Investors in Alibaba were dealt a blow as the company’s stock took a sharp nosedive. What caused this unexpected drop in value and what does it mean for the future of Alibaba?

Alibaba, the Chinese e-commerce giant, has been a powerhouse in the stock market for years. However, its recent financial report revealed a significant revenue miss, causing concern among shareholders and analysts alike.

The stock market can be unpredictable, and even the most successful companies can experience setbacks. Alibaba’s recent decline in stock value serves as a reminder of the ever-present risks of investing in the market. This article will delve into the factors behind the company’s weak revenue and explore the potential implications for the future growth of Alibaba.

Alibaba Group Announces December Quarter 2023 Results

Alibaba Group did announce their December quarter 2023 results on February 7, 2024. Here are some key highlights:

- Revenue: RMB260,348 million (US$36,669 million), an increase of 5% year-over-year.

- Cloud Computing: Revenue increased 24% year-over-year.

- International Digital Commerce: Revenue increased 44% year-over-year.

- Alibaba Cloud: Revenue increased 3% year-over-year.

Overall, the results were mixed. While revenue grew slightly, it was slower than analyst expectations. However, the strong performance of the international digital commerce segment was a positive sign.

Here are some resources where you can learn more about the results:

- Alibaba Group Investor Relations: https://www.alibabagroup.com/en/ir/home

- Press release: https://www.businesswire.com/news/home/20240205735477/en/Alibaba-Group-Announces-December-Quarter-2023-Results

- Financial Times: https://markets.ft.com/data/announce/detail?dockey=600-202402070630BIZWIRE_USPRX____20240205_BW735477-1

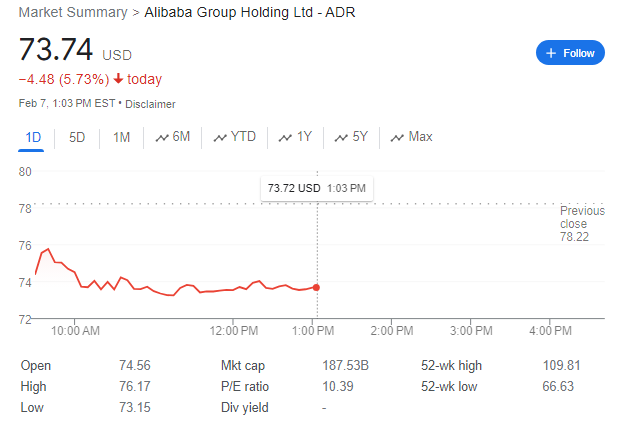

And Then… Alibaba Stock drop 5.73%

Alibaba’s share price did drop by around 5.73% following the release of their December quarter 2023 results on February 7, 2024. While the results showed some positive aspects, like growth in international digital commerce and cloud computing, it seems the overall performance and slower than expected revenue increase fell short of investor expectations, leading to the stock price decline.

Here are some possible reasons for the drop:

- Slower revenue growth: Although revenue did increase, it was only by 5%, which was slower than analysts’ predictions. This might have disappointed investors hoping for a stronger rebound.

- Mixed earnings report: While some parts of the business like cloud and international commerce performed well, others like Alibaba Cloud showed slower growth. This lack of uniformity could raise concerns about the company’s overall health.

- Macroeconomic headwinds: The Chinese economy continues to face challenges, and investors might be wary of Chinese stocks in general due to these uncertainties.

- Profitability concerns: While Alibaba is profitable, its profit margins have been shrinking in recent quarters. This could be another red flag for investors.

It’s important to note that the stock market is complex and influenced by many factors. While the earnings report likely played a role in the share price drop, it’s not the only explanation.

Would you like me to find more information about the specific reasons behind the drop, or perhaps analyze what analysts are saying about the future of Alibaba’s stock?