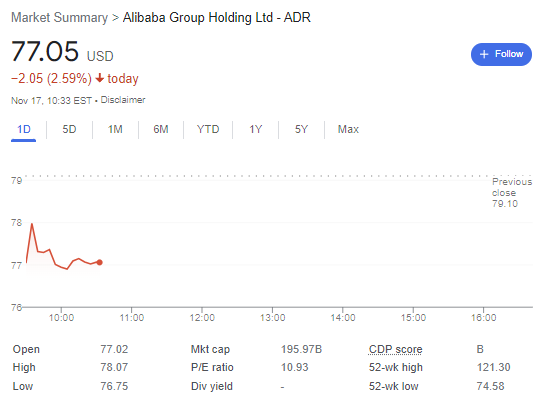

Alibaba stock is currently down -2.59% as of 2023-11-17 15:37 WET. This decline is part of a broader sell-off in the Chinese stock market, which is being driven by concerns about the slowing Chinese economy and the ongoing trade tensions between the United States and China.

Alibaba has been particularly vulnerable to these concerns because it is a large and well-known Chinese company with significant exposure to the Chinese economy. The company has also been facing its own challenges in recent months, including a slowdown in revenue growth and increased regulatory scrutiny.

As a result of these factors, Alibaba’s stock has been underperforming the broader market in recent weeks. However, it is important to note that the company is still a fundamentally strong business with a dominant position in the Chinese e-commerce market. Long-term investors should consider these factors before making any investment decisions.

Alibaba has scrapped plans to spin off its cloud

In a stunning reversal of fortune, Alibaba Group Holding Ltd. (NYSE: BABA), the Chinese e-commerce giant, has scrapped plans to spin off its cloud computing business and list its supermarket unit, Freshippo. This decision comes on the heels of lukewarm investor reception to Alibaba’s ambitious restructuring plan, which aimed to unlock greater value for its shareholders.

The U.S. government’s imposition of export controls on technology transfers to certain Chinese companies, including Alibaba, has thrown a wrench into the company’s plans. Alibaba has cited these export controls as creating “uncertainties” for its cloud business, leading to the cancellation of the separate initial public offering (IPO) that was planned for the unit.

Furthermore, the listing of Freshippo, Alibaba’s grocery chain, has been put on hold as the company “evaluates market conditions.” This decision suggests that Alibaba is not confident in the market’s ability to support an IPO for Freshippo at this time.

The news sent shockwaves through the investor community, causing Alibaba’s shares to plummet by 10% in response. This sharp decline reflects the deep concerns that investors have about the impact of U.S. export controls on Alibaba’s business prospects.

The Impact of U.S. Export Controls

The U.S. government has imposed export controls on a number of Chinese technology companies, citing national security concerns. These controls restrict the ability of these companies to acquire certain technologies from the United States, potentially hampering their ability to innovate and compete.

In Alibaba’s case, the export controls could have a significant impact on its cloud business. Alibaba Cloud is one of the leading cloud computing providers in China, and it relies heavily on U.S.-made technology. The export controls could make it more difficult for Alibaba Cloud to access this technology, potentially slowing its growth and development.

The Uncertain Future of Alibaba’s Restructuring

Alibaba’s decision to scrap its cloud spinoff and list Freshippo IPO raises questions about the future of the company’s ambitious restructuring plan. This plan, which was announced in August 2023, aimed to simplify Alibaba’s corporate structure and unlock greater value for its shareholders.

The U.S. export controls have thrown a cloud of uncertainty over Alibaba’s restructuring plans. The company may now need to reconsider its strategy and focus on other ways to boost its valuation.

Investor Concerns and the Market’s Reaction

Investors have reacted negatively to Alibaba’s decision to scrap its cloud spinoff and list Freshippo IPO. This reaction is driven by concerns about the impact of U.S. export controls on Alibaba’s business prospects.

The market’s response has been swift and severe, with Alibaba’s shares falling by 10% in the wake of the news. This decline reflects the deep concerns that investors have about the company’s future.

The Road Ahead for Alibaba

Alibaba faces a number of challenges in the wake of its decision to scrap its cloud spinoff and list Freshippo IPO. The company will need to navigate the complex and uncertain landscape of U.S. export controls while also evaluating market conditions for its supermarket unit.

The future of Alibaba’s restructuring plan remains uncertain, and the company will need to carefully consider its next steps. In the meantime, investors will be closely watching Alibaba’s performance and assessing the impact of U.S. export controls on its business.tunesharemore_vert