If you’re looking for stability and consistent growth in your investment portfolio, blue chip stocks are a smart choice. These stocks are from some of the largest and most well-known companies in the world, and they offer investors a high level of security and predictability. In this blog post, we will take a look at top ten blue chip stocks to buy right now. So if you’re looking for a safe investment, these best stocks should be at the top of your list!

What are Blue Chip Stock?

Blue chips stocks are shares in blue chip companies. A blue chip company is a large, stable, and well-established company that is financially strong and has a good reputation. These companies are usually leaders in their industry and have a history of consistent growth, so their stocks are so-called blue chips.

Investing in blue chip stocks is often seen as a safe investment because these companies are less likely to experience sudden drops in value. However, blue chip stocks may also provide lower returns than other types of stocks over the long term.

Blue chip stocks are shares of large, established companies that have a history of best examples of growth stocks and profitability. They are typically household names that have a strong brand presence in their industry. Because blue chip stocks are less likely to experience sudden or drastic changes in price, they are often considered to be relatively safe investments. They are also generally less volatile than smaller, newer companies.

For these reasons, blue chip stocks tend to be favored by conservative investors who seek stability and relative safety. However, because blue chips tend to be less volatile, they may also provide less opportunity for growth than more speculative stocks. As a result, investors seeking high returns may choose to allocate only a small portion of their portfolio to blue chips.

Is Market Cap Important for Investors?

For investors, market capitalization is an important metric. It is a way to measure the size of a company and its potential for growth. Companies with a large market cap are typically well established and have a track record of success. They also tend to be more stable and less risky than smaller companies.

As a result, they are often seen as a safer investment. However, there are also some drawbacks to investing in large companies. They can be less nimble and adaptable than smaller companies, and they may be slower to respond to changes in the market. For these reasons, it is important for investors to consider all factors before making any decisions.

How To Buy Blue Chip Stocks?

When it comes to investing in the stock market, there are a lot of different strategies that investors can use. Some investors focus on buying penny stocks in the hopes of finding the next big thing, while others focus on buying blue chip stocks. Blue chip stocks are stocks of large, well-established companies that have a history of strong financial performance.

As a result, they tend to be less volatile than their smaller counterparts and offer investors a greater degree of safety. If you’re interested in buying blue chip stocks, there are a few things you need to keep in mind.

First, you need to make sure that you’re buying stocks of companies that you’re familiar with and that you understand their business model. Second, you need to make sure that you’re buying stocks at a reasonable price. overpaying for a stock is one of the quickest ways to lose money in the stock market.

Finally, you need to make sure that you have a diversified portfolio. This means buying stocks of different types of companies in different industries. By following these tips, you’ll be well on your way to buying the best blue chip stock successfully.

See Our Top Ten Blue Chip Companies Selection

1. Johnson & Johnson (JNJ)

The first stock on our list is Johnson & Johnson (JNJ). This company is a diversified healthcare conglomerate with a long history of success. They are one of the largest pharmaceutical companies in the world, and their products are sold in over 175 countries. Their stock has performed well in recent years, and they offer a dividend yield of around two percent.

Johnson & Johnson (JNJ) is one of the popular blue chip stocks with a market cap of $369 billion. The company’s strong brand and diversified product portfolio have helped it to weather economic downturns and generate consistent growth. As a result, JNJ is one of the most popular stocks among long-term investors.

2. Coca-Cola (KO)

The second stock on our list is Coca-Cola (KO). This ultimate blue chip stock needs no introduction – they are the largest beverage company in the world, and their products are sold in over 200 countries. Their stock has also performed well in recent years, and they offer a dividend yield of around three percent.

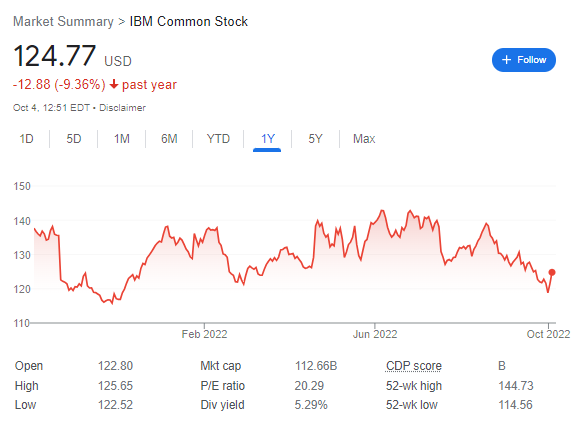

3. IBM (IBM)

The third stock on our list is IBM (International Business Machines Corporation). This company is a global leader in information technology, and their products are used by businesses of all sizes. They have a strong track record of dividend growth, and their stock has performed well in recent years. Their dividend yield currently stands at around four percent.

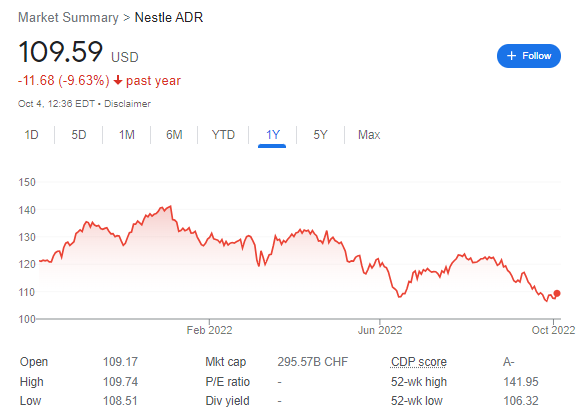

4. Nestle (NSRGY)

The fourth stock on our list is Nestle (NSRGY). This company is the largest food and beverage company in the world, with a portfolio of over 2000 brands. They have a long history of dividend growth, and their stock has performed well in recent years. Their dividend yield currently stands at around three percent.

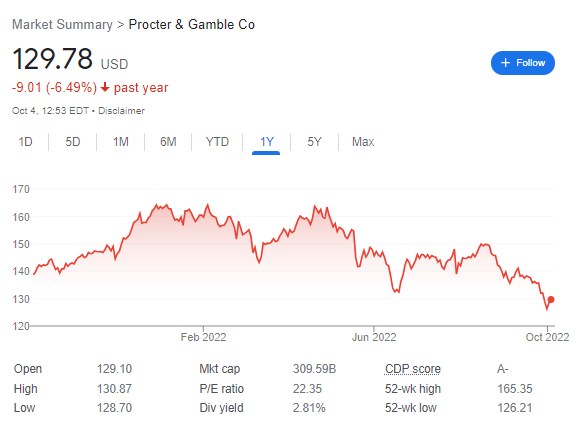

5. Procter & Gamble (PG)

The fifth stock on our list is Procter & Gamble (PG). This company is a global consumer goods giant, with a portfolio of over 300 brands. They have a long history of rising dividends, and their stock has performed well in recent years. This blue chip stock pays at around three percent.

6. Exxon Mobil (XOM)

The sixth stock on our list is Exxon Mobil (XOM). This company is the largest publicly traded oil and gas company in the world. They have a long history of paying dividends, and their stock has performed well in recent years. Their dividend yield currently stands at around four percent.

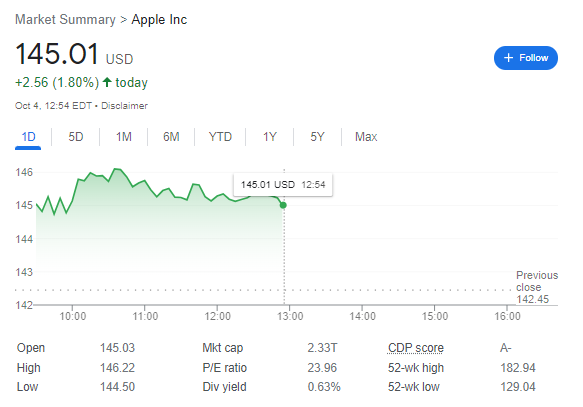

7. Apple (AAPL)

The seventh stock on our list is Apple (AAPL). This company needs no introduction – they are the largest technology company in the world, with a strong track record of innovation and growth. Their stock has also performed well in recent years, and they offer a dividend yield of around two percent.

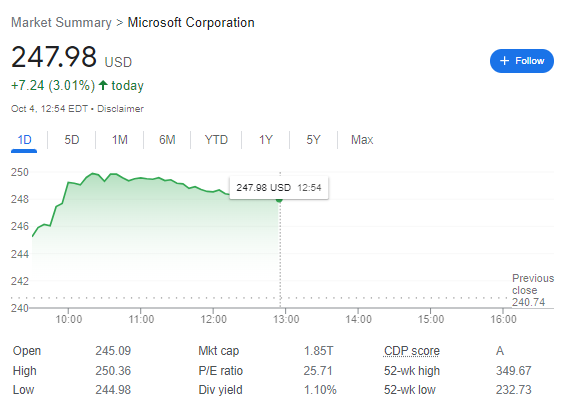

8. Microsoft (MSFT)

The eighth stock on our list is Microsoft (MSFT). This company is the largest software company in the world, and their products are used by businesses of all sizes. They have a strong track record of dividend growth, and their stock has performed well in recent years. Their dividend yield currently stands at around two percent.

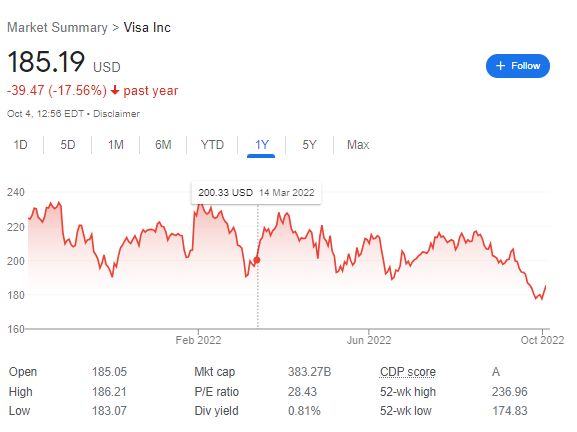

9. Visa (V)

The ninth stock on our list is Visa (V). This company is a global leader in financial services, and their products are used by businesses and consumers all over the world. Their stock has also performed well in recent years, and they offer a dividend yield of around one percent.

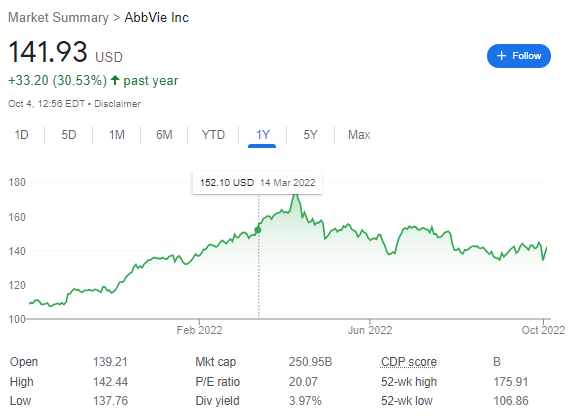

11. AbbVie Inc (ABBV)

AbbVie is a pharmaceutical company that is engaged in the discovery, development, manufacture, and sale of drugs. The company’s products include treatments for arthritis, diabetes, heart disease, and cancer. AbbVie also manufactures and markets biologic therapies. The company has a market capitalization of over $100 billion and its shares are traded on the New York Stock Exchange.

Blue Chip Stocks Abbvie has outperformed the broader market in recent years, and analysts believe that the company is well-positioned for continued growth. AbbVie’s strong product pipeline includes several potential blockbuster drugs, and the company is also well-positioned to benefit from the aging of the global population. In addition, AbbVie’s dividend yield of 4.4% is among the highest of any large pharmaceutical company. As a result, analysts believe that AbbVie stock is an attractive investment for long-term investors.

What is a blue-chip fund?

Blue Chip funds are a type of mutual fund that invests in large, well-established companies. These companies tend to be leaders in their respective industries and have a proven track record of success. blue chip funds are often considered to be a safe investment, as they offer the potential for stability and growth. However, blue chip stocks may also be more volatile than other types of stocks, so it is important to carefully consider your investment objectives before investing in a blue chip fund.

Is It Smart To Invest in Blue Chip Stocks?

Many people believe that investing in blue chip stocks is the only smart investment. While there are definitely some advantages to blue chip stocks, there are also some disadvantages that you should be aware of before making any investment decisions. One of the main advantages of blue chip stocks is that they tend to be much more stable than other types of stocks.

This means that you are less likely to lose money if the stock market takes a turn for the worse. Additionally, blue chip companies usually have a long history of success, which can give you confidence that your investment will pay off in the long run. However, there are also some downsides to blue chip stocks. For one thing, they often trade at a much higher price than other stocks, which means that you could potentially lose a lot of money if the stock market crashes.

Additionally, blue chip companies can sometimes become too big and bureaucratic, which can make it difficult for them to adapt to changing market conditions. As with any investment, it is important to do your research before making any decisions. However, if you are looking for a relatively safe and stable investment, blue chip stocks may be a good option for you.

Conclusion Blue Chip Stocks

If you’re looking for a safe investment, these stocks should be at the top of your list. Best Blue Chip Stocks To Buy Right Now (JNJ, KO, IBM, NSRGY, PG, XOM, AAPL, MSFT) (V), JPM) offer a long history of success, dividend growth, and stock performance. While there are no guarantees in the stock market, these companies have proven to be reliable over time.

Do you have any other stocks that you think should be on this list, are you looking for the best 10 dollar stocks? Let us know in the comments below! And be sure to check out our other blog posts for more great investment ideas.