The stock market is a fickle thing. One day, stocks are up and the next they are down. This can be especially true during times of economic uncertainty, such as we are currently experiencing. If you are looking for Recession-Proof Stocks to invest in, then you have come to the right place! In this blog post, we will discuss 5 stocks that have proven themselves to be resilient during tough times. So don’t wait any longer – read on to learn more!

What are the Recession-Proof Stocks?

While no investment is totally secure, some stocks are known to be relatively recession-proof. These include companies that provide basic necessities to consumers, such as food, clothing, and utilities. Others are very resilient due to the fact that their business model simply cannot be disrupted by changes in the economic environment.

For example, companies that sell online media or other digital services will remain in high demand regardless of fluctuations in the stock market or wider economy. Additionally, industries that require large upfront costs for their products may also thrive during times of recession, since consumers have a greater need for these costlier items. Overall, identifying recession-proof stocks can help investors weather economic downturns with minimal losses.

During a recession, it is better to build a portfolio of stocks that historically perform better, such as those in the consumer staples, healthcare, and utilities sectors. These industries are less affected by rising inflation and tend to remain stable while other assets like stocks can tumble due to people stopping spending and companies pulling back on investing. Large cap stocks also tend to perform well during recessions, especially companies that make necessary products for consumers. It is important to consider earning consistency, foundation, and solid earnings of companies with reasonable prices. Selective exposure to technology stocks is still recommended, but not to the degree of 2020. Overall, a diversified portfolio is key for investing during any economic situation. [1]

References: [1] Looking for Recession-Proof Stocks? Find the Outperformers [2] What assets are recession-proof? [3] What To Invest In During A Recession

So, What are the Best 5 Stocks to Invest in Recession?

So if you’re looking for Recession-Proof Stocks to invest in, be sure to keep an eye on these companies: Apple, Amazon, Alibaba, Microsoft, and Tesla. With their strong track records and proven resilience during tough economic times, these stocks are definitely worth considering for any savvy investor looking to make the most of their portfolio.

However, our selection is different. We are in a Recession related to Energy Crisis. So what are you waiting for? Start researching these Recession-Proof Stocks today, and get ready to ride out the storm!

Constellation Energy (CEG)

Constellation Energy is one of the most well-known and trusted companies in the energy sector. Over many years, it has proven itself to be a reliable source of power for homes and businesses across the United States. And despite volatile economic conditions, this company continues to thrive and grow.

One reason for its resilience is that Constellation Energy is a truly recession-proof stock. As an essential service with predictable demand, it is relatively immune to fluctuations in the broader economy. Whether consumers are booming or struggling, they will always need power and are likely to continue to turn to CEG for their energy needs.

Another reason for CEG’s continued success is its focus on innovation. With new technologies, such as renewable energy sources like wind and solar, becoming increasingly important, CEG has made strategic investments into these areas. This focus on innovation helps ensure that the company remains adaptable and able to meet changing market demands over time.

Overall, due to its solid financials, diversified revenue streams, and commitment to innovation, Constellation Energy is a stock you can rely on through any economic climate. Whether your interest lies in stability or growth potential, this company is definitely one worth considering.

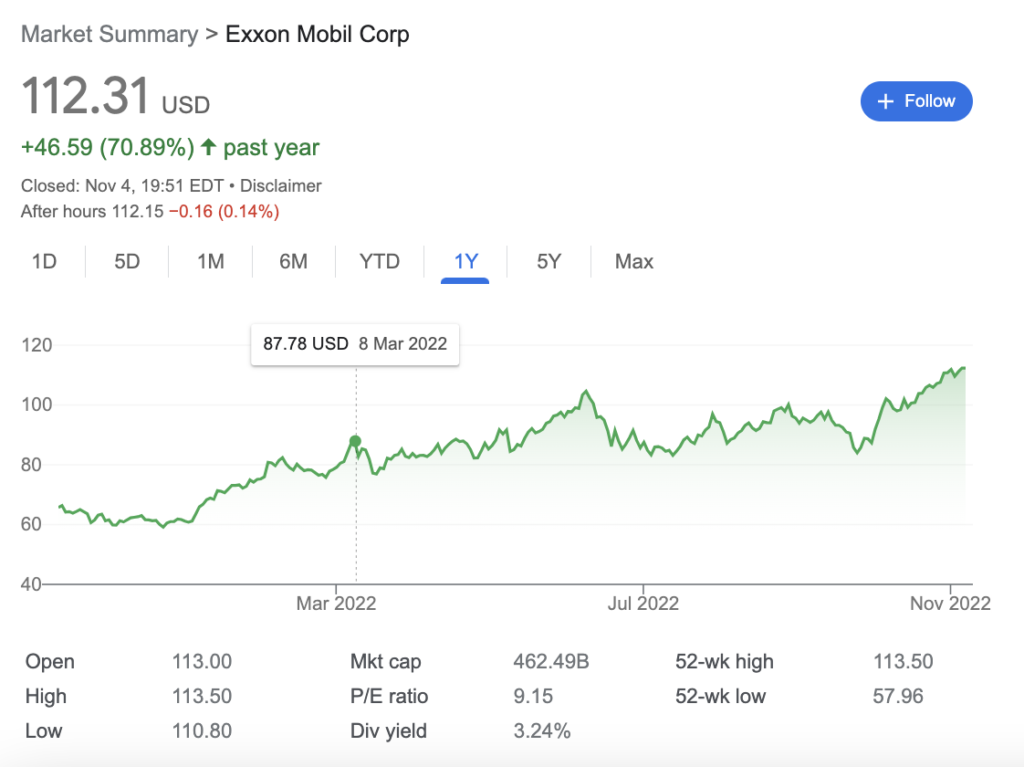

ExxonMobil (XOM)

ExxonMobil, one of the world’s largest energy companies, is renowned for its strong financial performance and impressive track record. Despite the ever-changing economic landscape, XOM has continued to remain resilient in the face of slowdowns and downturns. This resilience can be attributed in part to XOM’s status as a so-called “recession-proof stock”. Unlike many other companies that rely heavily on consistent consumer spending levels or cyclical demand for their products, XOM has established itself as an indispensable resource for industries such as transportation and manufacturing. In fact, during times of uncertainty or when customers cut back on spending, these industries tend to ramp up their use of XOM’s products due to the steady and dependable nature of its output. Given this business model, it is clear that ExxonMobil will remain a pillar of the global economy regardless of fluctuations in market conditions. In short, XOM is able to weather even the harshest economic headwinds with grace and ease – truly making it a “recession-proof” stock.

Marathon Petroleum (MPC)

Marathon Petroleum Corporation, commonly known as MPC, is a leading energy company that specializes in refining and distributing petroleum products. With a global network spanning over 20 countries, MPC is well-positioned to weather any economic downturn. Even in times of market volatility or recession, MPC continues to generate strong revenues and profits. This resilience is due largely to the fact that MPC operates in the highly competitive oil production sector, which requires companies to minimize costs while optimizing operational efficiency.

Additionally, as a player in an essential field, MPC benefits from strong demand for its products even during times of economic stress when consumers may be more selective about how they spend their money. Overall, Marathon Petroleum Corporation is a testament to the fact that good companies can thrive even in tough economic times. Whether you’re investing for short-term returns or looking for solid long-term growth opportunities, MPC is definitely a stock worth considering.

Devon Energy (DVN)

Devon Energy (DVN) is a leading oil and gas company that is well-known for its impressive stability and resilience in the face of economic downturns. This is largely due to the intrinsic qualities of the oil and gas industry itself, which are less impacted by shifts in economic conditions than other sectors. For example, demand for fossil fuels tends to remain relatively stable regardless of external factors, making this an attractive option for investors looking to protect their portfolios against recession.

Additionally, Devon Energy boasts a strong track record of performance that gives investors confidence in the company’s ability to weather turbulent times in the markets. Overall, Devon Energy represents one of the top choices for recession-proof investments today.

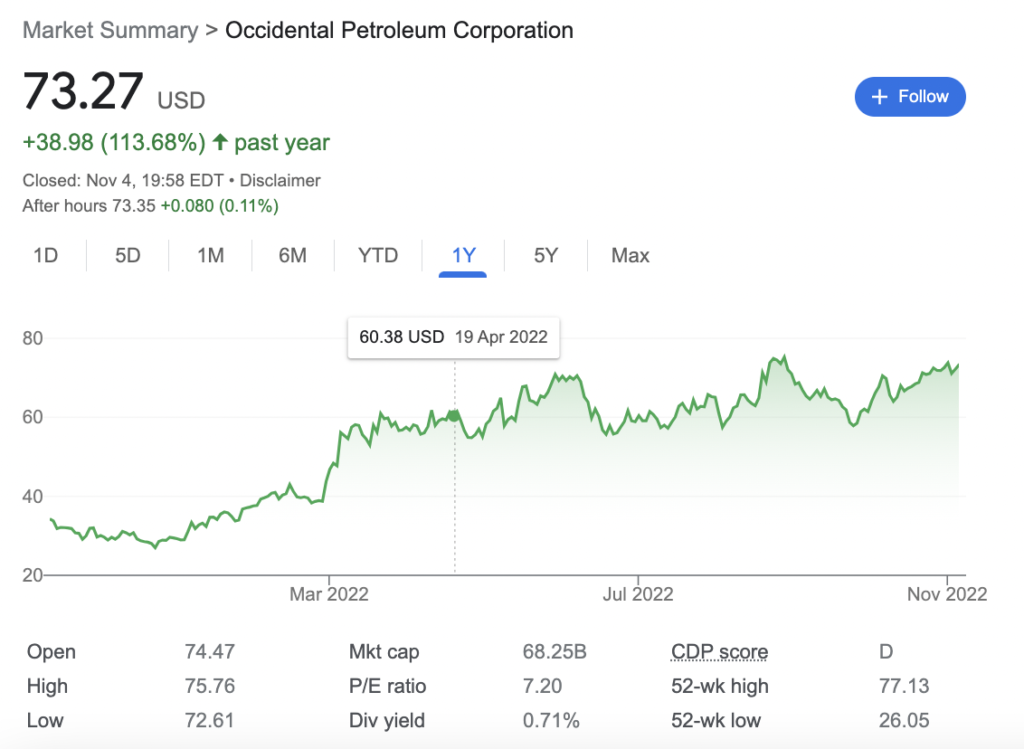

Occidental Petroleum (OXY)

Occidental Petroleum (OXY) is one of the most recession-proof stocks in the energy industry. This company’s revenue comes largely from high-margin oil and gas production, which continues to be in high demand even during economic downturns. In addition, OXY takes a highly efficient approach to operations, minimizing costs and boosting profit margins, and has consistently outperformed its peers over the past several years. Overall, this stock is an excellent investment for anyone looking to weather periods of economic uncertainty.

Whether you’re looking for long-term growth or short-term returns, OXY is a great choice for investors of all stripes. With tried-and-true strategies and strong foundations to build on, it’s no wonder that this stock remains a favorite among traders today. So if you’re ready to boost your portfolio in times of market volatility, look no further than Occidental Petroleum. You won’t regret it!

Conclusion

In today’s economic climate, it is more important than ever to invest in stocks that are resistant to downturns. As the article “Looking for Recession-Proof Stocks? Here Are 5 to Watch” points out, there are a number of factors to consider when evaluating potential investments. These include the company’s financial performance, its market position and its strong fundamentals. Ultimately, while no stock can be truly recession-proof, these five companies represent some of the most promising investment opportunities in today’s market. Whether you’re looking for long-term growth or an immediate income stream, they are well worth considering.

FAQs

While no one can accurately predict when or how severe a recession might be, careful investors should be prepared for the possibility. In times of financial instability, certain types of stocks can perform well in spite of market conditions. These include companies that offer essential goods and services, such as utilities and consumer staples.

Additionally, stocks of firms that provide products or services that people tend to reduce in a recession may also do well. For example, stocks of discount retailers often see an increase in value during tough economic periods, while stocks of luxury goods companies tend to fall. Overall, understanding what sorts of businesses weather recessions best is an important factor for anyone looking to make sound investment decisions.

There is no stock that can be considered absolutely recession proof, as stocks are inherently vulnerable to market fluctuations. However, there are some stocks that may be less impacted by falling markets than others.

For example, dividend stocks like utilities and real estate investment trusts tend to perform better than other sectors in economic downturns, as investors gravitate towards more stable, income-producing assets. Other stocks that have historically performed well during economic downturns include those in the technology and healthcare industries, both of which offer valuable products or services that many consumers continue to need even in tough times.

So while it is impossible to say with certainty which stocks will weather a recession better than others, certain sectors may prove more resilient during these challenging periods.

The recent economic recession posed a major threat to many industries, particularly those that are heavily dependent on consumer spending. While some sectors, such as retail and manufacturing, were hit particularly hard during the downturn, other industries managed to weather the storm by identifying ways to remain profitable even in times of economic uncertainty. For example, certain sectors in the tech industry have seen steady growth in recent years, largely due to their ability to adapt and provide valuable services that consumers need regardless of the state of the economy.

Additionally, industries such as healthcare continue to thrive due to population growth and increasing demands for care. Ultimately, while no business can completely insulate itself from fluctuations in the economy, those who can recognize opportunities for innovation and maintain strong customer-oriented practices are best positioned to survive a recession and maintain long-term success.