Navigating the world of loans can be overwhelming, especially with so many options available. We at FintechZoom.com understand this challenge and have created a comprehensive loans guide to help you make informed decisions. Our goal is to provide you with a clear understanding of the various types of loans, enabling you to choose the best financial solution for your needs.

In this FintechZoom.com Loans guide, we’ll explore personal loans, mortgage loans, auto loans, and student loans. We’ll break down each loan type, discussing their purposes, benefits, and potential drawbacks. By the end of this FintechZoom.com Loans article, you’ll have a solid grasp of these different loan options and be better equipped to navigate the loan application process. Whether you’re looking to finance a home, car, education, or personal project, we’ve got you covered with our in-depth FintechZoom.com loans guide.

Personal Loans: Versatile Financing Options

Personal loans offer a flexible way to access funds for various purposes. We at FintechZoom.com Loans understand that these can be a valuable tool to help you achieve your financial goals. Whether you’re looking to consolidate debt, finance a home improvement project, or cover unexpected expenses, personal loans provide a versatile solution.

Common Uses for Personal Loans

One of the most popular reasons people turn to personal loans is for debt consolidation. By combining multiple high-interest debts into a single loan with a potentially lower interest rate, you can simplify your finances and potentially save money on interest charges. Personal loans can also be used to fund home improvements, which can add value to your property. Whether you need to repair a roof, replace a water heater, or remodel your kitchen, a personal loan can help you get your project off the ground.

Unexpected expenses can arise at any time, and personal loans can provide a financial safety net. From sudden medical bills to car repairs, these loans can help you cover costs without depleting your savings or resorting to high-interest credit cards. Some borrowers even use personal loans to finance special events like weddings or dream vacations, although it’s essential to consider the long-term financial impact of borrowing for non-essential expenses. Whatever the motivation behind your loan, you could rely on a personal loan calculator to get an idea of how it works, how much you can get, and other essential details.

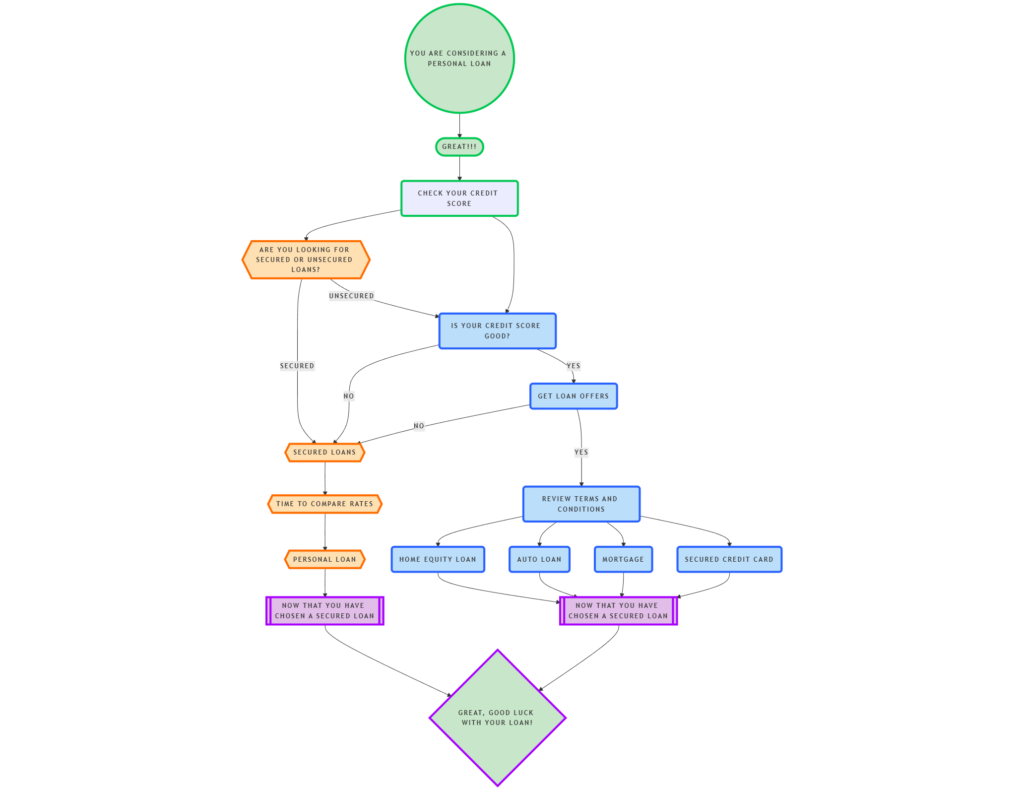

Secured vs. Unsecured Personal Loans

When exploring personal loan options, you’ll encounter two main types: secured and unsecured loans. Secured loans require collateral, such as a car or savings account, which the lender can seize if you fail to repay the loan. These loans often come with lower interest rates due to the reduced risk for the lender. Unsecured loans, on the other hand, don’t require collateral. Instead, approval is based on your creditworthiness, including factors like your credit score and income.

Unsecured loans are more common and offer greater flexibility in how you use the funds. However, they typically have higher interest rates compared to secured loans. The choice between secured and unsecured loans depends on your financial situation, credit history, and comfort level with putting up collateral.

Typical Interest Rates and Terms

Interest rates for personal loans can vary widely based on factors such as your credit score, income, and the lender you choose. As of recent data, the average personal loan interest rate for consumers with good credit (690 to 719 credit score) is 14.34%. However, rates can range from around 6% to 36%, depending on your creditworthiness and the lender’s policies.

Loan terms typically range from two to seven years, allowing you to choose a repayment period that fits your budget. Keep in mind that while longer terms may result in lower monthly payments, they often mean paying more in interest over the life of the loan.

Mortgage Loans: Financing Your Home Purchase

When it comes to buying a home, mortgage loans are often the key to making that dream a reality. At FintechZoom.com, we understand that navigating the world of mortgage loans can be overwhelming. That’s why we’re here to guide you through the different types of mortgages and their requirements.

Types of Mortgages

There are several types of mortgage loans available, each with its own set of features and benefits. The most common types include:

- Conventional loans: These are not backed by the government and typically require a minimum credit score of 620. They can be a good option if you have a strong credit history and can afford a down payment.

- FHA loans: Backed by the Federal Housing Administration, these loans are popular among first-time homebuyers. They have lower credit score requirements and allow for down payments as low as 3.5%.

- VA loans: Available to eligible veterans, active-duty military members, and some military spouses, VA loans often require no down payment.

- USDA loans: These loans are designed for homebuyers in rural areas and also offer a zero down payment option.

Down Payment Requirements

The amount you’ll need for a down payment varies depending on the type of mortgage you choose. Here’s a quick overview:

- Conventional loans: As low as 3% for first-time homebuyers, but typically 5% to 20%

- FHA loans: 3.5% with a credit score of at least 580, or 10% with a credit score between 500 and 579

- VA and USDA loans: 0% down payment

It’s worth noting that in 2023, the median down payment among homebuyers was 15%. However, don’t let a large down payment requirement discourage you. There are many options available, and we at FintechZoom.com Loans can help you find the right fit for your financial situation.

Fixed vs. Adjustable Rate Mortgages

When choosing a mortgage, you’ll also need to decide between a fixed-rate and an adjustable-rate mortgage (ARM). Here’s what you need to know:

Fixed-rate mortgages:

- The interest rate remains the same throughout the loan term

- Offers predictable monthly payments

- Typically available in 15, 20, or 30-year terms

Adjustable-rate mortgages:

- Start with a lower initial interest rate

- The rate can change after the introductory period, usually every 6 months or annually

- May be a good option if you plan to move or refinance before the rate adjusts

At FintechZoom.com Loans, we’re committed to helping you understand all aspects of mortgage loans. Whether you’re a first-time homebuyer or looking to refinance, we’ve got the resources and expertise to guide you through the process. Remember, the right mortgage can make all the difference in your homeownership journey.

Auto Loans: Driving Your Dream Car

When it comes to financing your dream car, auto loans play a crucial role in making that dream a reality. We at FintechZoom.com Loans understand that navigating the world of auto loans can be overwhelming, so we’re here to guide you through the process.

Dealership Financing vs. Bank Auto Loans

One of the first decisions you’ll face is whether to opt for dealership financing or a bank auto loan. Both options have their advantages, and it’s essential to understand the differences to make an informed choice.

Dealership financing offers convenience as a one-stop-shop for both your car purchase and financing needs. It’s fitting for those who want a streamlined process and have strong credit. Dealerships work with various lenders, including banks, online lenders, and credit unions, to offer auto loans through their financing division.

On the other hand, bank auto loans often provide more competitive interest rates and the opportunity to negotiate like a cash buyer at the dealership. Many banks offer online applications that allow you to get prequalified for an auto loan, giving you an idea of your likely rates before you commit.

We recommend exploring both options to find the best deal. Getting preapproved for a car loan from a direct lender can aid you in negotiation, save you time, and potentially secure you a better interest rate than you might qualify for at a dealership.

New vs. Used Car Loan Rates

When considering an auto loan, it’s important to understand that interest rates can vary significantly between new and used cars. Generally, new cars tend to have lower interest rates compared to used cars. According to recent data, the overall average car loan interest rate is 6.84% for new cars and 12.01% for used cars.

Your credit score plays a significant role in determining your auto loan rate. For instance, if you have a credit score between 781 to 850, you might qualify for an average new car loan interest rate of 5.25%, while the same credit score range could get you an average used car loan interest rate of 7.13%.

Auto Loan Terms and Down Payments

The loan term and down payment are two crucial factors that can affect your auto loan. Loan terms typically range from 24 to 84 months, with longer terms resulting in lower monthly payments but higher overall interest paid over the life of the loan.

We at FintechZoom.com Loans recommend limiting new car loans to 60 months and used car loans to 36 months when possible to avoid paying excessive interest.

As for down payments, while some lenders may not require one, making a substantial down payment can help you secure a better interest rate. The rule of thumb is to put down at least 20% of the actual cash value (ACV) of the car, although the average down payment is typically around 12%.

Student Loans: Investing in Your Education

When it comes to financing higher education, student loans play a crucial role in making college accessible for many students. At FintechZoom.com Loans, we understand the importance of making informed decisions about student loans. Let’s explore the different types of student loans and their key features.

Federal vs. Private Student Loans

One of the first decisions you’ll face is choosing between federal and private student loans. Federal student loans, offered by the government, typically have lower interest rates and more flexible repayment options compared to private loans. For the 2020-21 school year, the interest rate for federal student loans was set at 5.30%. These loans don’t require a credit check, making them more accessible to most students.

Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. While they may offer competitive rates for creditworthy borrowers, they generally have higher interest rates and less flexible repayment terms compared to federal loans. Private loans also require a credit check, which may make them more challenging to obtain for students with limited credit history.

Repayment Options and Loan Forgiveness

Federal student loans offer various repayment options to help borrowers manage their debt. Income-driven repayment (IDR) plans are particularly helpful, as they tie your monthly payment to a percentage of your discretionary income. These plans can lower your payments to as little as USD 0.00 if you’re unemployed or underemployed.

Another advantage of federal loans is the possibility of loan forgiveness. For example, the Public Service Loan Forgiveness (PSLF) program allows borrowers working in public service to have their remaining loan balance forgiven tax-free after making 120 qualifying payments.

Parent PLUS Loans

For parents looking to help finance their child’s education, Parent PLUS loans are an option. These federal loans allow parents to borrow up to the full cost of attendance, minus any other financial aid received. However, it’s important to note that Parent PLUS loans have higher interest rates and fees compared to other federal student loans. For the 2020-21 school year, the interest rate for Parent PLUS loans was 5.30%, with an origination fee of 4.236%.

While Parent PLUS loans can be a helpful tool, it’s crucial to carefully consider the long-term financial implications before borrowing. Parents should explore all available options, including scholarships, grants, and their own savings, before taking on this type of debt.

Conclusion

Navigating the world of loans can be a complex task, but understanding the different types available can make the process much easier. This guide has covered personal loans, mortgage loans, auto loans, and student loans, each serving unique purposes to meet various financial needs. By exploring these options, you’re now better equipped to make informed decisions about borrowing money, whether it’s to buy a home, finance education, purchase a car, or cover personal expenses.

Remember, choosing the right loan has a significant impact on your financial well-being. It’s crucial to carefully consider factors like interest rates, repayment terms, and your personal financial situation before committing to any loan. By doing so, you can find a loan that not only meets your immediate needs but also aligns with your long-term financial goals. So, take your time, do your research, and don’t hesitate to seek advice from financial professionals to ensure you’re making the best choice for your unique circumstances.