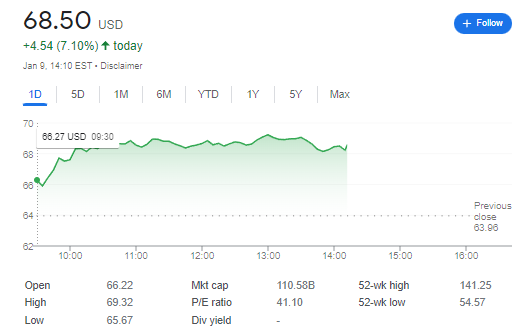

Have you been following the stock market? You may have noticed a jump in AMD stock today – it went up by 7.10%.

AMD, a technology company based in California, is well known for producing processors, graphics cards and other hardware components. It’s one of the most popular semiconductor companies.

What caused this sudden increase in the stock price? To find out, investors need to look at the company’s financial reports and news announcements to understand what pushed AMD’s stock higher. In this article, we take an in-depth look into why AMD’s share prices rose and whether it will continue to go up or fall back down again.

Shares of AMD, Intel, and Nvidia increased sharply on Monday and the reason for the rise in their stock prices

At the beginning of the week, the semiconductor industry saw a strong start on Monday, with Intel increasing by 2.3%, Nvidia rising by 6.3%, and AMD leading the pack with an increase of 6.9% as of 10:25 a.m. ET. Despite the positive outlook, investing in these stocks comes with a certain level of risk.

At present, some semiconductor stocks are looking attractive due to their prices. Intel, for instance, is trading for less than nine times its trailing earnings. Although AMD and Nvidia’s prices of 39 and 60 times trailing earnings, respectively, may not be considered as inexpensive, they are approximately half as expensive compared to one year ago.

Moreover, the possibility of China not being able to afford the expected $143 billion investment (Reuters) for its semiconductor sector is perceived as good news for Western semiconductor corporations that will most likely receive subsidies from the U.S. government. Nevertheless, the news is not all positive for those investing in semiconductors.

Last Friday, Samsung revealed that its profits for the December quarter are expected to plunge by 69%, mainly due to reduced demand for semiconductors. The prices of DRAM and NAND flash memory are also lowering due to the lack of demand, in addition to the piling up of chip inventories across the supply chain, reported by Nikkei Asia.

This is not even the most awful information. Because of low consumer demand and lower prices, most semiconductor companies have chosen to reduce their capital investments and stop adding more supply to the market. On the other hand, Samsung has made the opposite decision, still investing in equipment and producing more chips. This could make the oversupply issue last until 2023, and possibly make prices go even lower. In my opinion, this is not a rational reason to invest in semiconductor stocks right now.

Samsung was unsuccessful in obtaining orders for fabrication of cutting-edge semiconductor chips from AMD.

It appears that Samsung’s 4nm and 5nm chips are not as effective as those made by TSMC, which could explain why AMD decided to go with TSMC (plus GlobalFoundries) to construct its new processors. Yet, there is still no clear explanation as to why Samsung didn’t get the order.

However, according to Sammobile, Samsung Foundry has secured orders from AMD to develop chips based on the 14nm fabrication process. In contrast, the South Korean manufacturer could not get orders to fabricate the more advanced chips utilizing 5nm, 6nm, and 7nm fabrication processes, such as Zen 3, Zen 3+, and Zen 4. Supposedly, TSMC and Global Foundries will be AMD’s primary associates for the upcoming three years, producing the new chips up until 2025. Samsung has the technology to assemble 4nm and 5nm semiconductors, however, these are believed to be less effective than the ones made by TSMC. This could be why AMD decided to go with TSMC (and GF) for their new chips. Unfortunately, the reasons behind Samsung not getting the order are still not known.

According to Guru3d, AMD says it is out of stock to replace faulty Radeon RX 7900 XTX GPUs.