3M has agreed to pay more than $6.5 million to resolve U.S. charges of Foreign Corrupt Practices Act violations (FCPA) related to a 3M subsidiary in China.

The Securities and Exchange Commission (SEC) said that 3M’s subsidiary, 3M China, had paid bribes to government officials in order to win or retain business. The bribes were paid in the form of travel expenses, gifts, and other things of value.

The SEC also said that 3M had failed to adequately supervise its subsidiary in China. As a result, 3M was liable for the subsidiary’s actions. 3M has agreed to pay a fine of $5 million and to disgorge $1.5 million in profits. The company has also agreed to improve its compliance program.

The FCPA is a law that prohibits U.S. companies from bribing foreign officials to win or retain business. The law is designed to protect the integrity of the global marketplace and to promote fair competition. This is not the first time that 3M has been accused of violating the FCPA. In 2019, the company agreed to pay $890 million to settle charges that it had bribed officials in Asia, Europe, and Latin America.

3M is a multinational corporation that manufactures a wide variety of products, including tapes, adhesives, and medical supplies. The company is headquartered in Minnesota. The FCPA is a serious law, and violations can result in significant fines and penalties. Companies that do business overseas should be aware of the FCPA and take steps to comply with the law.

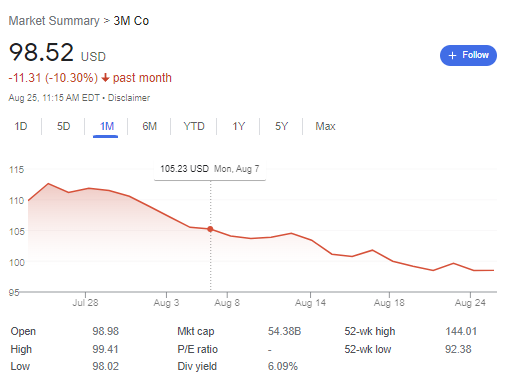

3M Stocks down -10.3% in past month and today is +0.49%

3M stock (NYSE:MMM) has been down 10.3% in the past month. There are a few factors that could be contributing to this decline.

- Weak consumer discretionary spending. 3M is a diversified company with businesses in a variety of sectors, including consumer, industrial, and healthcare. The consumer discretionary segment, which includes products like Post-it notes and Scotch tape, has been particularly weak in recent months due to rising inflation and declining consumer confidence.

- Supply chain constraints. 3M is also facing supply chain constraints, which are impacting its ability to meet demand for its products. These constraints are being caused by a variety of factors, including the COVID-19 pandemic, the war in Ukraine, and the ongoing chip shortage.

- Legal challenges. The recent news regarding 3M’s violation of the FCPA and the subsequent settlement may have contributed to the decline in the company’s stock price. 3M is also facing a number of legal challenges, including lawsuits related to its use of PFAS chemicals and its sale of combat arms earplugs. These lawsuits could result in significant costs for the company, which could weigh on its financial performance.

Overall, the outlook for 3M stock is uncertain. The company is facing a number of challenges, but it also has a strong track record of innovation and growth. Investors should carefully consider these factors before making any investment decisions.

In addition to the factors mentioned above, 3M’s stock is also being affected by the broader market sell-off that has been taking place in recent months. As investors become more cautious about the economic outlook, they are selling off stocks of companies that are considered to be more cyclical, such as 3M.

References: [1] SEC Charges 3M with Foreign Corrupt Practices Act … [2] 3M settles US anti-bribery law charges in China unit, SEC … [3] 3M pays SEC $6.5 million to settle luxury tourism bribes