The world of technology is booming, and the opportunities for growth in the sector are almost limitless. From software to semiconductors and everything in between, tech is a broad-reaching sector that has something for everyone. Tech stocks have been booming recently, as investors begin to see how much potential this growing sector has. These companies are leading the way in innovation, and that means there are plenty of great stock options for investors looking to get involved. To help you find the best stocks to invest in, we’ve listed our top 5 tech stock recommendations.

Read How to Find the Best Robo Advisor: A Guide to Selecting an Investment Management Service.

FintechZoom Recommend These Tech Stocks

Himax Technologies, Inc. – NASDAQ: HIMX

| Index | – | P/E | 2.32 | EPS (ttm) | 2.96 | Insider Own | 12.30% | Shs Outstand | 174.40M | Perf Week | -2.83% |

| Market Cap | 1.12B | Forward P/E | 13.96 | EPS next Y | 0.49 | Insider Trans | 0.00% | Shs Float | 121.86M | Perf Month | 21.81% |

| Income | 447.60M | PEG | – | EPS next Q | 0.14 | Inst Own | 18.70% | Short Float / Ratio | 8.09% / 6.40 | Perf Quarter | 4.57% |

| Sales | 1.60B | P/S | 0.70 | EPS this Y | 819.10% | Inst Trans | -2.55% | Short Interest | 9.86M | Perf Half Y | -26.76% |

| Book/sh | 9.62 | P/B | 0.71 | EPS next Y | -61.98% | ROA | 27.60% | Target Price | 7.65 | Perf Year | -31.51% |

| Cash/sh | 2.83 | P/C | 2.43 | EPS next 5Y | – | ROE | 52.30% | 52W Range | 4.81 – 16.50 | Perf YTD | -57.04% |

| Dividend | 1.25 | P/FCF | 4.20 | EPS past 5Y | 53.30% | ROI | 40.50% | 52W High | -58.36% | Beta | 1.95 |

| Dividend % | 18.20% | Quick Ratio | 1.40 | Sales past 5Y | 14.00% | Gross Margin | 48.90% | 52W Low | 42.83% | ATR | 0.36 |

| Employees | 2083 | Current Ratio | 1.80 | Sales Q/Q | -14.40% | Oper. Margin | 34.60% | RSI (14) | 60.46 | Volatility | 5.34% 5.25% |

| Optionable | Yes | Debt/Eq | 0.24 | EPS Q/Q | 29.70% | Profit Margin | 28.00% | Rel Volume | 0.57 | Prev Close | 7.09 |

| Shortable | Yes | LT Debt/Eq | 0.05 | Earnings | Nov 10 BMO | Payout | 0.00% | Avg Volume | 1.54M | Price | 6.87 |

| Recom | – | SMA20 | 10.33% | SMA50 | 20.54% | SMA200 | -15.54% | Volume | 875,654 | Change | -3.10% |

Nortech Systems Incorporated – NASDAQ: NSYS

| Index | – | P/E | 4.20 | EPS (ttm) | 3.27 | Insider Own | 0.10% | Shs Outstand | 2.69M | Perf Week | 4.35% |

| Market Cap | 37.34M | Forward P/E | – | EPS next Y | – | Insider Trans | 0.00% | Shs Float | 0.85M | Perf Month | 36.18% |

| Income | 9.40M | PEG | – | EPS next Q | – | Inst Own | 3.90% | Short Float / Ratio | 0.26% / 0.30 | Perf Quarter | -10.55% |

| Sales | 126.10M | P/S | 0.30 | EPS this Y | 535.90% | Inst Trans | 2.91% | Short Interest | 0.00M | Perf Half Y | 14.39% |

| Book/sh | 10.40 | P/B | 1.32 | EPS next Y | – | ROA | – | Target Price | – | Perf Year | 37.68% |

| Cash/sh | 0.48 | P/C | 28.72 | EPS next 5Y | – | ROE | – | 52W Range | 9.31 – 19.56 | Perf YTD | 32.63% |

| Dividend | – | P/FCF | – | EPS past 5Y | 175.70% | ROI | 20.90% | 52W High | -29.82% | Beta | 0.65 |

| Dividend % | – | Quick Ratio | 1.30 | Sales past 5Y | -0.30% | Gross Margin | 15.70% | 52W Low | 47.44% | ATR | 0.51 |

| Employees | 782 | Current Ratio | 2.20 | Sales Q/Q | 19.70% | Oper. Margin | – | RSI (14) | 79.72 | Volatility | 4.41% 3.98% |

| Optionable | No | Debt/Eq | 0.39 | EPS Q/Q | -56.90% | Profit Margin | – | Rel Volume | 0.52 | Prev Close | 13.62 |

| Shortable | Yes | LT Debt/Eq | 0.38 | Earnings | Nov 10 AMC | Payout | 0.00% | Avg Volume | 7.27K | Price | 13.73 |

| Recom | – | SMA20 | 19.60% | SMA50 | 23.95% | SMA200 | 18.34% | Volume | 3,776 | Change | 0.75% |

ASE Technology Holding Co., Ltd. – NYSE: ASX

| Index | – | P/E | 5.61 | EPS (ttm) | 1.13 | Insider Own | – | Shs Outstand | 2.17B | Perf Week | 0.96% |

| Market Cap | 11.94B | Forward P/E | 7.78 | EPS next Y | 0.81 | Insider Trans | – | Shs Float | 1.64B | Perf Month | 29.65% |

| Income | 2.46B | PEG | 0.16 | EPS next Q | 0.21 | Inst Own | 6.70% | Short Float / Ratio | 0.53% / 0.94 | Perf Quarter | 8.19% |

| Sales | 21.25B | P/S | 0.56 | EPS this Y | 127.50% | Inst Trans | 1.54% | Short Interest | 8.69M | Perf Half Y | -4.37% |

| Book/sh | 4.25 | P/B | 1.49 | EPS next Y | -10.44% | ROA | 11.00% | Target Price | 6.22 | Perf Year | -17.66% |

| Cash/sh | 0.93 | P/C | 6.79 | EPS next 5Y | 34.20% | ROE | 29.20% | 52W Range | 4.45 – 8.15 | Perf YTD | -18.82% |

| Dividend | 0.47 | P/FCF | 4.00 | EPS past 5Y | 59.85% | ROI | 13.70% | 52W High | -22.21% | Beta | 1.15 |

| Dividend % | 7.37% | Quick Ratio | 0.80 | Sales past 5Y | – | Gross Margin | 20.10% | 52W Low | 42.47% | ATR | 0.22 |

| Employees | 99104 | Current Ratio | 1.20 | Sales Q/Q | 25.20% | Oper. Margin | 14.60% | RSI (14) | 68.22 | Volatility | 2.56% 3.48% |

| Optionable | Yes | Debt/Eq | 0.74 | EPS Q/Q | 23.10% | Profit Margin | 11.60% | Rel Volume | 0.94 | Prev Close | 6.30 |

| Shortable | Yes | LT Debt/Eq | 0.46 | Earnings | Oct 27 BMO | Payout | – | Avg Volume | 9.27M | Price | 6.34 |

| Recom | 2.30 | SMA20 | 14.47% | SMA50 | 18.68% | SMA200 | 1.87% | Volume | 8,707,060 | Change | 0.63% |

Kulicke and Soffa Industries, Inc. – NASDAQ: KLIC

Kulicke and Soffa Industries, Inc. (NASDAQ: KLIC) (“Kulicke & Soffa”, “K&S” or the “Company”), announced on November 16 financial results of its fourth fiscal quarter ended October 1, 2022. The Company reported fourth quarter net revenue of $286.3 million, net income of $64.9 million and non-GAAP net income of $70.2 million.

| Quarterly Results – U.S. GAAP | |||

| Fiscal Q4 2022 | Change vs.Fiscal Q4 2021 | Change vs.Fiscal Q3 2022 | |

| Net Revenue | $286.3 million | down 41% | down 23.1% |

| Gross Profit | $132.7 million | down 42.6% | down 30.4% |

| Gross Margin | 46.3 % | down 140 bps | down 490 bps |

| Income from Operations | $67.5 million | down 56.4% | down 44.7% |

| Operating Margin | 23.6 % | down 830 bps | down 920 bps |

| Net Income | $64.9 million | down 51.5% | down 45.5% |

| Net Margin | 22.7 % | down 490 bps | down 930 bps |

| EPS – Diluted | $1.10 | down 47.6% | down 44.7% |

Quarterly Results – Non-GAAP | |||

| Fiscal Q4 2022 | Change vs.Fiscal Q4 2021 | Change vs.Fiscal Q3 2022 | |

| Income from Operations | $73.6 million | down 54.1% | down 42.9% |

| Operating Margin | 25.7 % | down 730 bps | down 900 bps |

| Net Income | $70.2 million | down 49.2% | down 43.9% |

| Net Margin | 24.5 % | down 400 bps | down 910 bps |

| EPS – Diluted | $1.19 | down 45.2% | down 43.1% |

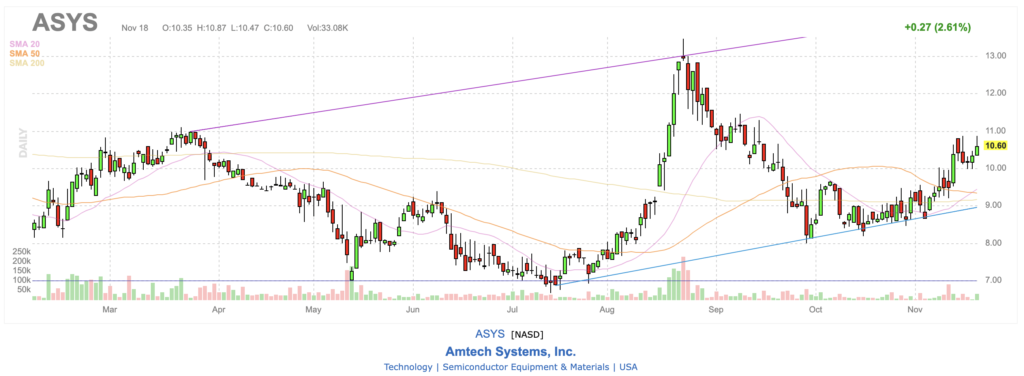

Amtech Systems, Inc. – NASDAQ: ASYS

ASYS is a NASDAQ – listed global provider of industrial automation and controls products and services. ASYS designs and manufactures a range of products and services that automate manufacturing processes, improve production consistency, and save time and money. The company has four divisions: Industrial Automation, Software & Systems, Energy & Transportation and Mining. ASYS operates facilities in Canada, the United States, Mexico, China, Europe, India and Brazil. As of August 2018, the company had over 7,000 employees. In 2018, it was ranked the #1 Automation System Design Provider in North America by Frost & Sullivan.

ASYS was founded in 1971 by Donald D. Taylor as a small business that manufactured control panels for use in large factories. Taylor’s son founded a second division focused on software and systems integration. In 1974 the company launched its first product: a panel control system for small machines that could be operated from a remote location using an operator panel located at the machine site. The product was successful enough to warrant the creation of two additional divisions: industrial automation (for larger machines) and energy & transportation (for medium-sized vehicles).

In 1975 the company introduced its first industrial automation product – an encoder for conveyor belts that could guide trucks to pick up products without needing to manually count every step along the way. By 1976 the company had moved into building its own lines of

The Most Usual Tech Stocks to Buy

Microsoft Corp.

When it comes to tech stocks, Microsoft is one of the heavyweights. It’s the world’s largest software company, with a market value of $889 billion. Microsoft is primarily a software company, focused on products and services related to cloud computing, business applications, and great content. The company also has a large presence in gaming, with Xbox. Microsoft has a solid position in the tech sector, and a great reputation for innovation. It’s been a leader in the technology sector for years, and continues to grow and expand. The company is growing in new sectors like healthcare, artificial intelligence, and quantum computing. In terms of potential, Microsoft has a lot of room left to grow. It’s still dominating in many sectors, and hasn’t yet tapped into the full potential of new technologies like AI and quantum computing.

Intel Corporation

Intel is one of the world’s largest semiconductor manufacturers, and heavily invests in new technologies and innovative ideas. Intel is a leader in semiconductors, and produces CPUs, graphic processing units, and other computer hardware. The company also has a large presence in IoT, AI, and quantum computing. Intel is one of the best tech stocks, with a market cap of $205 billion. It’s a company that’s poised to benefit as more and more people turn to the cloud for data storage and information. As the shift to cloud computing grows, so does Intel’s potential for profits. It’s also been investing in AI and quantum computing, two cutting-edge technologies that have a lot of room for growth. Intel is one of the cleanest, most stable tech stocks out there. It’s been a leader in semiconductors for years, and its products are used in almost every type of computer.

Cisco Systems

Cisco Systems is a networking and communications technology company. It’s one of the world’s leading providers of networking hardware, with offerings in routers, switches, security, and network management. It also offers cloud-based software and services related to networking. Cisco is a solid tech stock, with a market cap of $220 billion. It’s one of the few tech companies that’s actually an increase in the sector. Businesses are increasingly relying on the internet for communications, and Cisco is right there to meet that demand. The company is also working to expand into IoT and AI, showing that it’s a forward-thinking tech company. Cisco has a great reputation for innovation, and is one of the best tech stocks out there. It’s been growing steadily in recent years, and has a clean track record for sound financial management.

Amazon.com Inc.

Amazon is an e-commerce and technology company, focused primarily on retail. It offers everything from groceries and essentials, to apparel and home appliances. Amazon also has a strong presence in the gaming and entertainment industries. Amazon is one of the biggest tech stocks out there, with a market cap of $833 billion. It’s one of the few companies that has a hand in every sector of the tech industry, giving it potential for long-term growth. Amazon is one of the biggest retailers in the world, and continues to grow. It’s also making a big push into home automation, with a line of smart home products that integrate with Alexa. Amazon has a reputation for innovation and growth, making it one of the best tech stocks. It’s a massively diverse company that’s still growing and expanding into new industries.

Alphabet Inc. (formerly Google)

Formerly known as Google, Alphabet is a giant in the tech world. It’s one of the biggest companies in the world, with a market cap of $806 billion. Technically a subsidiary of Google, Alphabet is a forward-thinking company that offers a wide variety of products and services. These include search, artificial intelligence, mapping, cloud computing, and more. Alphabet is a great tech stock, with a wide variety of potential in the future. It’s one of the biggest tech companies, and has a reputation for innovation. Google has been a leader in many areas of technology for years, and Alphabet continues that trend. It’s a forward-thinking company that’s poised to lead in many areas of tech in the future.

Meta

Facebook is a social media and technology corporation. It’s one of the biggest social media sites in the world, with over 2.3 billion users. The company also offers other technology-based services, such as virtual reality, online gaming, and online video. Facebook is a great tech stock, with a market cap of $515 billion. It’s one of the most recognizable tech companies in the world, and continues to grow and expand. The company has been branching out into new industries as of late, making it a diverse and exciting company. Facebook has a strong reputation for innovation and growth, making it one of the best tech stocks. It’s a leading tech company in many areas, and has a lot of potential for continued growth.

Conclusion

Tech stocks are a great way to diversify a portfolio and get exposure to some of the fastest-growing industries. The tech industry is constantly growing and changing, so these companies always have something new coming out. Tech stocks are often riskier than other sectors, but have the potential for huge gains. They’re a great place to start if you’re looking to expand your portfolio.