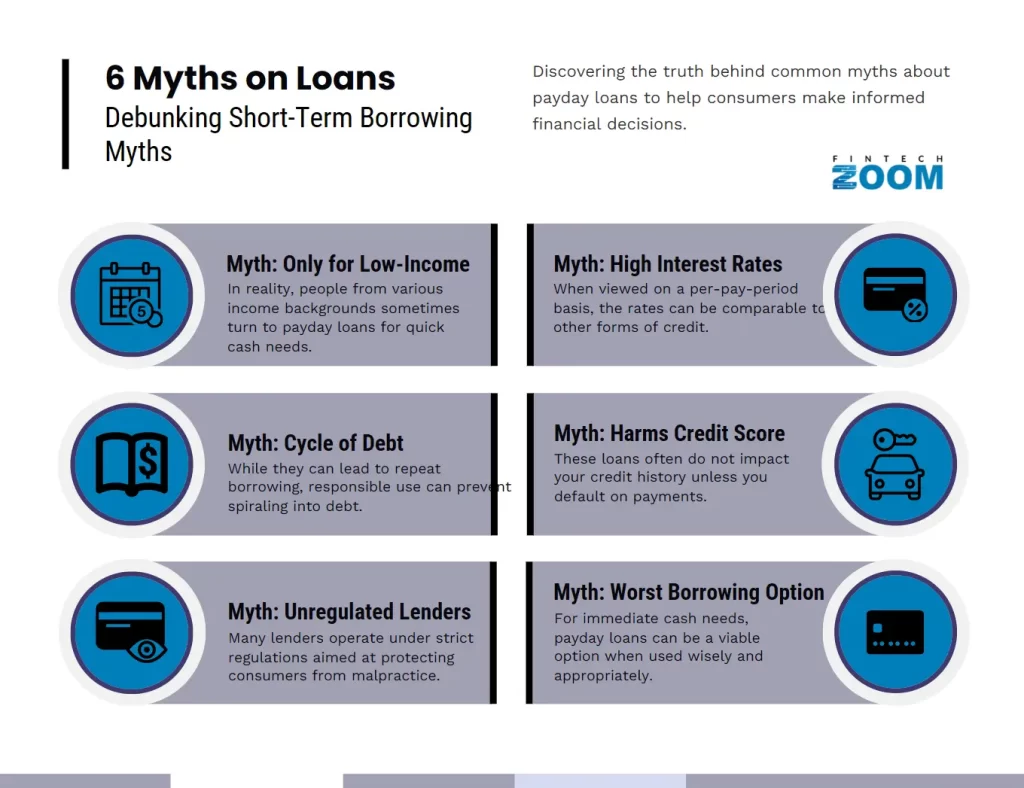

The term payday loan often brings to mind images of high interest rates and financial distress. However, not everything you hear about payday loans is accurate. In this article, we aim to debunk some common myths about payday loans and provide you with the facts you should know.

Myth 1: Payday Loans Are Only for Low-Income Individuals

One of the most pervasive myths is that payday loans are only utilised by low-income individuals. In reality, payday loans can be used by anyone in a financial pinch, regardless of their income level. Unexpected expenses or emergencies can affect anyone, making these types of loans a viable option for diverse financial situations.

Myth 2: Payday Loans Trap You in a Cycle of Debt

Many believe that payday loans inevitably lead to a cycle of debt, but this isn’t always the case. Responsible borrowing and timely repayment can help prevent such scenarios. Financial education and proper budget management are crucial in using payday loans effectively. Remember, payday loans are designed as short-term solutions, not long-term financial strategies.

Myth 3: Payday Lenders Are Unregulated and Exploitative

It’s a common misconception that all payday lenders are unregulated and exploitative. In fact, payday lenders in the UK are regulated by the Financial Conduct Authority (FCA), which ensures that borrowers are treated fairly. Regulations limit interest rates and fees, and guidelines are in place to protect consumers from harmful lending practices.

“By understanding and navigating the regulatory landscape, consumers can safely access payday loans as a short-term financial tool.”

Myth 4: Payday Loans Have Sky-High Interest Rates

While payday loans do come with higher interest rates compared to traditional bank loans, they are not as exorbitant as many think. The rates are proportional to the short-term nature of the loan. Always ensure you understand the total repayment amount before accepting the terms. It’s recommended to compare different lenders to find the best terms available.

Myth 5: Taking a Payday Loan Harms Your Credit Score

Not all payday loans negatively impact your credit score. The key lies in how you manage the loan. Failure to repay on time can hurt your credit, but timely repayments can actually show that you are a responsible borrower, potentially improving your credit score. Transparency with your lenders and adhering to the agreed loan terms are essential.

Myth 6: Payday Loans Are the Worst Option for Borrowing

Though payday loans are often seen as a last resort, they are not necessarily the worst borrowing option. For individuals with poor credit who cannot access traditional loans, payday loans can offer a critical financial lifeline. They are particularly useful for emergency expenses that need to be addressed before your next payday.

Conclusion

Payday loans are often misunderstood and maligned, but many of the myths surrounding them are not based on fact. Understanding the true nature of payday loans, their regulations, and responsible usage can help you make informed financial decisions.