The healthcare sector is one of the most important and fastest-growing industries in the world. If you’re looking to invest your money and see huge profits, you should consider investing in healthcare stocks. In this blog post, we will discuss some of the best healthcare stocks on the market today. We’ll also provide tips on how to choose the right stock for your portfolio. So if you’re ready to start making some serious money, keep reading!

Why Healthcare Industry is very important nowadays?

The healthcare industry is one of the most essential and important industries today. This is due, in part, to the fact that advances in medical technology have greatly improved our ability to treat and prevent diseases and disorders. However, there are also a number of social factors at play.

With an increasingly aging population, the demand for healthcare services continues to grow each year. Furthermore, as more individuals gain access to quality healthcare through government programs like Medicaid and Medicare, there has been a shift away from traditional fee-for-service healing models towards a more comprehensive approach of integrating mental health with primary care.

Given these trends and developments, it is clear that the healthcare industry will continue to be vital and important for years to come.

How to Choose the Best Healthcare Stock?

To choose the best stocks for your investment watchlists, it is important to do your research and carefully assess each company’s track record, growth potential, and products or services.

You should also consider the overall market conditions, as well as your own risk tolerance and investment goals. With a little time and effort, you can find the right healthcare stock to help you achieve financial success. So why wait? Start exploring today!

What are the Best Healthcare Stocks Right Now?

There is no easy answer to the question of which healthcare stocks are the best right now, as it can depend on a number of different factors. On the one hand, certain stocks may offer higher returns than others, while some might offer more stability or better prospects for long-term growth.

Additionally, some companies may be focused on specific areas of healthcare, while others may offer products or services that are more geared towards addressing overall health and wellness. Ultimately, the best approach is to do your research and identify those companies that seem to best match your investment priorities and goals. Whether you’re looking for fast growth or stable performance, there are plenty of great options in the healthcare sector today.

So take your time, do your due diligence, and find the stocks that best suit your individual needs and risk tolerance. With solid research and smart investing strategies, you’re sure to succeed in this exciting field.

Is Johnson & Johnson a good stock to buy?

One of the top healthcare stocks to consider is Johnson & Johnson. J&J has been around for many years, and it is renowned for its commitment to innovation and high-quality products. This company offers a wide range of medical devices, pharmaceuticals, consumer products, and more.

With a strong track record of growth and profitability, J&J is a great choice for investors looking to make big gains in the healthcare sector.

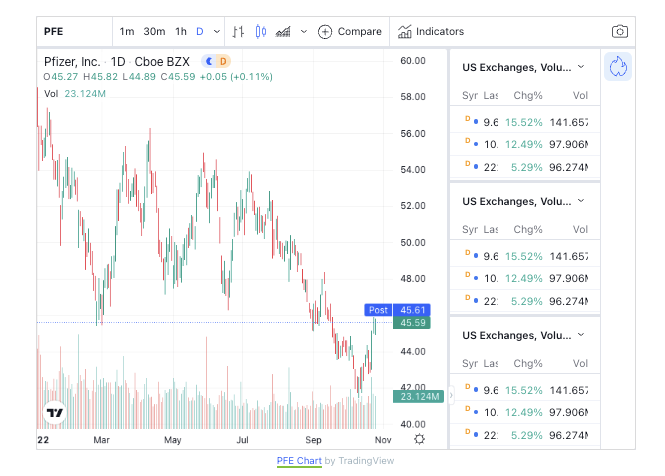

Is it a good idea to invest in Pfizer stock?

Another top healthcare stock to consider is Pfizer. Like J&J, Pfizer has been around for many years and has a stellar track record of success and performance. This company produces pharmaceuticals for both humans and animals, as well as consumer products like vitamins and supplements.

With a wide range of offerings, Pfizer is a great choice for investors looking to diversify their portfolios with high-quality healthcare stocks.

Is Vanguard Healthcare fund a good investment?

Vanguard Healthcare Fund is a popular investment choice for many investors due to its strong track record of providing high returns. This fund typically invests in shares of medical and pharmaceutical companies, so it is an ideal choice for those who are bullish on the healthcare industry.

Additionally, Vanguard offers extensive guidance to help investors make the most of their investments, making this fund a good choice for beginners as well as experienced investors.

Overall, it seems clear that Vanguard Healthcare Fund is an attractive option for those looking to invest in one of today’s most dynamic and rapidly growing industries. Whether you’re looking to hold your current investments or diversify your portfolio, Vanguard Healthcare Fund is sure to be a smart choice.

Is T Rowe Price health Sciences A Good Investment?

When it comes to choosing a company for your investments, there are many factors to consider. One key consideration is the investment’s risk profile: how likely you are to lose money on your investment, and how much you could stand to gain if it succeeds.

In this regard, T Rowe Price Health Sciences is a good choice, as it has a relatively low risk profile compared to many other investments. This is due in part to its focus on well-established companies in the health and biotech industries. Additionally, its track record speaks for itself: it consistently outperforms industry benchmarks year after year, providing great returns for investors who choose to put their money into this company.

Overall, T Rowe Price Health Sciences offers an attractive option for those looking for a reliable investment with the potential for growth.

Is Fidelity Select Health Care A Good Investment?

When considering any investment opportunity, it is important to assess a variety of factors in order to determine whether or not that particular investment is right for you. One important consideration to keep in mind when evaluating the Fidelity Select Health Care fund is its historical performance.

This fund can be a good option if you are looking for an investment with the potential for strong returns over time, as it has historically outperformed industry benchmarks across all timeframes. Additionally, this fund boasts a smooth ride, with low levels of volatility as compared with other healthcare sector funds. However, it should be noted that Fidelity Select Health Care does carry higher than average fees; therefore, it may not be the best choice if you are looking for a lower cost option.

Ultimately, when deciding whether or not this fund is a good investment opportunity, it is important to weigh both its strengths and its weaknesses against your own needs and goals.

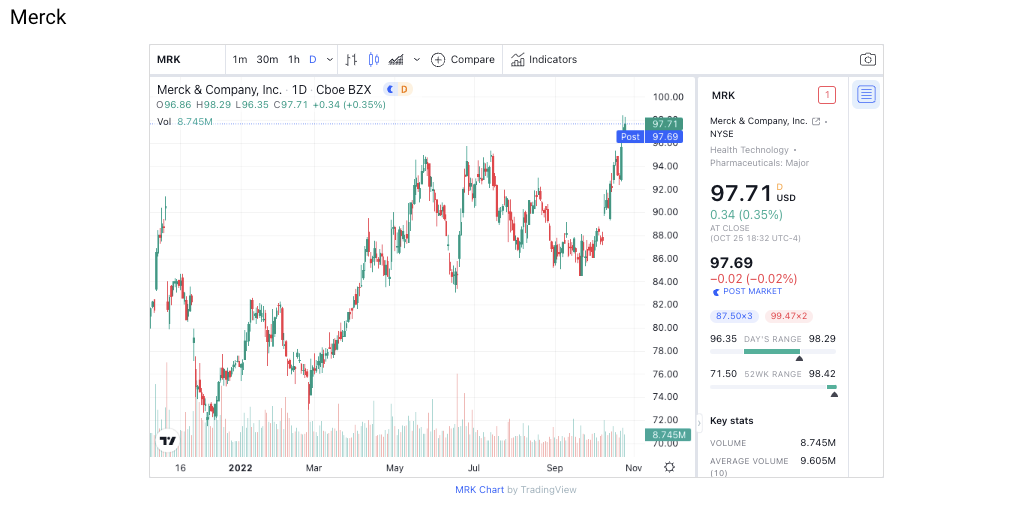

Is Merck Stock a good buy?

Merck stock has seen significant ups and downs in recent years, with the ebola epidemic devastating its sales and earnings. However, despite these setbacks, I believe that Merck is still a good investment. With a strong focus on research and development, Merck’s pipeline is stocked with potential blockbuster drugs that could drive future growth.

In addition, Merck’s long history of success in the pharmaceutical industry gives it a solid foundation that should continue to make it an attractive investment moving forward. Overall, while there may be risks associated with purchasing Merck stock at this time, I believe that its long-term prospects make it one of the best investments in the healthcare sector today.

Is Gilead a good company to invest in?

While Gilead may seem like an odd choice for investors at first glance, there are many reasons why it could be a promising company to put your money into. For one, Gilead is a leader in developing antiviral medications, and with the rising threat of global pandemics such as ebola, this market is set to grow rapidly in the coming years.

Additionally, Gilead’s strong pipeline of innovative drugs means that it is constantly working on new treatments that have the potential to benefit millions of people around the world. Finally, Gilead has shown impressive financial performance over the past few years, with consistent growth in both revenue and earnings.

Overall, while there are risks associated with investing in any company, Gilead shows great promise as a promising long-term investment.

Conclusion

Whether you are a seasoned investor or just starting out, investing in the best healthcare stocks is one of the smartest ways to maximize your profits. These companies offer a range of innovative treatments and services that people around the world need and use on a regular basis.

By investing in these companies, you can rest assured that your money will be safe and your return on investment will be high. When looking for potential investments, it is important to choose companies with strong track records and solid financials. With all of the incredible healthcare options available today, there has never been a better time to invest in these stocks. So if you want to see huge profits, then it’s definitely time to invest in healthcare stocks!