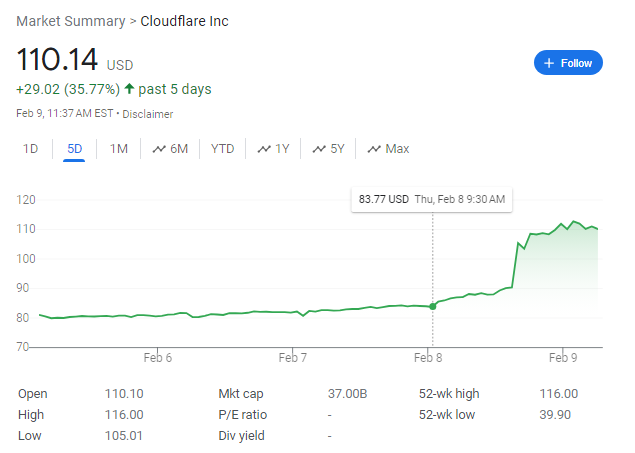

Cloudflare stock price jumped an impressive 35.77% during its earnings week, buoyed by strong financial results and impressive customer growth. This surge reflects the company’s strong position in the cloud computing and cybersecurity markets, where it is seeing continued demand for its products and services.

Here are some of the key highlights from Cloudflare’s earnings report that likely contributed to the stock price jump:

- Strong revenue growth: Cloudflare reported revenue of $254 million for the quarter, up 54% year-over-year. This exceeded analyst expectations and was driven by strong growth in both its core product lines, content delivery network (CDN) and zero-trust security.

- Impressive customer growth: The company added 155 new large customers during the quarter, bringing its total to 1,644. This indicates that Cloudflare is successfully expanding its reach and adoption across different industries.

- Improving profitability: Cloudflare is still not profitable, but it is narrowing its losses. The company reported a net loss of $33 million for the quarter, compared to a loss of $42 million in the same period last year.

Cloudflare Earnings Breakdown: A Deep Dive (Q4 2023)

While the news of Cloudflare’s stock jump is recent (February 9th), the actual earnings report was released on February 8th. Let’s look a a comprehensive picture:

Financial Highlights:

- Revenue: $362.5 million, surpassing analyst estimates of $356.3 million and representing a 34% year-over-year increase.

- Earnings per share (EPS): $0.15, beating analyst expectations of $0.12 and marking the company’s first profitable quarter on a GAAP basis.

- Gross margin: 77.2%, maintaining impressive profitability.

- Customer base: Increased by 22% year-over-year, reaching 162,400 paying customers.

- Large customer growth: The number of customers spending over $100,000 annually grew 58% year-over-year, highlighting traction with bigger enterprises.

Key Takeaways:

- Strong revenue growth: This quarter continues Cloudflare’s trend of exceeding expectations, demonstrating consistent product-market fit and execution.

- Profitability milestone: Achieving GAAP profitability is a significant achievement, signaling financial stability and potentially attracting wider investor interest.

- Large deal momentum: Winning bigger contracts reinforces the value proposition for larger organizations and indicates future growth potential.

- Growing customer base: Expansion across various customer segments showcases the versatility and appeal of Cloudflare’s solutions.

Additional Details:

- Product segment performance: While the overall picture is positive, specific segment breakdowns weren’t readily available. Further analysis might reveal strengths and weaknesses within different offerings.

- Guidance: Cloudflare projected full-year 2024 revenue of $1.65 billion and EPS of $0.58-$0.59, exceeding analyst forecasts. This optimistic outlook further boosted investor confidence.

- Challenges: Competition in the cybersecurity and content delivery network (CDN) space is fierce. It’s worth exploring how Cloudflare plans to maintain its edge against rivals.

Overall:

Cloudflare’s Q4 2023 earnings report paints a positive picture, with strong financials, impressive customer growth, and a bright outlook for the future. However, a complete understanding requires delving deeper into specific segments, competitive landscape, and potential risks.