The cashless society is rapidly transforming the way people and businesses handle financial transactions. As digital payments become more prevalent, traditional cash usage is declining, leading to significant changes in economic systems worldwide. This shift has an impact on various aspects of daily life, from how consumers make purchases to how businesses manage their operations.

The move towards a cashless economy brings both opportunities and challenges. For businesses, it offers enhanced efficiency and reduced costs associated with cash handling. Consumers benefit from increased convenience and improved financial inclusion. However, concerns about privacy, cybersecurity, and accessibility remain. This article explores the effects of a cashless society on modern businesses and consumers, examining its benefits, potential drawbacks, and the path forward in this evolving financial landscape.

Benefits of a Cashless Society for Businesses

The shift towards a cashless society has a significant impact on modern businesses, offering numerous advantages that enhance efficiency, security, and overall operations. As digital payments become more prevalent, companies are experiencing a transformation in how they handle financial transactions.

Increased transaction speed and efficiency

One of the primary benefits of a cashless society for businesses is the remarkable increase in transaction speed and efficiency. Digital payments are significantly faster than traditional cash transactions. According to research, cash payments typically take between six and seven seconds to process, while contactless payments require only one or two seconds. This substantial difference in processing time has a direct impact on business operations, especially during peak hours.

For businesses that often face long queues, particularly during busy periods like commuting hours, going cashless can speed up the checkout process considerably. This increased efficiency allows companies to handle more sales in a day, potentially boosting profits. The reduced queueing time also encourages consumers who are in a hurry to make purchases, as they know they can complete their transactions quickly.

Reduced cash handling costs

Another significant advantage of a cashless society is the reduction in cash handling costs for businesses. By eliminating the need for physical currency, companies can save a considerable amount of time and resources that would otherwise be spent on handling and counting cash at the end of each day. This time can be redirected towards other activities aimed at benefiting the business.

Moreover, cashless transactions streamline accounting processes by minimizing the risk of errors associated with manual cash handling. This enables small businesses to focus more on core activities and less on administrative tasks. The automation of financial processes also makes it easier for companies to export data for tax reports, further simplifying their financial management.

Improved security and fraud prevention

Cashless transactions offer enhanced security measures, helping businesses protect themselves and their customers from various forms of fraud and theft. Digital payments leave a clear transaction trail, making it significantly more difficult for fraudulent activities to go undetected. This increased traceability not only deters potential criminals but also aids in investigations if any suspicious activity occurs.

The security behind card payments is constantly being updated and tightened, providing businesses with more robust protection against fraud compared to cash transactions. For instance, in 2022, 199,000 fake notes worth the equivalent of £4.4 million were taken out of circulation. By going cashless, businesses can eliminate the risk of accepting counterfeit money.

Furthermore, cashless transactions reduce the risk of robbery and employee theft. Research shows that employee theft costs UK businesses £140,000 a year. By removing cash from the equation, businesses can mitigate this risk and create a more secure environment for both their assets and employees.

Advantages for Consumers in a Cashless Economy

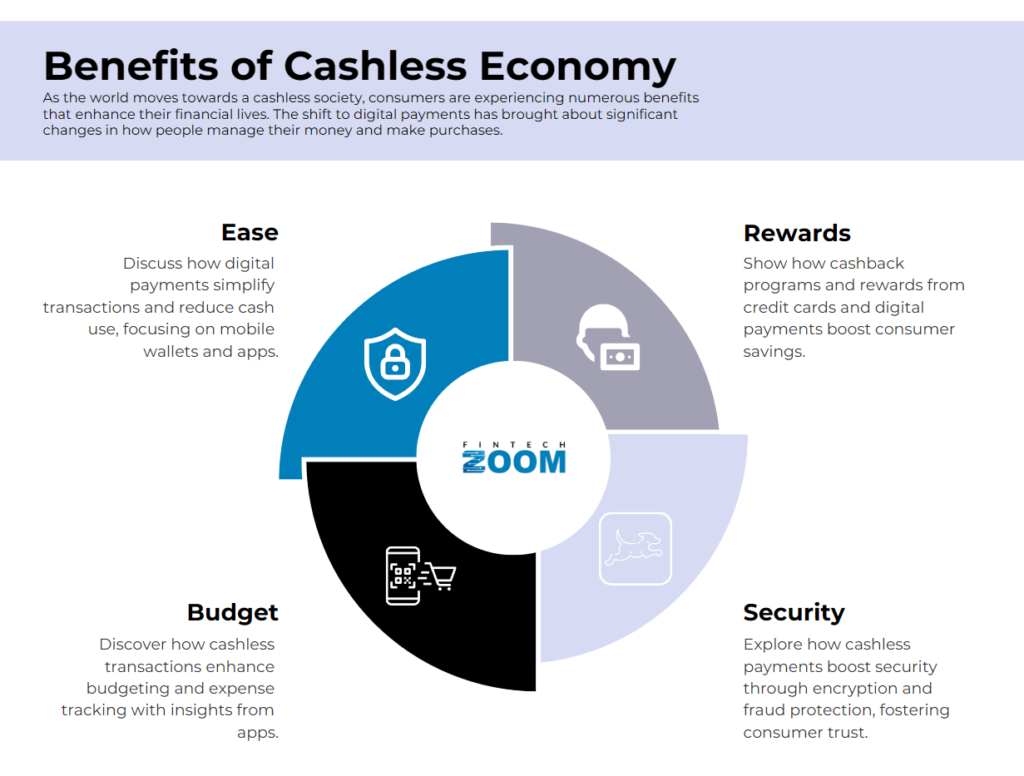

As the world moves towards a cashless society, consumers are experiencing numerous benefits that enhance their financial lives. The shift to digital payments has brought about significant changes in how people manage their money and make purchases.

Convenience of digital payments

One of the primary advantages of a cashless economy is the convenience it offers consumers. Digital payments have made transactions faster and more efficient, eliminating the need to carry cash or visit ATMs. With the rise of mobile payment apps and digital wallets, consumers can now make purchases using their smartphones or other devices. This technology allows for quick and easy payments, reducing wait times and streamlining the checkout process.

The convenience extends beyond retail purchases. Consumers can now pay bills, transfer money to friends and family, and manage their finances with just a few taps on their mobile devices. This level of accessibility has transformed the way people handle their day-to-day financial transactions, making it easier to stay on top of payments and avoid late fees.

Better expense tracking and budgeting

Another significant advantage of a cashless economy is the improved ability to track expenses and manage budgets. Digital transactions create a clear record of all financial activities, allowing consumers to easily monitor their spending habits. Many banking apps and financial management tools provide detailed insights into spending patterns, categorizing expenses and offering visual representations of where money is being spent.

This increased visibility into financial transactions has made it easier for consumers to create and stick to budgets. With real-time updates on account balances and spending, individuals can make more informed decisions about their purchases and avoid overspending. Some apps even offer features that alert users when they are approaching their budget limits or when unusual spending patterns are detected.

Rewards and cashback opportunities

The cashless economy has also brought about an increase in rewards and cashback opportunities for consumers. Many credit card companies and digital payment platforms offer incentives for using their services, such as cashback on purchases or points that can be redeemed for various rewards.

These programs have become increasingly popular, with some studies showing that cashback has replaced miles and rewards as the top credit card perk consumers want. The appeal of cashback lies in its simplicity and immediate value to consumers. Unlike points or miles, which may have restrictions or expiration dates, cashback provides a straightforward way for consumers to save money on their purchases.

Moreover, the competition among financial institutions and payment providers has led to more generous reward programs, benefiting consumers who take advantage of these offers. Some cashback programs offer up to 5% back on certain categories of purchases, providing significant savings over time.

Challenges and Concerns of Going Cashless

While the cashless society offers numerous benefits, it also presents significant challenges and concerns that need to be addressed. These issues range from privacy and security risks to the potential exclusion of certain populations and technological barriers.

Privacy and data security risks

One of the primary concerns in a cashless society is the issue of privacy and data security. Digital transactions leave a traceable record, which raises concerns about personal data protection and the potential for data breaches. As more transactions occur digitally, individuals may become more vulnerable to identity theft or unauthorized access to their financial information.

The vast amounts of personal and financial data generated by cashless transactions must be safeguarded. Payment service providers and financial institutions need to implement robust data protection measures, including encryption and secure data storage. Compliance with relevant data protection regulations, such as the General Data Protection Regulation (GDPR), is crucial to protect consumer privacy.

Moreover, the risk of cyberattacks and hacking attempts increases in a cashless economy. According to research, cyberattacks increased by 31% between 2020 and 2021. This highlights the need for continuous innovation in security measures to address emerging threats and vulnerabilities.

Financial exclusion of unbanked populations

Another significant challenge of a cashless society is the potential exclusion of unbanked and underbanked populations. Approximately 2 billion people globally do not have a bank account, which means they rely primarily on cash transactions. The transition to a cashless economy may further marginalize these individuals, making it difficult for them to participate in economic activities.

In many countries, there is a gender divide in access to digital financial services, with women often being excluded from internet access. This disparity can exacerbate existing inequalities and hinder efforts to promote financial inclusion.

The unbanked population often faces barriers such as lack of identification documents, limited financial literacy, or low income levels. Without access to digital payment methods, these individuals may find themselves unable to engage in transactions, both formal and informal.

Technological barriers and infrastructure needs

The widespread adoption of cashless payments relies on the availability of reliable infrastructure, including high-speed internet connectivity, payment terminals, and mobile devices. In many countries, particularly those with less developed financial systems, the necessary infrastructure for seamless digital payments is still in its infancy.

Rural areas and underserved communities may face challenges in accessing the required technology and always-on internet connections needed for digital transactions. This digital divide can create a significant barrier to the adoption of cashless payment systems in these regions.

Moreover, the lack of digital literacy, especially among older generations, can hinder the adoption of cashless payments. Many individuals may be reluctant to embrace technologies they do not fully understand, creating a need for comprehensive education and support programs to bridge this knowledge gap.

Future Outlook: The Path to a Cashless Society

Government initiatives and regulations

As the world moves towards a cashless society, governments are playing a crucial role in shaping the future of digital payments. Many countries are implementing initiatives to promote the adoption of cashless transactions and regulate the evolving financial landscape.

In Australia, the government is updating the Payment Systems (Regulation) Act 1998 to address risks posed by new digital payment services, protect consumers, and promote competition. These amendments will subject emerging payment systems, such as digital wallets like Apple Pay and Google Pay, to the same oversight as traditional credit and debit cards.

The European Union has introduced its Digital Payment Strategy, which includes the Payment Services Directive 2 (PSD2). This initiative aims to increase competition and innovation in the payment sector while enhancing security and consumer protection.

In Asia, countries like India and China are leading the charge towards a cashless future. India’s Digital India Initiative seeks to transform the country into a digitally empowered society, promoting cashless transactions through mobile payment platforms and digital wallets. China, on the other hand, is piloting the Digital Yuan (e-CNY) to encourage cashless transactions and enhance payment security.

Emerging payment technologies

The future of cashless payments is being shaped by innovative technologies that are transforming the way people transact. Central Bank Digital Currencies (CBDCs) are gaining traction as governments explore the potential of issuing digital versions of their national currencies. These CBDCs aim to offer privacy, financial security, and convenience to businesses and consumers, especially those with limited access to traditional banking services.

Digital wallets are expected to account for more than half of all e-commerce payments worldwide by 2024. The convergence of technologies such as blockchain, artificial intelligence, and the Internet of Things (IoT) presents exciting possibilities for financial innovation, including tokenized assets and decentralized finance (DeFi) applications that have the potential to revolutionize traditional banking and finance.

Predictions for global cashless adoption

Experts predict that the transition to a cashless society is inevitable and well underway. Some analysts estimate that countries like Australia will enter into a cashless society by 2030, while others project even earlier adoption dates.

According to PwC’s 2025 & Beyond: Navigating the Payments Matrix report, global cashless payment volumes are set to increase by more than 80% from 2020 to 2025 and to almost triple by 2030. The Asia-Pacific region is expected to lead this growth, with cashless transactions increasing by 109% from 2020 to 2025, followed by Africa and Europe.

However, the path to a cashless society is not without challenges. Concerns about privacy, cybersecurity, and financial inclusion remain significant hurdles. Governments and industry stakeholders must work together to address these issues and ensure that the transition to a cashless economy does not exclude vulnerable populations or compromise consumer protection.

As the world moves towards a cashless future, collaboration between financial institutions, technology providers, regulators, and consumer advocacy groups will be essential to drive innovation, foster trust, and address the multifaceted challenges of this transformative shift in global finance.

Market Expert Opinion

Nick Fisher, General Manager of Sales and Marketing UK at JCB International (Europe) Ltd, has provided to FintechZoom.com exclusive commentary on this topic, highlighting the need for initiatives that leverage technology and promote financial literacy.

“The UK is rapidly approaching a cashless future, with individuals increasingly relying on cards for everyday purchases. With the continued growth of e-commerce and governments actively promoting the security of digital payments, it is no surprise that cash usage is predicted to account for only 6% of UK payments in 2033 by Accenture.

This shift towards a cashless society, while positive in many ways, underscores the critical importance of Financial Inclusion Week 2024 and its theme, “Financing the Future – Shaping the Next Decade of Inclusive Finance.” Millions around the world could remain excluded from traditional financial systems, hindering economic growth and perpetuating inequality. This exclusion disproportionately impacts vulnerable communities, limiting their opportunities for advancement.

Financial inclusion is not just a social imperative, but a catalyst for sustainable development. By leveraging the power of technology, financial institutions can actively expand access to digital payment solutions in emerging markets, fostering partnerships that empower the underprivileged and SMBs and promoting financial literacy to ensure individuals can confidently navigate the evolving financial landscape. The success of financial inclusion relies on building a future where everyone has the opportunity to participate and prosper.

The ultimate goal is to foster an inclusive financial ecosystem where a diverse range of financial services are readily available and accessible to all segments of society. By expanding access to these services and empowering individuals and businesses with essential financial literacy skills, we can drive greater participation in the formal economy, ultimately leading to more robust economic growth and widespread social progress.”

Conclusion

The shift towards a cashless society is causing a revolution in the way businesses operate and consumers manage their finances. This transition brings numerous benefits, including increased efficiency, improved security, and enhanced convenience. However, it also presents challenges such as privacy concerns, potential financial exclusion, and the need for robust technological infrastructure. To address these issues, governments, financial institutions, and technology providers must work together to create a more inclusive and secure cashless ecosystem.

Looking ahead, the future of cashless payments seems bright, with emerging technologies like digital currencies and innovative payment platforms paving the way for further advancements. As we move towards this cashless future, it’s crucial to strike a balance between innovation and accessibility, ensuring that the benefits of digital payments are available to all members of society. By addressing the challenges and leveraging the opportunities, we can create a financial landscape that is more efficient, secure, and inclusive for everyone.

FAQs

Businesses that adopt a cashless model save on the costs and fees related to handling and processing cash. This includes avoiding bank fees for coin counting and deposits, as well as eliminating the need for secure cash transport services.

A cashless society can lead to more effective tax collection, reducing tax evasion and increasing government revenue. This additional revenue can support more public welfare programs. Additionally, digital transactions improve transparency, scalability, and accountability.

One major concern is the risk of identity theft and the compromise of personal information. Furthermore, every digital payment leaves a trace, which financial institutions can monitor, potentially leading to privacy issues.

The primary advantages include increased efficiency in transactions, reduced costs related to cash handling, and enhanced security against theft and fraud. On the downside, it raises concerns about privacy, the exclusion of those without bank accounts or digital access, and the reliance on technological infrastructure which might not be robust everywhere.