In many countries, consumer credit is often associated with high interest rates and opaque terms. This is precisely the case when quick loans, which should help people in challenging situations, actually cause even greater financial issues. In such an atmosphere, trust in lenders falls, and consumers themselves are afraid to take out a loan even in case of real need.

However, Norway chose a completely different path. What’s special? Consumer lending works for the benefit of people. It is characterized by fundamental openness, responsibility, technological excellence. There are clear rules and services aimed at protecting the interests of consumers.

A large role is played by the forbrukslån site, a specialized platform that has actually become the new “face” of consumer lending in Norway. Here, people can choose the best conditions, calculate their capabilities, and understand all the details without the risk of “falling into a trap.”

What is Forbrukslån, and How It Differs from Typical Quick Loans

It is important to understand: forbrukslån is a consumer loan, but it differs from the usual “fast money” in several key points. The first is its purpose: not to cover urgent expenses in the event of an unforeseen situation, but specifically consumer needs. You can buy equipment, pay for repairs, training, or even partially invest in a business – and all this on transparent terms.

Norway does not allow loan terms with unprecedented interest rates, and also has strict limits on maximum rates. The forbrukslån site provides comprehensive information on rates and overpayments, as well as personalized calculations. This removes a huge layer of uncertainty that so often causes panic among borrowers.

Moreover, forbrukslån is not a short-term payday loan, i.e., not for 30 days. The repayment terms are longer, which allows for a more conscious approach to financial planning.

The Role of Online Platforms

Norwegian forbrukslån sites have become something like financial guides. They do not encourage instant decisions, do not pressure with advertising, but on the contrary, they allow you to navigate, compare, choose, and understand.

Typical functionality of such sites includes:

- a convenient loan calculator (with all fees and costs);

- filters by terms, amounts, age, and other criteria;

- a clear description of the terms with examples, etc.

In addition, some consumer loan sites integrate APIs with credit bureaus. This means you can check the chances of getting a loan without harming your credit history. No applications, no rejections – just an honest assessment of the probability.

This creates a completely different feeling: the user is a partner in the process.

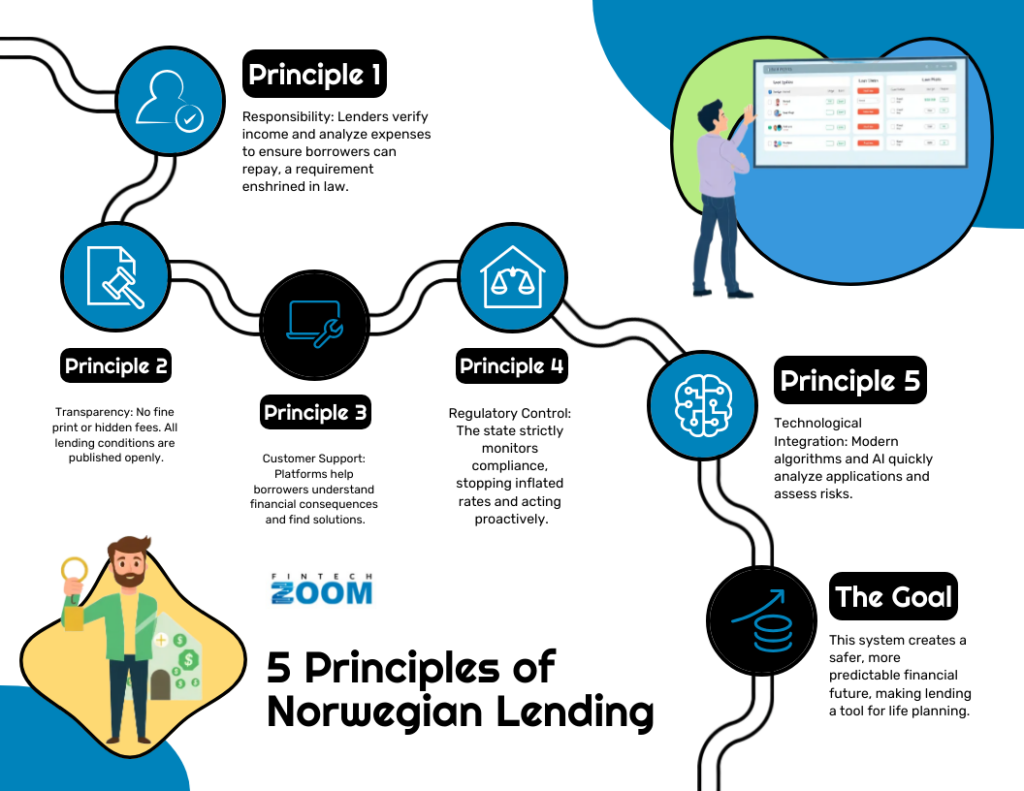

5 Principles Underpinning the Norwegian Lending System

What really sets forbrukslån apart? Regulations? Or technology? Rather, certain fundamental approaches that together form an entire ecosystem.

The first and perhaps most important principle is responsibility. In Norway, no one will give a loan if the borrower cannot repay it. These are not empty words, but a clear requirement, enshrined in law and fulfilled by creditors. Verifying income, analyzing expenses, and accounting for other liabilities are standard procedures that cannot be avoided.

Second, transparency. No fine print, hidden fees, or confusing terms. Lending conditions are published openly, and the forbrukslån site offers convenient tools for comparison:

- interest rate (including all fees);

- total cost of the loan over the entire term;

- penalties for late payments;

- repayment terms;

- minimum and maximum loan amount.

The third point – customer support system. Norwegian platforms and lenders do not just try to sell a loan. They help borrowers understand what financial consequences await them, offer advice, and, in case of problems with payments, look for individual solutions. This is much deeper and, of course, more useful.

The fourth principle is regulatory control. The state strictly monitors compliance with the rules. Inflated rates are stopped instantly. Regulators act proactively, not just react when the problem has already become serious.

And finally, the fifth is technological integration. Thanks to modern algorithms, artificial intelligence (AI), automation, platforms quickly analyze applications, assess risks, and offer the most suitable options, reducing the human factor.

Thus, lending becomes a tool for life planning. It’s about building a safer, more predictable financial future.

This system is not perfect, of course, but it gives a real chance to avoid the typical problems that still accompany fast loans in many countries.

Why This Model Really Works

The answer to the question of why the Norwegian forbrukslån model is so effective is not in one or two rules, but in a combination: the state creates the framework, technology provides the tools, society – responsibility, and the market – healthy competition.

From an external perspective, it is a kind of triangle of trust, in which each element supports the other.

Strong Regulation

The legislation is strict but very balanced. It is not about any unnecessary restrictions that could slow down development, but rather strict enough rules to protect against excessive debt burden and rash decisions.

Lenders cannot set too high interest rates or hide extra fees in the fine print. Everything is under control.

Financial Literacy

It may seem obvious, but understanding what a loan is, how interest rates work, and what risks they carry is critical. Where basic knowledge is lacking, problems usually arise – reckless borrowing, debt accumulation, financial stress…

In Norway, financial literacy is taught systematically – starting in school, through large-scale information campaigns for adults, and even in the workplace. This approach helps people avoid unnecessary risks, but also better plan their lives, without being afraid to take out a loan if it is really needed.

Innovative Technologies for Process Simplification

It’s hard to overestimate the role of the Internet and mobile applications. You don’t have to go to banks or collect tons of papers – the task can be done online, quickly and conveniently.

You can assess your financial capabilities in a matter of minutes and compare dozens of offers from different lenders. Yes, this is a great simplification of the process. But not only. It’s an opportunity to make a conscious choice, without haste, unnecessary pressure from sellers, and intrusive marketing. You gain control over the situation and a real choice. The level of trust in the system increases, without a doubt.

What Challenges Still Remain

Some problems still exist. They usually arise due to individual circumstances and the constant need to adapt systems to new challenges, behavioral patterns.

Debt Burden of Certain Population Groups

Creditors carefully check solvency; however, the risk of worsening financial condition when taking out a loan cannot be completely ruled out. Why is that? For example, this can happen due to a sudden loss of income, such as dismissal from work, a long-term illness, or other unforeseen circumstances that affect the ability to fulfill obligations on time.

Life is unpredictable, and even the most reliable system cannot completely protect a person from personal financial crises…

The Risk of Tech Dependency and Algorithm Errors

Automated systems are certainly a step forward. But algorithms sometimes miss “red flags”. Or, conversely, refuse a loan to those who could easily repay it. This is not a technical problem, but a balance between the speed and quality of decision-making.

Information Availability and Understanding

Despite the high level of financial literacy in general, some people still don’t use online platforms or don’t understand all the ins and outs. This is especially true for the older generation or those who have less experience using digital services.

Platform developers, regulators, and public organizations are currently working on these issues. For instance, more flexible models of borrower support are being introduced. Financial assistance and consulting programs are being developed. And algorithms are constantly being improved based on new data and experience.

This is a natural process of evolution – a sign that the system stays alive, adapts to new challenges, and isn’t stuck in some static, flawless ideal.

What Other Countries Can Adopt

Other countries have much to learn from this experience. Main directions:

- Strict creditworthiness checks. A thorough/realistic assessment of the borrower’s financial condition, which lowers the risks of non-repayment and at the same time reduces the number of problem loans on the market.

- Maximum transparency. Open access to information, simple calculators, comparison of offers. People should see all the “pitfalls” before taking out a loan.

- The development of online platforms that do not simply aggregate loan offers but actually help users make informed choices. This approach forms a healthy market and increases trust.

- Investment in financial literacy. Without understanding the basic principles of lending, all other efforts will be half-measures.

- Regulatory support that balances consumer protection and market development. Excessive control can inhibit innovation, and its absence leads to chaos.

With all elements working in sync, this is what gives the Norwegian forbrukslån its strength and real value.

Concluding Remarks

So, forbrukslån shows that consumer lending can be transparent, safe, and responsible at the same time. This is the result of a combination of clear regulations, technological solutions, and a high level of financial culture in society.

Other countries can take advantage of this experience, starting with strict solvency checks, clear and open lending conditions, and well-developed online platforms that actually guide people toward informed, balanced decisions.