So you’re considering taking out a personal loan? Whether for an unexpected expense, debt consolidation, or that dream vacation, personal loans are quite a helpful financial tool. But before you jump in headfirst, let’s break down the particulars. This guide will help walk you through the ins and outs of how to secure a personal loan in the USA.

Understanding Personal Loans

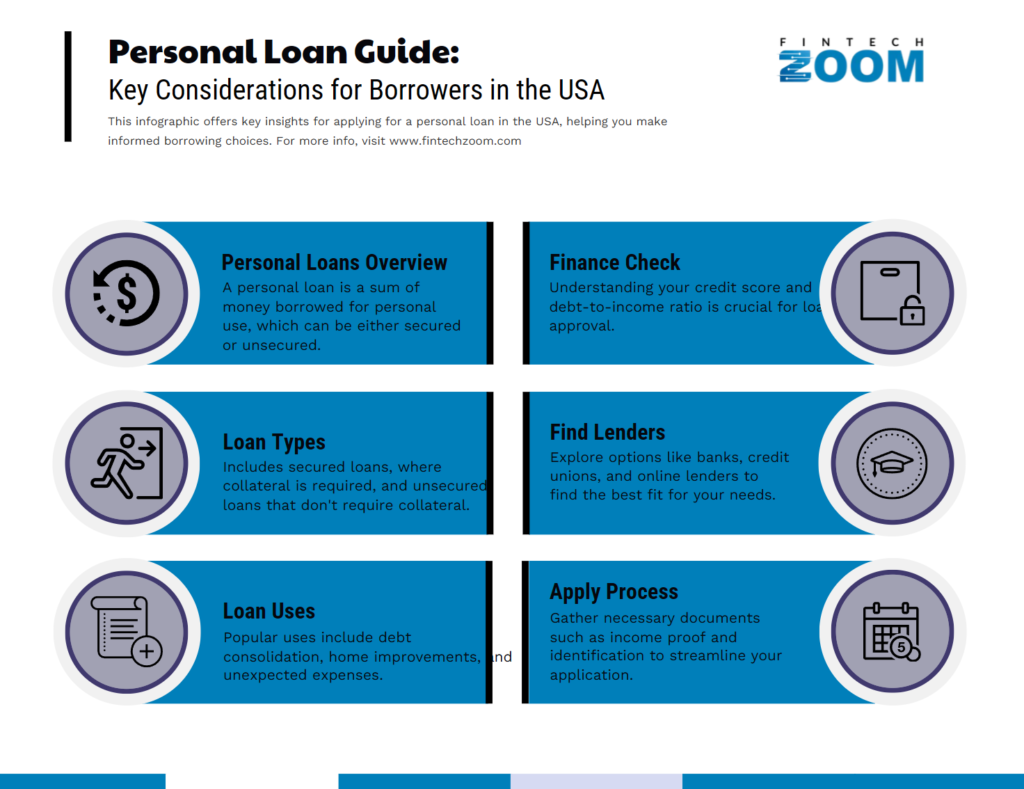

First things first—what is a personal loan, exactly? Simply put, it is a loan taken out for personal use. You can use this for nearly anything, from paying off credit cards to home improvements. The beauty of personal loans is that they can be either secured – applying collateral in case of failure, or unsecured – with no assets attached to it. Most people would opt for unsecured loans because it’s generally easier to get one, and you don’t have to put your property at risk.

Know Your Financial Standing

Before you start applying, take a closer look at your finances. This is where it gets real, and yes, your credit score will play a major role in the loan process. That goes to say, the better the score, the more your chances of securing a good interest rate

Next, you have your debt-to-income ratio. What is that, you ask? Quite simply, it’s the percentage of your monthly income that you spend servicing debt. Lenders will like to see this number as low as possible, as that would mean you are not overextending yourself. You want the number to be below 36%. If you’re above that, perhaps you need to rework your finances before applying.

Finally, set a budget that is appropriate for the loan repayments. Many online calculators can help you calculate personal loan payments based on different interest rates and terms, making it easier to see what fits your budget.

How to Research Lenders

Now that you have a good idea of where your finances stand, it is time to shop. You have choices, including traditional banks, credit unions, and online lenders, all having various advantages. It would not be wise to take whatever old offer comes your way. You are going to want to compare the interest rates, any fees, and the terms. Watch for that fine print, some lenders may have origination or prepayment penalties you should know about.

Also, take the time to read customer reviews and ratings. This will give you an idea of how a lender treats its customers and if they are easy to work with.

The Application Process

Once you are ready to apply, you will need to assemble your documents. You usually need proof of your income, identification, and details about your expenses. Being prepared can make the process smoother and faster.

Especially if you have mediocre credit, you will want to apply with a co-signer to increase your chances of being accepted. A co-signer with a good credit history increases the likelihood of approval.

Understanding Loan Terms

Now, on to the nitty-gritty – the loan terms. Know what important terms mean, like APR, how long your loan term is, and what your monthly payments will be. Knowing these ahead of time can save you confusion later on. Seriously, read the fine print. You don’t want any surprises when you actually sign on the dotted line.

Principles of Responsible Borrowing

Responsible borrowing means not asking for more than what is needed. Remember, this is money that will need to be paid back, usually with interest involved. Develop a plan that dictates how you will handle the repayments. It literally comes down to finding a balance that works for you.

And remember, defaulting on a loan also affects your credit score and may add other fees to your loans. It’s simply not worth it.

Other Options for Personal Loans

If a personal loan just doesn’t feel right, fear not, there are other options out there. Credit cards might do the trick if you can pay them off quickly. Home equity loans fall into another category altogether, especially if you have built up equity in your home. Some borrowers might find that peer-to-peer lending platforms or holiday loans meet their needs. What is a holiday loan? This type of personal loan is for holiday usage and is designed to cover holiday-related expenses.

Conclusion

Getting a personal loan in the USA need not be daunting. You just have to go into the process with the right mindset and information to pull it off confidently. Take time to comprehend your financial situation, shop around, and know what you’re getting yourself into. By following these tips, you will be well on your way to making informed borrowing decisions that fit your needs.