast and secure is crucial. This guide will walk you through the most efficient ways to transfer money abroad and provide key insights into minimizing fees and avoiding delays.

Step 1: Choose the Right Transfer Method

When transferring money internationally, you’ll want to choose a reliable method. Traditional bank transfers are secure but can be slow and often come with high fees. On the other hand, modern online services offer fast and secure transactions, often at a fraction of the cost. Services such as card to card transfer online are gaining popularity due to their simplicity and speed. These platforms allow you to transfer money directly from one card to another without the need for bank accounts or complicated procedures.

Step 2: Verify Exchange Rates and Fees

One of the most overlooked aspects of transferring money abroad is the exchange rate. Even a slight difference can result in a substantial loss, especially if you’re transferring large amounts. Before finalizing any transfer, make sure to compare exchange rates offered by different services. Many online platforms display exchange rates upfront, allowing you to make an informed decision. Additionally, keep an eye on transfer fees. Some services may offer lower rates but add hidden fees that could increase your overall cost.

Step 3: Secure Your Transfer

Security is paramount when sending money overseas. Always ensure that the platform you’re using employs encryption technologies to protect your information. Reputable services will also offer fraud protection measures, giving you peace of mind. Moreover, for extra safety, consider using platforms that allow for two-factor authentication, ensuring only authorized individuals can access the funds.

Step 4: Track Your Transfer

Many online services allow you to track your money throughout the transfer process. This is especially important when dealing with large sums or urgent transfers. By tracking the progress, you can be sure that the recipient gets the money on time and that no issues arise during the transaction.

Conclusion

Transferring money abroad doesn’t have to be a complex or costly process. By selecting the right method, verifying rates, and ensuring security, you can complete your international transactions quickly and safely. Whether you choose a bank transfer or a card to card transfer online, make sure to follow these key steps to avoid any potential pitfalls.