It’s been a rollercoaster of a year for investors. From the COVID-19 pandemic to unprecedented monetary stimulus, it’s been a year full of market uncertainty. And as we head into the final months of 2022, the outlook remains uncertain. Will inflation return? Will interest rates continue to rise? Is a recession on the horizon? Amidst all this uncertainty, some investors are looking for best stocks in such a broader market that offer a sense of certainty in terms of cash flows and company fundamentals. That’s where this list comes in. These are the 10 best companies to invest in for 2022.

Amazon (NASDAQ:AMZN)

The online retail giant is a force to be reckoned with. Despite being in the crosshairs of antitrust regulators, Amazon continues to grow at an incredible pace. In the second quarter of 2022, the company reported $121.2 billion in revenue, up 7% from the prior year.

While Amazon’s revenue growth has slowed in recent quarters, it is still one of the fastest-growing companies in the world. And with a market cap of over $1.14 trillion, it is one of the most valuable companies in the world.

Annaly Capital Management Inc.

With a market cap of $7.51 billion, Annaly Capital Management is a mortgage real estate investment trust (REIT) working on housing market. The company invests in a variety of mortgage-backed securities, including agency and non-agency MBS.

With interest rates expected to rise in the coming year, Annaly is poised to perform well in 2022.

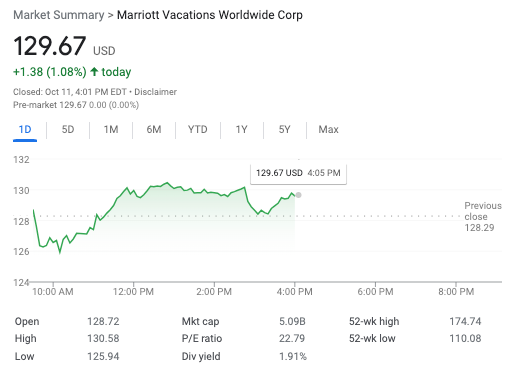

Marriott Vacations Worldwide Corp. (VAC)

Marriott Vacations Worldwide is a timeshare company with a market cap of $5.09 billion. The company owns and operates a network of vacation ownership resorts under the Marriott Vacations Club, Grand Residences by Marriott, and Hyatt Residences brands.

While the COVID-19 pandemic has been a drag on the company’s business, travel should rebound in 2022 as vaccine distribution ramps up.

Coterra Energy Inc.

Coterra Energy Inc. is a U.S.-based oil and gas company involved in the development, exploration, and production of oil, natural gas, and natural gas liquids. With a market cap of $23.23 billion, Coterra is one of the smaller oil and gas companies on this list but the world’s 664th most valuable company by market cap.

However, the company is well-positioned to benefit from the expected recovery in oil prices in 2022.

Occidental Petroleum Corp. (OXY)

Occidental Petroleum is one of the world’s largest oil and gas companies, with a market cap of $60.87 billion.

While Occidental has been weighed down by debt in recent years, the company is in a much better position now.

With oil prices expected to rebound in 2023, Occidental is well-positioned to benefit.

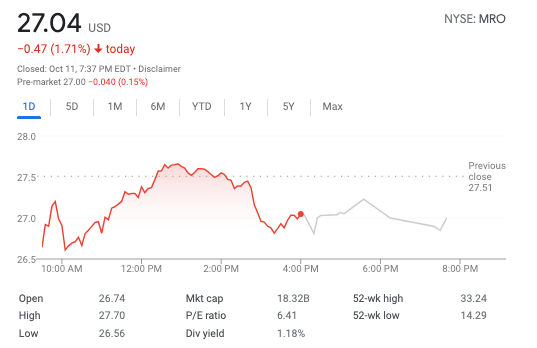

Marathon Oil Corp.

Marathon Oil is another large oil and gas company with a market cap of $18.32 billion. Out of the 11 Wall Street analysts that offered 12-month price predictions for Marathon Oil in the last 3 months, the average forecast is $33.09. The highest prediction was $43.00 and the lowest was $25.00- which would be a 22.37% change from its current price at $27.04/share.

So even with the recent rally in oil prices, Marathon Oil is still trading at a discount to its peers.

The Walt Disney Company (NYSE: DIS)

The Walt Disney Company is a global entertainment powerhouse. With a market cap of $169.73 billion, it is the largest company on this list.

The average 12-month stock price forecast for DIS stock is $146.64, which predicts a rise of 50.93 percent, according to 34 stock analysts. With the release of several highly-anticipated films in 2022, Disney is poised for a strong year.

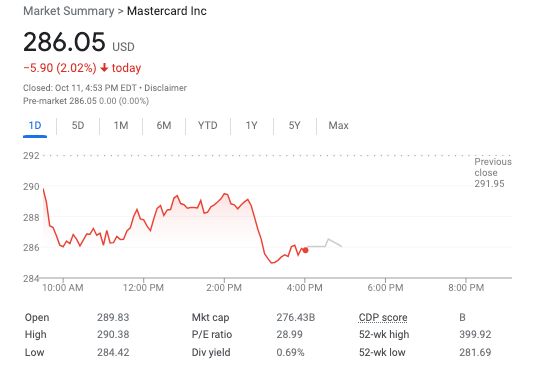

Mastercard Inc. (MA)

Every time you swipe your debit or credit card, there’s a good chance Mastercard is involved. With a market cap of $276.43 billion, it’s one of the biggest credit card companies in the world.

Founded in 1966, Mastercard has a long history of success. The company has a strong bal

ance sheet with plenty of cash and little debt. Its median target for 2022 is to be at $410 per share, meaning there is potential for significant upside.

Costco Wholesale Corporation (NASDAQ: COST)

Costco is the world’s largest membership-only warehouse club. With a market cap of $208.92 billion, it is one of the most valuable retailers in the world.

Costco is expected to continue its strong performance in 2022, with analysts forecasting an average 12-month stock price target of $565.

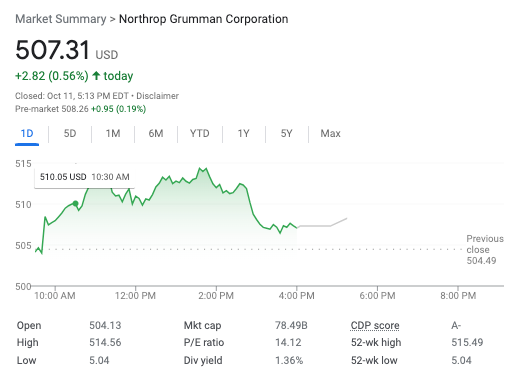

Northrop Grumman Corp. (NOC)

If you’re looking for a defense stock to buy in 2022, Northrop Grumman is a good option. With a market cap of $78.49 billion, it is one of the largest defense contractors in the world.

Northrop Grumman is expected to benefit from increased defense spending in 20

22. Analysts have a median 12-month stock price target of $516 for the company which is a great potential return.

What Criteria Were Used to Select the Best Companies to Invest in for 2022?

Individual investors had a challenge decades ago: obtaining enough data, yet without spending money on pricey membership services. Individual investors now have free real-time data at the press of a button on their smartphones.

There are more analysts and research firms than ever before offering their takes on which companies are the best to buy. While this is great for investors, it can also be overwhelming. So how did we select the best companies to buy for 2022?

Here are some of the key criteria we used:

Determine Your Goals

What is the purpose of your portfolio? Are you looking to invest for short-term or long-term gain? Once you know your goals, you can begin researching companies that will fit into your investment portfolio. Also, don’t forget to consider your risk tolerance.

If you’re investing for the long term, you may be able to stomach more volatile stocks. But if you’re looking to make a quick profit, you’ll want to stick with more stable stocks.

Current and Projected Profitability

A company’s current and projected profitability is important when considering whether or not to invest. You’ll want to look at the company’s financial fundamentals, including earnings, cash flow, and operating margins.

You should also look at earnings stability when considering a company’s profitability. A company that has been profitable for several years is more likely to be profitable in the future than a company that has only recently become profitable.

Be Aware Everytime

It’s important to keep up with financial and stock market news and opinions when selecting companies to invest in. You don’t want to invest in a company that is about to go bankrupt or is being investigated for shady business practices. Keeping your eyes open can help you avoid these types of situations.

Earnings Momentum

When a company is experiencing earnings momentum, it means that its stock price is going up because its earnings are increasing. This is usually a good sign that the company is doing well and is a good candidate for investment.

Favorable Asset Utilization

Favorable asset utilization is another important metric to consider when selecting companies to invest in. This ratio measures how much revenue a company earns for each dollar of assets it owns.

A company with favorable asset utilization is usually a good candidate for investment because it means that the company is efficient and generates a lot of revenue relative to its size. This ratio is different for every industry, so it’s important to compare companies within the same industry when considering this metric.

FAQs

Is it true that rising interest rates will harm the stock market?

Because higher inflation rates lead to increased interest rates, this can in turn lower stocks’ value due to decreased future earnings.

What causes market volatility?

Many factors can lead to market volatility, but the most common include geopolitical & global events, inflation rates, monetary policies, and changes in interest rates.

What bear market is?

A bear market is when the stock market falls 20 percent or more from its previous high. Bear markets are usually caused by a combination of factors, including a decrease in earnings, an increase in interest rates, and uncertainty about the future.

What Is Market Cap?

Market cap is a company’s market value, which is the total value of all its outstanding shares. Market cap is calculated by multiplying a company’s share price by the number of shares outstanding.

What is the Net income ratio?

The net income ratio is a company’s net income divided by its total sales revenues. The net income ratio lets business owners see if their company makes enough money to cover operating and non-operating expenses.

Does stock trading involve a lot of risks?

Stocks trading involve some degree of risk, but there are also a number of strategies that can be used to mitigate that risk. For example, diversification is a popular strategy that involves investing in a variety of different growth stocks to spread out the risk.

How Is the Consumer Price Index Used?

The CPI Index is a highly watched inflation indicator that has a significant influence on policy and financial markets. Cost-of-living adjustments for federal benefit payments are calculated using a related CPI statistic.

Conclusion on Best Stocks to Buy In 2022

There you have it—the 10 best companies to invest in for 2022 ranging from tech companies like Amazon to payment processors like Mastercard, on Nasdaq, Nyse or in Dow Jones Industrial Average. If you’re looking for companies that offer strong competitive advantages, stable or growing cash flows, and are run by management teams with a history of making smart capital-allocation decisions—then these are companies you should consider investing in for next months for your investment strategy.