Have you ever felt that managing money takes too much time and effort, even for simple daily tasks?

Many people ask this question while paying bills, checking balances, or planning savings. Today, financial technology is helping people handle money in a smooth and friendly way, using simple tools that fit into daily life.

From small payments to long-term planning, these digital solutions support comfort, clarity, and confidence with money matters.

What Financial Technology Means in Simple Terms

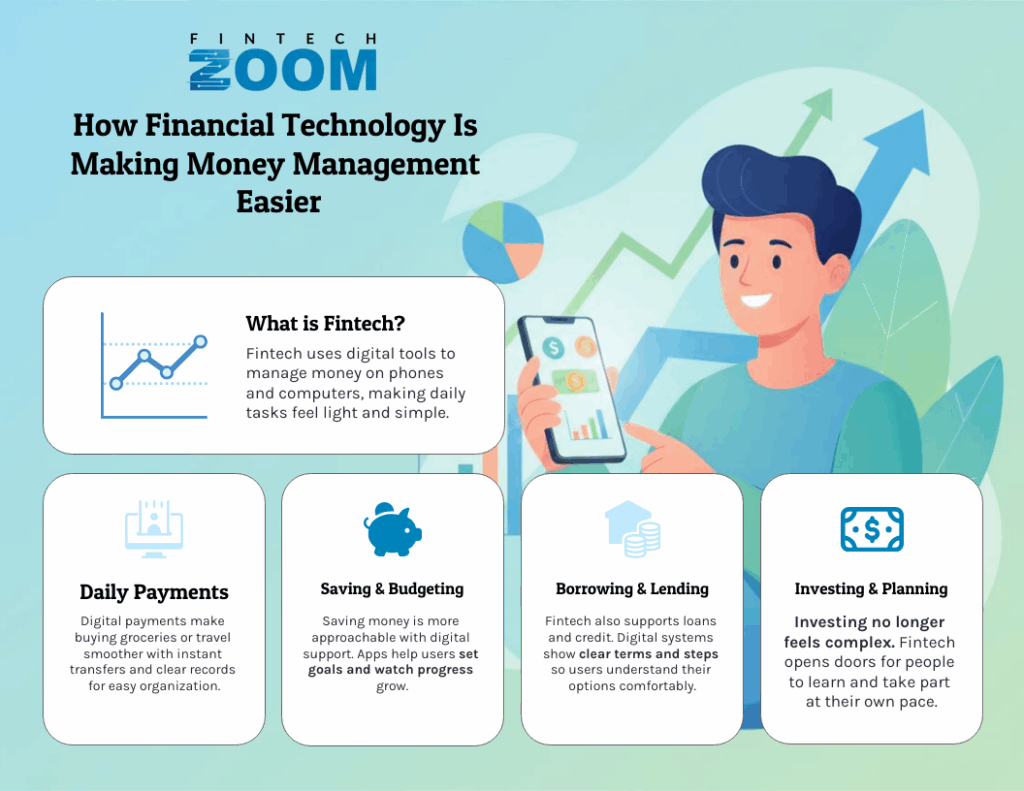

Financial technology, often called fintech, refers to digital tools that help people manage money using phones, computers, and the internet. It combines finance with modern software, so daily money tasks feel light and organized.

People use it for paying bills (จ่ายบิล), sending money (ส่งเงิน), checking expenses (การตรวจสอบค่าใช้จ่าย), and planning savings without stress.

Simple Start With Digital Finance

After understanding the meaning, it becomes clear why these tools feel friendly and comfortable to use. They remove long steps and help people focus on their goals without stress. Instead of paperwork and waiting, actions happen with a few taps, saving time and effort.

This ease feels similar to how people enjoy simple digital activities online, like ทดลองเล่นสล็อต, where clear steps and smooth flow make the experience relaxed and easy to follow. When processes feel this simple, users stay confident and calm. Digital finance works in the same way, keeping things clear so people can manage money without pressure and with full peace of mind.

Why Digital Money Tools Feel Helpful

Money matters touch daily life, from morning tea payments to monthly rent. Financial technology supports these needs by keeping things clear and fast. It helps people track spending and feel more aware of their habits.

Comfort in Daily Use

Many tools use clean screens and easy language, so even first-time users feel relaxed. This comfort builds trust and encourages regular use.

Easy Support for Daily Payments

Paying for groceries, travel, or utilities feels smoother with digital payment systems. These tools allow instant transfers and clear records, which help users stay organized.

Simple Payment Flow

A payment starts, gets processed, and finishes in seconds. This flow reduces confusion and helps people focus on their day instead of worrying about cash handling.

Smart Help for Saving and Budgeting

Saving money becomes more approachable with digital support. Many apps help users set goals and watch progress slowly grow.

Daily Habit Building

Small daily tracking builds awareness. People start noticing patterns and adjust spending with ease. This habit supports steady savings without pressure.

Clear Help for Borrowing and Lending

Financial technology also supports loans and credit in a friendly way. Digital systems show clear terms and steps so users understand options comfortably.

Transparency in Choices

Clear screens and simple explanations help users choose plans that suit their income and needs. This clarity supports confidence and calm decision-making.

Digital Tools for Investing and Future Planning

Investing no longer feels distant or complex. Financial technology opens doors for people to learn and take part at their own pace.

Learning Along the Way

Many platforms offer gentle guidance and simple visuals. This helps users understand the basics and plan for future needs with patience.

Safety and Trust in Modern Financial Systems

Digital finance systems focus strongly on user safety. Secure logins and clear alerts help people feel protected.

Peace of Mind

Peace of mind is very important when it comes to handling money in daily life. When people know that digital systems keep track of activity and maintain clear records, they feel relaxed while using them. Every payment, transfer, or update is noted properly, which helps users feel secure. This clarity removes confusion and builds confidence over time.

Regular records also help users stay organized. If someone wants to check a past payment or understand spending, the information is easy to find. This reduces stress and saves time. People feel assured because nothing feels lost or unclear. Having this level of transparency supports calm decision-making.

Financial Technology and Daily Life in India

In India, financial technology fits well with daily routines. From small vendors to families, digital payments and tools support convenience across cities and towns.

Local Comfort

Local comfort plays a big role in how people feel while managing money. When apps and digital tools use simple language, users feel relaxed from the first step itself.

There is no pressure to understand hard terms or confusing instructions. Everything feels familiar, just like talking to someone in daily life. This makes people more confident while using money tools on their phone or computer.

Familiar steps also help a lot. When buttons, options, and flow feel similar to common daily actions, users do not feel lost. They know where to tap, what to check, and how to move forward.

This comfort saves time and keeps the mind calm. Even people who are not very comfortable with technology start feeling confident after a few uses.

Areas Where Financial Technology Helps Most

| Area of Life | How Technology Supports It |

| Daily Payments | Quick transfers and clear records |

| Budgeting | Easy tracking and spending awareness |

| Savings | Goal-based planning and progress view |

| Borrowing | Clear terms and simple steps |

| Investing | Easy access and learning support |

This comparison shows how financial technology supports different money needs in a balanced way.

Building Future-Friendly Money Habits

Using digital tools daily helps people build healthy money habits. Regular checking, planning, and small adjustments support steady growth.

Simple Steps Forward

Simple steps forward make a big difference in how people handle money over time. When financial tools are used regularly, they slowly become part of a daily routine. Checking balance, tracking spending, or planning small savings starts feeling normal and calm. There is no rush or pressure. People begin to understand their money better, step by step.

Regular use brings clarity. When someone sees where money goes, decisions become easier. Small changes like adjusting daily expenses or planning monthly needs feel natural. This builds confidence and removes confusion. Over time, people feel more in control because they know what is happening with their finances.

Comfort also grows with familiarity. When tools feel easy to use, users do not avoid them. Instead, they check updates freely and make changes without stress. This relaxed approach supports better habits. Saving, planning, and managing expenses no longer feel heavy or complicated.

Long-term stability comes from these small actions done consistently. There is no need for big jumps or complex plans. Simple tracking and regular checking help create balance. People feel secure because they understand their financial position clearly. In the end, simple steps taken daily help build peace of mind and steady financial confidence for the future

Final Thoughts

Financial technology is making money management easier by keeping things simple, clear, and friendly. It supports daily payments, savings, planning, and future goals without adding stress. With easy-to-use tools and a human-focused approach, people can manage their finances with confidence and calm, making everyday life smoother and more organized.