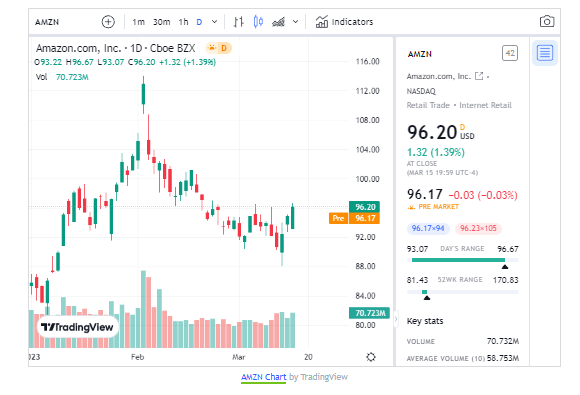

In past 6 months Amazon stock price plunged -22.12%. Yesterday increased +1.39%.

However, Amazon’s long-term prospects remain strong. The company has a dominant position in the e-commerce market, with a wide range of products and services that are in high demand, particularly as more consumers turn to online shopping in the wake of the pandemic. In addition, Amazon has made significant investments in areas such as cloud computing and artificial intelligence, which are likely to be key growth areas in the coming years.

Furthermore, Amazon has a track record of successfully navigating challenging economic environments, such as the 2008 financial crisis. The company has a strong balance sheet, with ample cash reserves and low debt levels, which positions it well to weather short-term market volatility.

Read: Banking Crisis: Silicon Valley Bank was closed!

Overall, while the decline in Amazon’s stock price over the past 6 months is certainly significant, it is important to consider the broader context of the current economic environment and the long-term prospects of the company.

Amazon has revealed three satellite internet antenna models

Amazon has revealed three satellite internet antenna models for its Project Kuiper broadband satellites, which will offer affordable broadband to areas with limited connectivity, similar to SpaceX’s Starlink network. The three models include a small model with speeds up to 100Mbps, a standard model for residential and small business customers with speeds up to 400Mbps, and a Pro model for enterprise or government users with speeds up to 1Gbps. Amazon plans to launch more than 3,000 broadband satellites, but no details regarding availability or pricing have been revealed yet. [1][2][3]

References:

[1] Amazon Shows off Its New Starlink-Style Satellite Internet … [2] Amazon rivals SpaceX with new antenna – LinkedIn [3] Amazon shows off new satellite internet antennas … – FlipboardAmazon’s drone business has faced regulatory hurdles

Amazon’s drone business has faced regulatory hurdles and weak demand in its efforts to get off the ground [4]. The company has been working on developing a drone delivery service for several years, but regulations from the Federal Aviation Administration (FAA) have limited the scope of its testing and deployment. In addition, consumer demand for drone deliveries has been slower to materialize than initially anticipated.

Despite these setbacks, Amazon has continued to invest in its drone technology and has made progress in expanding its testing capabilities. In 2020, the company received FAA approval to operate its Prime Air drones for commercial delivery, and it has been testing drone deliveries in select markets since then.

Amazon’s drone business also faces competition from other companies, including Alphabet’s Wing and UPS, which have also been testing drone deliveries. However, Amazon’s extensive logistics network and customer base give it an advantage in the race to develop a viable drone delivery service.

Overall, while Amazon’s drone business has faced challenges, the company remains committed to developing this technology and has made progress in overcoming regulatory and market barriers.

[4] – Amazon’s drone business can’t get off the ground as regulationsAmazon might reduce its order for Rivian electric delivery vans?

Rivian’s stock fell recently due to news that Amazon might reduce its order for Rivian electric delivery vans. However, it is possible that this reaction may be overblown. While Amazon has not confirmed any changes to its order, it is important to note that Rivian has other customers for its vehicles, including Ford and the delivery company, DHL.

Moreover, Rivian has received significant investment from other sources, including Ford, Cox Automotive, and T. Rowe Price, indicating confidence in the company’s long-term prospects. Additionally, Rivian’s electric vehicles have been well-received by consumers and have received positive reviews from critics.

It is also worth noting that Rivian is still a relatively young company, having only recently begun production of its vehicles. As such, there may be some volatility in its stock price as the company navigates the challenges of scaling up production and expanding its customer base.

Overall, while the news of Amazon potentially reducing its order for Rivian electric delivery vans may have contributed to a decline in the company’s stock price, it is important to consider the broader context and long-term prospects of the company.