According to the Federal Reserve, interest rates were raised by 75 basis points in July to prepare for slower rate hikes in the next few quarters.

However, the NYSE remains stuck in a bear market. Various high-quality tech stocks including DigitalOcean (NYSE: DOCN), is now available at historically low price points, making it an attractive investment for retail investors. You can make profitable investments in the stock below for various reasons.

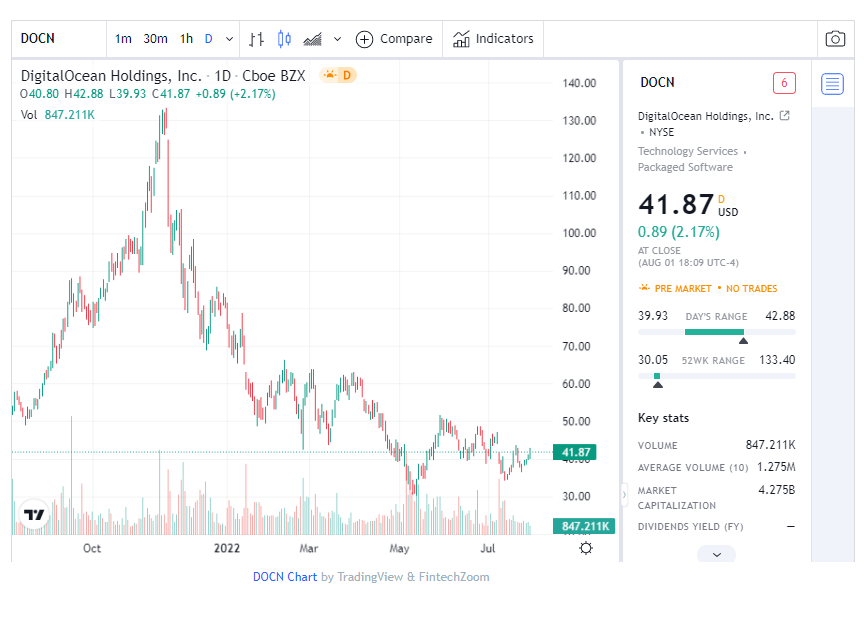

Digital Ocean (NYSE: DOCN)

A 49% decline has been recorded in the stock price of cloud computing services provider DigitalOcean since the beginning of the year. Although the company’s fundamentals are sound, it suffered during the broader tech crash.

Cloud-native infrastructure and platform tools are what DigitalOcean provides for developers, startups, and small businesses (fewer than 500 employees). This area is largely ignored by large cloud providers like Amazon, Microsoft, and Alphabet.

Market opportunities are estimated to reach $145 billion by 2025, a $72 billion market.

Digital Ocean Stock – Why is it an excellent stock?

Small businesses benefit from Digital Ocean’s extensive content library. After CSS-Tricks’ acquisition, Digital Ocean’s content is visited by more than 9 million unique users each month. Developers who may not have heard of Digital Ocean are also brought to the brand’s attention.

Research and development spending by Digital Ocean in the first quarter was less than half of what it spent in the previous quarter. With increased revenue, the company will be able to improve its profitability.

Its easy-to-adopt, reasonably priced, and technologically advanced software and cloud-based solutions are critical in attracting new customers and increasing DigitalOcean’s average revenue per user.

The company’s net dollar retention rate increased from 107% in the first quarter to 117% in the first quarter of this year, demonstrating the success of its land-and-expand strategy. Based on the impact of client churn, paying customers spent 17% more on company solutions in the first quarter of 2022.

Customer switching to competitors becomes even more difficult because of its upselling strategy. As a developer-friendly solution provider and 24/7 customer service provider, DigitalOcean distinguishes itself from its competitors.

Reason to avoid

A simple thing isn’t something Digital Ocean monopolizes. Cloud computing platforms are also available from private cloud providers. Platforms that do away with servers allow applications like Fly, Render, and Railway to run. Serverless platforms such as Netlify and Vercel exist.

Several methods exist for setting up and running an application. A sea of alternatives awaits developers as the company tries to convince them that its platform is the best choice.

Digital Ocean Stocks – Technical analysis

As of the latest trading session, DigitalOcean Holdings, Inc. closed at $38.90, representing a -0.66% move from the previous day. Additionally, DigitalOcean has demonstrated impressive financial performance in recent years.

The company’s revenue increased by 36% compared to the same quarter a year ago. In fiscal 2021, free cash flow became favorable for the company, but it has not yet become profitable.

Digital Ocean is trading at a forward sales multiple of 7.4, the lowest in the last year. The solid business position and improving financials of this investment opportunity can make it an exciting investment opportunity for long-term investors.