If you’re looking for stocks with long-term growth potential, lithium stocks are a smart choice. Lithium is a key ingredient in many of the latest and most advanced technologies, and its demand is only going to increase in the coming years. With companies like Tesla Motors investing billions in lithium-ion batteries, the market for this metal is set to explode. So if you’re looking to invest in a company that’s well positioned for future growth, stocks lithium should be at the top of your list.

Lithium – a key component in the modern world’s growing obsession with electronic devices such as smartphones, laptops, and tablets – have been dwindling rapidly over the past few years. This is largely due to increased global demand for lithium, which has made some popular mining sites quickly disappear. However, experts predict that lithium reserves will continue to be discovered and mined in the near future, helping to keep up with increasing global demand.

This makes lithium shares an appealing investment opportunity for those seeking long-term growth potential in a rapidly changing market. Whether you are looking to add to your investment portfolio or start one from scratch, investments in lithium stocks are a smart choice. With their potential for both exponential growth and strong financial performance, they represent an attractive option for anyone looking to make a profitable investment.

Investment in battery tech ETF

The battery tech etf is a great way to invest in the future of battery technology. This fund invests in companies that are developing and manufacturing batteries, as well as companies that are using battery technology in innovative ways. With the world moving towards a more sustainable future, battery technology is becoming more and more important. This fund is a great way to support the development of this crucial technology while also earning a profit.

What are the top lithium stocks to buy?

There are many lithium stocks to choose from, but when it comes to investing in this exciting industry, it is important to do your research first. At the top of the list, you will find companies like Tesla, which has built its own huge battery factory and plans on leading the transition towards electric vehicles. Another high-quality stock to consider is Galaxy Resources, a company with a proven track record of successfully mining lithium. Additionally, some investors may want to look beyond lithium mining and explore battery manufacturing companies like Panasonic, which plays an important role in powering Tesla’s electric vehicles. Ultimately, when choosing the best lithium shares for your portfolio, it is important to pay attention to both company fundamentals and market trends in order to make an informed investment decision.

The top lithium stocks as of April 2023 include Ganfeng Lithium Group, Sociedad Química y Minera de Chile, Li-Cycle Holdings Corp., Livent Corp., and Albemarle Corp. [1] Another list mentions Albemarle Corp., Livent Corp., Lithium Americas Corp., and Allkem Ltd. as the best lithium stocks to buy in 2023. [2] Additionally, there are two Lithium ETFs worth considering, the Amplify Lithium & Battery Technology ETF and the Global X Lithium & Battery Tech ETF. [3] It’s important to do your own research and seek professional advice before investing in any stocks or ETFs.

References: [1] 8 Best Lithium Stocks Of 2023 – Investing [2] 7 Best Lithium Stocks to Buy in 2023 | Investing [3] What Is the Best Lithium Stock to Buy Now? Our 7 Top Picks.

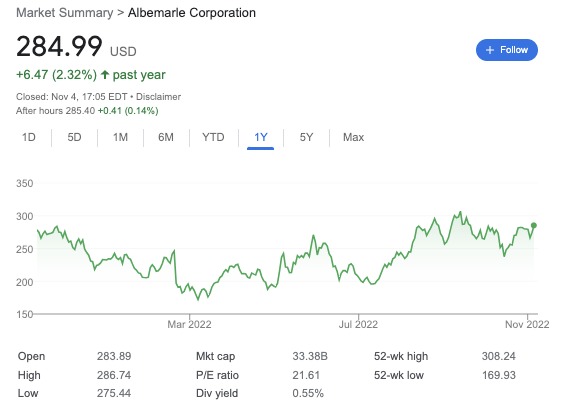

Albemarle (NYSE:ALB)

When it comes to considering the best lithium shares for investment, Albemarle is surely near the top of the list. With its extensive portfolio of lithium projects spanning multiple countries, Albemarle is well positioned to capitalize on increasing demand for this important mineral. What’s more, thanks to rising demand from consumers and businesses alike, as well as soaring prices for lithium-ion batteries, Albemarle is poised for continued growth in the years ahead. Whether you’re looking to invest directly in lithium or simply to benefit from growing interest in the space overall, Albemarle is a smart choice that should help increase your bottom line. So if you’re looking for a safe and profitable way to get in on one of today’s hottest trends, look no further than Albemarle.

Sigma Lithium (NASDAQ:SGML)

As one of the leading companies in the lithium mining industry, Sigma Lithium offers investors a wide range of high-quality stocks to choose from. With extensive experience and expertise in every aspect of the mining process, from exploration to extraction and commercialization, this company is known for delivering top-notch results that consistently exceed expectations. Whether you’re looking for short-term or long-term investments, Sigma Lithium has the ideal stock for you. Whether you’re seeking returns that are consistently high or looking for something with potentially huge growth potential, this is one company that should be at the top of your list when it comes to investing in lithium shares. So why not put your money to work with the best lithium shares on the market today? Invest in Sigma Lithium and watch your portfolio soar!

SQM (NYSE:SQM)

Sociedad Química y Minera de Chile, or SQM, is one of the leading lithium producers in the world. With extensive mineral deposits located throughout South America and ongoing efforts to expand its product offerings, SQM has consistently been at the forefront of developments in the lithium industry.

SQM’s long history in the mining and extraction business gives it a solid understanding of what it takes to be successful in this highly competitive market. The company is committed not only to maintaining high standards for safety and environmental ethics, but also to conducting research that will help further develop the industry going forward. Additionally, by continuously focusing on innovation and efficiency, SQM manages to stay ahead of the curve when it comes to today’s shifting consumer demands.

All of these factors make SQM one of the best lithium shares for investors looking to gain exposure to this quickly-expanding market. Whether you’re interested in gaining exposure through an index fund or building a portfolio of individual lithium shres , there’s no doubt that Sociedad Química y Minera de Chile belongs at the top of your list. So why wait? Start researching this top performer today and see how you can take advantage both now and into the future!

Nevada Sunrise Gold (TSXV:NEV)

Nevada Sunrise Gold is one of the top lithium shares to watch in the current investment climate. As one of the world’s leading producers of lithium, a highly sought-after commodity for its many uses in consumer electronics and green technologies, Nevada Sunrise Gold has an excellent track record of success.

With multiple cost-effective lithium extraction methods at their disposal, as well as a proven ability to identify promising sources of lithium both on and off-planet, Nevada Sunrise offers investors an exciting portfolio of opportunities for success. Whether you’re looking for long-term growth or fast returns, Nevada Sunrise is a top contender among the best lithium shares currently on the market. So don’t wait – act now and start investing in this dynamic company today!

Core Lithium (ASX:CXO)

Core lithium is widely considered to be one of the best stocks to invest in right now. With global demand for lithium surging due to its use in electric vehicles and other high-tech applications, companies that specialize in this critical mineral are seizing opportunities for growth.

Core lithium has a strong track record of success, having successfully navigated fluctuations in the market with an innovative business model and strategic partnerships with major players in the industry. Its resources are increasingly being recognized as some of the most valuable in the world, and it is well positioned for long-term growth and profitability. If you’re looking to invest in lithium, Core is definitely one stock you won’t want to miss out on.

FAQs

Lithium is a precious metal with a wide range of industrial, medical, and environmental applications. Due to its exceptional reactivity, lithium can be used in batteries to store large amounts of energy, making it an essential component in everything from smartphones to electric cars. It’s also used in lithium-ion batteries – one of the most common types of battery on the market today.

This unique material is thus crucial for our modern economy and plays an invaluable role in helping to power our daily lives. In addition to its technological uses, lithium also has important medicinal properties.

It has been shown that lithium can be effective in treating bipolar disorder and may even have preventative effects against dementia and other conditions that affect cognition. So the next time you see the word “lithium” on your smartphone or your favorite piece of hardware, remember that this unique metal is essential not only for cutting-edge technology but also for keeping us all healthy and well.

At the top of the list of lithium-producing countries is Chile. With over 16,000 tons produced annually, Chile leads the way in global lithium production, and this impressive output is partially due to its large lithium reserves. A close second on the list is Australia, which produces just over 14,000 tons per year thanks to rich deposits of lithium brine located in South Australia’s vast desert spaces.

Other major lithium-producing countries include Argentina, with nearly 6,000 tons produced each year; China, with over 2,500 tons produced annually; and Portugal, which produces around 1,240 tons of lithium per year. Overall, these five countries account for over 80% of global lithium production each year – a testament to the importance and prominence of this critical mineral in today’s world.

There has been a lot of speculation in recent months about the potential for lithium stocks, with many investors wondering whether it is already too late to buy these lucrative assets. At first glance, it may seem that this is indeed the case, given that prices of lithium stocks have been going up at an impressive rate over the past year.

However, there are several factors that suggest that prices could continue to rise in the coming months and years. For one thing, lithium remains a steadily increasing commodity due to its use in renewable energy, electric vehicles, and numerous other high-tech projects all around the world.

Furthermore, despite recent increases in production capacity from major producers like China and Australia, demand for lithium continues to climb. As such, it may be premature to write off lithium stocks as a potential investment opportunity just yet. Instead, if you have the financial means and appetite for risk, now might be an ideal time to invest in these assets and watch your profits soar.