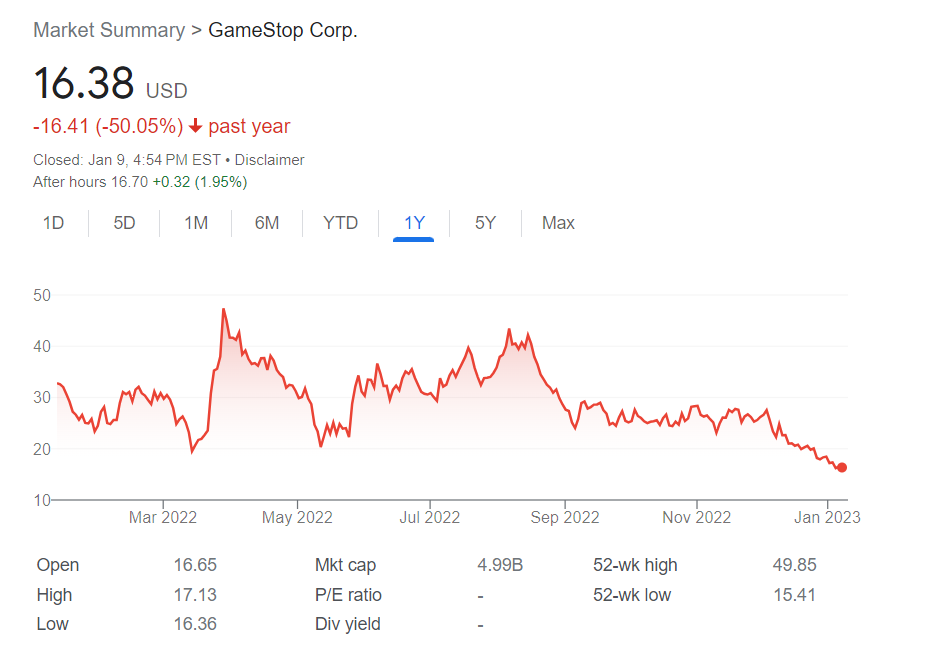

GameStop, the world’s largest video game retailer, has seen its share price tumble significantly over the past year. It’s been a turbulent ride for GME Stock investors who have seen their stock plunge -50.05% since January 2020. In same direction, S&P500 has fallen -16.56%.

Given that this stock currently trades at $16.41, investors are concerned if they can recoup past losses or if it is time to cut their losses and sell GME stock. In this FintechZoom article, I will explore why GME stocks have suffered such drastic declines and discuss options for investors who are looking to make an informed decision about their investments in GameStop.

GameStop Corporation’s (GME) equity has declined by 7.91% in the past seven days; Should you buy, maintain, or sell the stock?

GME’s rank is affected by a 14-point long-term technical score, as well as a 53-point short-term technical score.

During the last year, GameStop Corp. (GME) shares have dropped 50.05%, and the average assessment from Wall Street experts is to Sell. InvestorsObserver’s exclusive ranking system gives GME stock a rating of 24 out of a potential maximum of 100. This rating is affected by a long-term technical grade of 14, as well as a short-term technical score of 53.

What is the Current Status of GME Stock?

On Monday, Jan 9 , GameStop Corp. (GME) stock lose -0.49% and S&P 500 – 0.077%. GME had a closing price of $16.46 and traded 521,157 shares.

So, Do you want to Buy GME Stock?

Well, according to Statista, it’s not an AI article, since the coronavirus outbreak began, consumers around the world have changed their habits accordingly in line with measures imposed in a bid to control the spread of the disease (read this article too), and this has had a direct impact on media consumption on a global level. Data varies country by country, but figures on increased media consumption among four different generations also reveals certain patterns. For example, Gen Z are 20 percent more likely than Boomers to have spent more time listening to music streaming services, whilst Gen X are the most likely to have been listening to the radio more as a result of the COVID-19 pandemic. Tradtional formats were less prefereable to social networks or messaging apps, with newspaper and magazine readership increasing by just three to six percent across all generations.

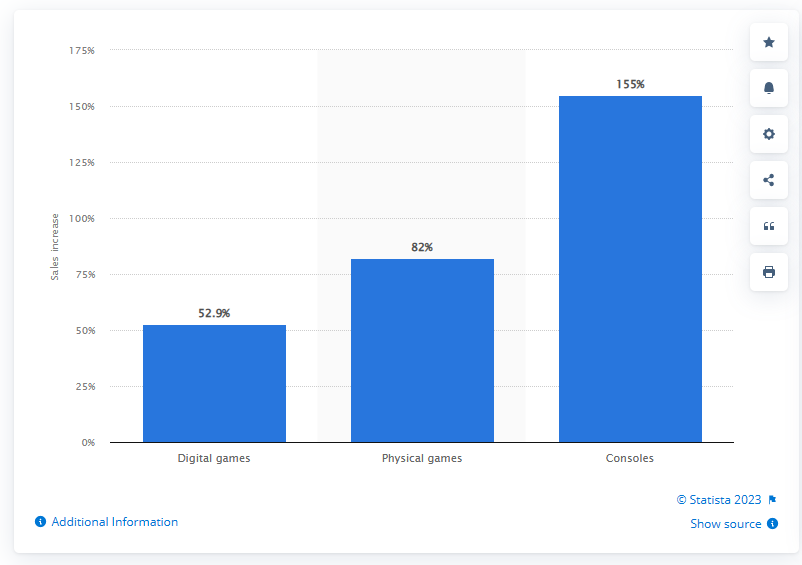

Increase in sales in the video game industry during the coronavirus (COVID-19) pandemic worldwide as of March 2020, by type

So, it seems that the Resistance Level for GME Stock is bellow the current price. In our Opinion it’s a Sell Sign too.