Introduction

Why Today’s Surge Matters

On October 6, 2025, Advanced Micro Devices (AMD) surprised markets as its shares surged as much as 37% in premarket trading. The spark: a multi-year, multi-billion-dollar AI partnership with OpenAI. For investors, builders, and IT leaders, this is more than a headline—it signals a real shift in who supplies the computing power behind modern AI, a space long dominated by Nvidia. A practical note for readers who watch market microstructure: premarket spikes this large can reflect both a change in fundamentals and mechanics like short covering or thin premarket liquidity. Follow-through in regular session volume, closing price, and subsequent disclosures will help confirm durability.

The surge also signals that hyperscale AI buyers are broadening their supplier lists to reduce risk and improve pricing, which can rebalance demand and ecosystem gravity. In plain language, AMD just earned a seat at the top of the AI infrastructure table, with implications for performance, procurement, and platform strategy across the industry. Public signals from AMD and major frameworks point to faster support for PyTorch and Triton on AMD’s ROCm stack—part of a multi-vendor trend already visible in cloud instance catalogs and enterprise procurement playbooks.

What You Will Learn in This Analysis

This article explains the partnership’s scope, the competitive implications for Nvidia, and why equity markets repriced AMD so quickly. You’ll also get a practical checklist for what to watch next—whether you allocate capital, plan capacity, or make architecture decisions for large-scale AI workloads. This analysis references primary sources, such as vendor documentation, benchmark consortia, and financial filings, to ground claims and avoid speculation.

We cover what the deal likely includes, how it could affect accelerator supply and core software stacks, where AMD still must execute, and concrete steps to reduce risk in a fast-moving market. To keep it actionable, we include field-tested patterns, such as how teams port inference services to ROCm-based fleets, and flag key caveats. This article is not financial advice. Please validate material developments against official AMD announcements and filings via AMD Investor Relations.

Pull quote: “The OpenAI–AMD pact is the strongest signal yet that AI compute is moving beyond a single-vendor model—on hardware, software, and supply.”

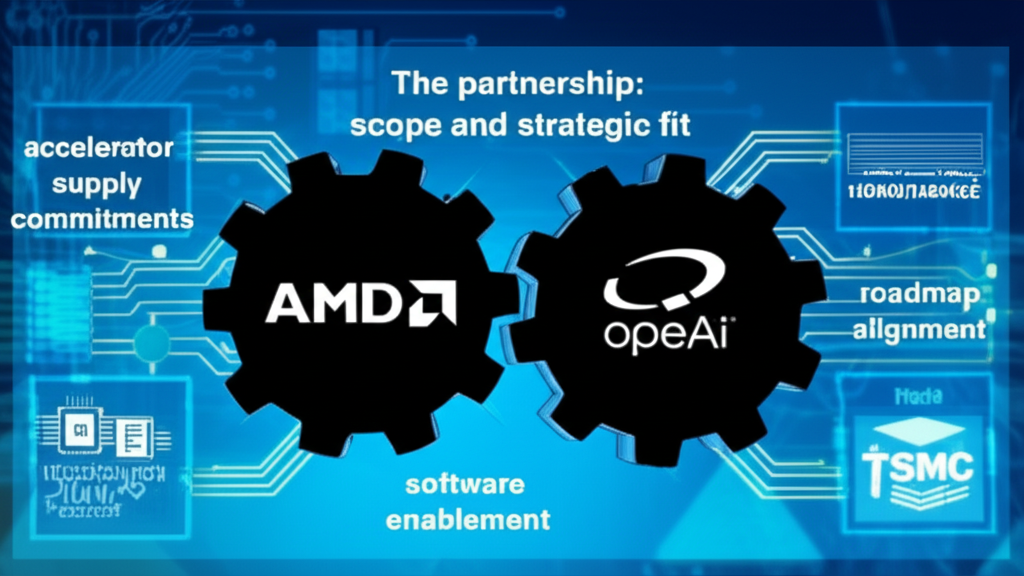

The Partnership: Scope and Strategic Fit

What AMD and OpenAI Announced

AMD confirmed a multi-year, multi-billion-dollar collaboration with OpenAI, which sparked the premarket rally. While specific line items are not public, partnerships of this size typically include accelerator supply commitments, co-engineering for software enablement, and roadmap alignment for next-generation silicon tuned to frontier model training and inference.

For OpenAI, the goal is straightforward: secure additional high-performance compute (HPC/AI) capacity and diversify vendor exposure to mitigate supply and pricing risk. For AMD, the benefit is anchoring demand for its data center GPUs and accelerators and expanding first-class AI framework support in the ROCm ecosystem—improving performance, developer experience, and reliability at scale. Concrete signals include first-party ROCm builds of PyTorch (install channels), Triton’s ROCm backend, and widening compatibility in inference stacks like vLLM on AMD and Hugging Face Optimum for AMD. Cloud previews such as Azure’s MI300X-based instances further reduce friction for pilots.

Why the Deal Could Be Transformative

A named anchor customer reduces demand volatility and tightens feedback loops between software, kernels, and hardware. Expect faster compiler and library optimizations for training and inference, better tooling, and more predictable performance. The halo effect can attract other hyperscalers and enterprises that want credible alternatives. Practically, teams should see quicker upstreaming of ROCm-specific optimizations into PyTorch 2.x (Inductor), Triton kernels for attention operations, and improved distributed training as RCCL approaches feature parity with NCCL.

Strategically, the partnership validates AMD’s AI accelerator trajectory, improving odds for foundry and packaging allocation, strengthening HBM supply leverage, and enabling multi-generation planning. It also raises the likelihood that more training and inference stacks ship with first-class AMD support—lowering switching costs for teams tied to a single vendor. Independent benchmarks such as MLPerf (MLCommons) and reproducible reference designs can accelerate enterprise adoption by providing third-party validation of performance and TCO, which many risk-aware buyers require before scaling.

Competitive Landscape: Is Nvidia’s Dominance at Risk?

Nvidia’s Enduring Moat—What Still Holds

Nvidia’s lead rests on a durable combination: the CUDA software ecosystem, mature kernels like cuDNN, high-speed interconnects, and a massive installed base across clouds and on-prem clusters. For years, that stack reduced developer friction, reinforced by tight integration from model frameworks to orchestration tools. Higher-level stacks—TensorRT-LLM, NCCL, and data center fabrics (NVLink/NVSwitch)—compress time-to-solution and sustain leadership on many workloads.

Hardware leadership plus software lock-in created high switching costs and predictable performance footprints. Even with new partnerships, Nvidia’s time-to-solution advantage, ecosystem breadth, and network effects remain formidable. The real question is how much share the market now allows AMD to win credibly. Risk-aware buyers often start with AMD for inference—where latency and throughput targets are reachable with focused kernel work—then expand to training as software parity improves and operational runbooks mature.

Paths for AMD to Close the Gap

AMD’s most direct path is competitive performance per dollar, backed by improving software parity and dependable supply. If OpenAI contributes optimizations to open tooling and kernels, developer friction can drop sharply, making AMD accelerators easier to adopt without major code rewrites or operational upheaval. Key enablers include stable ROCm releases, mature PyTorch ROCm wheels, robust Triton kernels, and distributed primitives in RCCL that mirror NCCL semantics to simplify multi-GPU training. Memory capacity is a practical wedge: high-capacity accelerators can host larger context windows and 70B-class models with lower quantization, reducing cross-GPU communication and tail latency.

Partnership leverage matters. With a flagship customer, AMD can prioritize framework compatibility, graph compilers, and distributed libraries that map cleanly to its hardware. If procurement teams can reliably source capacity, predict scaling behavior, and hit cost targets, share shifts can come faster than expected—especially for inference fleets. For example, teams have deployed vLLM-based text-generation services on ROCm by reusing Triton/ONNX export pipelines and containerizing with AMD’s ROCm images, then validated latency SLOs before expanding the footprint. This playbook limits risk while building in-house expertise. For reproducibility, insist on validated designs and golden configs with exact driver and firmware versions.

| Vendor/Player | Position Today | Key Differentiator | Primary Dependency | Near-Term Risk |

|---|---|---|---|---|

| AMD | Rapidly rising challenger | Price-performance, large HBM capacity, expanding software support | HBM/package supply, ecosystem maturity | Execution speed and developer adoption pace |

| Nvidia | Incumbent leader | CUDA ecosystem, network effects, proven scaling | Advanced packaging capacity | Price pressure, multi-vendor procurement, margin defense |

| OpenAI | Frontier model operator/buyer | Massive, predictable AI compute demand | Multi-vendor supply reliability | Concentration, regulatory constraints, scaling costs |

Pull quote: “Portability is the new performance—if it ships across vendors, it scales across budgets.”

Market Mechanics: Why Shares Jumped 37%

From Narrative to Numbers—How the Story Rerated

Markets reward visibility. A multi-year, multi-billion-dollar commitment improves revenue predictability, strengthens the case for a data center mix shift, and can support gross margin expansion if accelerators scale well. Investors are pricing in a larger total addressable market, more pricing power, and a quicker cadence of platform wins. Historically, when chipmakers secure anchor AI customers, analysts lift unit assumptions and the multiple can re-rate alongside higher revenue estimates. The move in AMD’s stock reflects both these fundamentals and market positioning.

Crucially, the deal reframes AMD as a primary AI supplier rather than a fast follower. That status shift changes how analysts model volumes, utilization, and operating leverage over time. The result is multiple expansion layered on higher revenue expectations—a classic setup for outsized price moves. A balanced view matters: premarket spikes can also reflect sentiment and positioning. Watch subsequent disclosures (backlog, data center revenue growth) and third-party benchmarks (for example, MLPerf) to separate durable fundamentals from momentum.

Pull quote: “Visibility plus volume is what turns a design win into a rerating.”

| Indicator | Why it matters | Where to find | Typical cadence |

|---|---|---|---|

| Backlog and hyperscaler commentary | Signals revenue visibility and capacity commitments | Earnings calls, investor decks, 10-Q/10-K | Quarterly |

| Cloud instance availability for AMD accelerators | Proxy for supply health and developer demand | Azure updates (e.g., ND MI300X v5), AWS/GCP catalogs | Monthly to quarterly |

| MLPerf submissions (Training/Inference) | Third-party validation of performance/TCO | MLCommons leaderboards | Semiannual (typical) |

| ROCm/PyTorch/Triton release notes | Measures software maturity and kernel parity | Vendor repos and docs | Monthly to quarterly |

What Could Still Go Wrong

Execution remains the watchword. The partnership must translate into on-time deliveries, stable software, and predictable scaling. Delays in advanced packaging, HBM availability, or kernel performance would erode the thesis. Single-customer concentration heightens sensitivity to deployment pace or contract changes. Supply realities—lead times for HBM3E and constrained packaging at leading foundries—are well-known bottlenecks in accelerator ramps.

Competitors will respond. Nvidia can adjust pricing, accelerate roadmaps, or deepen its own strategic agreements. Regulatory actions on AI compute exports and model governance could alter deployment timelines or regional mix, adding uncertainty as expectations rise. From a financial-risk angle, monitor inventory turns, gross margin cadence, and any unusual working-capital swings in AMD’s filings (10-Q/10-K) as early signals of either a smooth or strained scale-up.

Practical Playbooks: What to Do Now

For Investors: How to Underwrite the New Thesis

Focus on proof points that convert headlines into durable earnings power. Track software parity milestones, independent benchmarks, and customer diversity beyond the anchor account. Watch signs of supply scaling—especially HBM capacity—and whether gross margins improve as volume ramps through data center SKUs. Cross-check vendor claims with independent sources, such as MLCommons results and cloud-instance availability, to avoid overreliance on marketing narratives.

Position sizing should reflect both upside and execution risk. Consider scenarios where AMD gains inference share before training share, and where multi-vendor strategies compress industry pricing. Balance enthusiasm with discipline: the story is stronger, but contingent on timely delivery and adoption. A quick sanity check is to compare implied growth in consensus models with tangible capacity indicators like foundry and packaging commentary or memory vendor shipments.

- Monitor management commentary on backlog, utilization, and lead times via conference-call transcripts and 8-Ks. Note whether guidance converts pipeline into booked backlog.

- Track ROCm and framework updates, and read performance notes in release logs. Prioritize changes that improve transformer kernels and distributed training stability.

- Watch cloud marketplace listings and availability for AMD accelerators (for example, Azure’s ND MI300X v5) as a proxy for supply health and developer interest.

- Compare end-to-end TCO for training and inference across vendors. Include networking, energy, cooling, and operator time—not just chip list prices.

- Reassess risk if delays or regressions appear in production. Adjust position sizing to new information rather than averaging down on narrative alone.

For Builders and IT Buyers: Decisions that De-Risk Adoption

Adopt a multi-vendor architecture to avoid capacity bottlenecks and keep leverage in procurement. Prioritize portability: standardize framework abstractions, container images, and orchestration that minimize vendor-specific bindings. Start with inference to validate reliability, then expand to training as performance and tooling mature. A proven path is to pilot a few representative services (for example, vLLM text generation or embeddings) on ROCm and measure SLO attainment before widening the fleet.

Negotiate software support SLAs, roadmap transparency, and cross-vendor compatibility testing. Where possible, pilot identical workloads across vendors and measure stability, scaling efficiency, and operator overhead—not just raw throughput. Build internal champions who can contribute upstream fixes and share playbooks. In enterprise rollouts, clearly defined golden images (driver, ROCm version, container tags) and automated kernel regression tests prevent drift and “works-on-one-cluster” failures.

- Containerize workloads with consistent, vendor-agnostic base images. Use official ROCm images for AMD and keep CUDA-tagged images for Nvidia to enable clean A/B tests.

- Use CI pipelines to run cross-hardware regression tests on kernels. Include numerical parity checks and performance thresholds per model.

- Abstract hardware via schedulers that support heterogeneous clusters. Kubernetes device plugins and topology-aware scheduling reduce manual placement.

- Pilot fine-tuning and high-throughput inference first, then scale to training. Start with quantized or LoRA variants to meet latency targets while easing memory pressure.

- Document tuning parameters to speed repeatable deployments. Track compiler flags, environment variables, and batch sizes per model–hardware pair.

| Category | AMD (ROCm/Instinct) | Nvidia (CUDA/Hopper) | Practical takeaway |

|---|---|---|---|

| Software maturity | Rapidly improving framework support; growing Triton/Inductor optimizations | Mature kernels and tooling; broad ISV integrations | Pilot on AMD, keep fallbacks on CUDA to de-risk migrations |

| Memory capacity per accelerator | High-capacity options that ease large-context inference | Diverse SKUs with strong performance and ecosystem | Match hardware to context-window and model-size needs |

| Cloud availability | Expanding previews/rollouts (e.g., Azure ND MI300X v5) | Widely GA across major clouds | Use cloud trials to validate SLOs before capex |

| Distributed libraries | RCCL approaching feature parity | NCCL is very mature | Training scale depends on comms library parity |

What to Watch Next: Signals, Conclusion, and FAQs

Execution, Ecosystem, and Economics

Look for credible third-party benchmarks and customer case studies that show near-parity or better performance on key model families. Supply indicators—shorter lead times, stable yields, predictable deliveries—confirm that manufacturing is keeping pace. Independent test suites like MLPerf and cloud general availability announcements are stronger validation than vendor-only numbers. The faster developers see “it just works,” the faster adoption will rise. Key signals include PyTorch ROCm wheels in mainline releases, Triton kernel parity, and robust support in stacks like vLLM.

A healthy partner ecosystem—ISVs, MLOps vendors, and integrators—reduces friction. On economics, measure TCO at cluster scale, not just chip specs. Networking, memory, energy use, cooling, and operator time often dominate costs. If AMD delivers lower TCO with robust software, procurement will follow even without absolute peak-performance leadership. Use transparent, reproducible methods and ensure parity in compiler settings to make fair comparisons.

| Cost component | What to measure | Notes |

|---|---|---|

| Accelerators | $ per throughput (tokens/sec or images/sec) and utilization | Compare list vs. negotiated pricing; monitor supply-driven discounts |

| Memory & packaging | HBM capacity/bandwidth, lead times | Packaging and HBM availability can gate deployments |

| Networking | Fabric bandwidth (200/400/800G), oversubscription, cost/port | Interconnect efficiency impacts training/inference scaling |

| Power & cooling | kW per rack, PUE, $/kWh under target workloads | Thermal headroom can constrain cluster density |

| Engineering & operations | Operator hours, reliability SLOs, incident rates | Software maturity drives operational overhead |

| Software licensing & support | Support SLAs, optional enterprise tooling | Plan for cross-vendor support in multi-tenant environments |

Final Takeaways and Key Questions

AMD’s 37% premarket surge after its multi-billion-dollar OpenAI partnership marks a turning point in AI infrastructure. The deal elevates AMD from challenger to core supplier, pressures single-vendor assumptions, and reshapes pricing, performance, and supply. Independent validation—benchmarks, cloud GA availability, and customer case studies—will determine how much of today’s narrative converts into sustained share gains. Nvidia’s moat is real, but the market is widening.

Investors should update scenarios and watch for execution proof points, while builders and IT leaders should harden multi-vendor strategies now. Prioritize portability and pilot production workloads on AMD to validate performance and operability. The compute map is being redrawn faster than many expected. Diversifying vendor exposure is prudent, and production deployments should follow evidence, not headlines. Next step: create a two-quarter plan with defined checkpoints—benchmarks, supply confirmations, and cost analyses—to turn today’s headlines into confident, data-driven decisions.

The move followed news of a multi-year, multi-billion-dollar AI partnership with OpenAI. Markets priced in improved revenue visibility, a stronger data center mix, and potential margin expansion as AMD becomes a primary AI supplier rather than a follower. That said, follow-through in regular trading, disclosures, and benchmarks will determine durability.

Nvidia retains major advantages in software (CUDA), kernels, and ecosystem depth. The partnership mainly accelerates credible multi-vendor strategies—especially for inference—pressuring single-vendor assumptions and pricing. Over time, software parity and dependable supply will determine how much share AMD can win.

Start with inference services (e.g., vLLM text generation or embeddings) using official ROCm containers. Validate SLOs, numerical parity, and operational stability; then expand to training as Triton kernels, PyTorch Inductor, and RCCL mature. Use reproducible configs and cross-vendor CI to de-risk adoption.

Monitor AMD backlog and data center mix in filings, cloud instance availability for AMD accelerators, MLPerf results for third-party validation, and ROCm/PyTorch/Triton release notes. Consistency across these signals is a stronger indicator than any single datapoint.

Sources and further reading:

- AMD ROCm Documentation and Release Notes

- PyTorch Install Guide (ROCm/CUDA)

- OpenAI Triton (with ROCm backend)

- vLLM on AMD ROCm Guide

- Hugging Face Optimum for AMD

- MLCommons (MLPerf) Benchmarks

- NCCL and TensorRT (Nvidia Developer)

- Azure ND MI300X v5 VM Series (Preview/Updates)

- AMD Investor Relations (Filings and Press Releases)