The content offered by Disney is unsurpassed. The company produces movies and characters that are known globally. Disney’s streaming service is likely to have contributed to the company’s struggles this year. Despite growing subscriber numbers, the company faces many rivals in the sector, and spending on content could negatively affect its bottom line.

Disney+ and other streaming services have not only added recurring revenue to Disney’s theme parks that didn’t exist before but have also added a significant revenue stream.

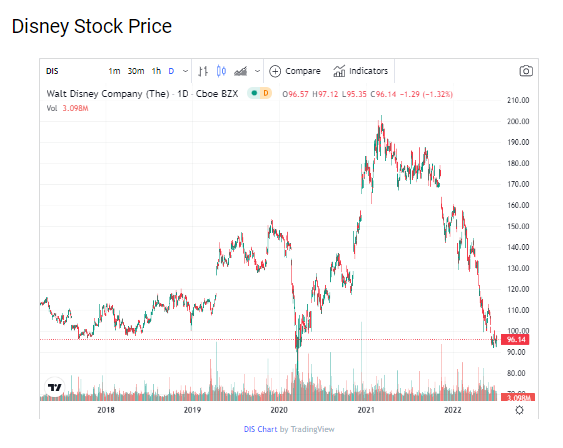

It’s an excellent time to add this powerhouse business to your portfolio, with its shares trading for less than they did five years ago.

Disney’s business is more than just streaming should alleviate investors’ concerns. Disney’s theme parks are expected to peak in the coming months. Pent-up travel demand and rising inflation may entice families to choose local vacations over overseas vacations, such as visiting Disney World. The results are already looking suitable for the company.

Reasons to buy

- Despite Disney’s latest earnings report coming in below analysts’ expectations. However, the streaming segment did not approach analysts’ expectations. Wall Street analysts have reconsidered their positive expectations following the recent performance. DIS’s average price target is $147, according to TipRanks, representing a 56% upside potential. Last month’s price target was $155, suggesting analysts are pessimistic.

- However, it seems that even the pessimists are optimistic about the risk-reward dynamic. Among TipRanks’ lower price targets for the Disney stock, $110 is the lowest, $20 above the current price.

- Disney maintained an impressive $1.6 billion in free cash flow over the past 12 months, despite its modest profit margins in recent months (before the pandemic, Disney was quickly earning more than 15% on average). The mere fact that you make a profit is a triumph in facing such challenges.

- Disney’s business will continue to perform well if the economy returns to normal for an entire year. In the current market, the stock has an attractive valuation of about 23 times forward earnings compared to its previous price-to-earnings multiple of more than 40 at the beginning of the year.

- As Disney has multiple businesses that can generate long-term growth (streaming and parks), it would be a great time to buy the company – it last traded at this price in March 2020.

Reasons to avoid

- Streaming video companies must keep their prices low to attract customers in a competitive industry. However, for its streaming services, Disney will likely face pressure to lower its prices as inflation, and the Federal Reserve will raise benchmark interest rates.

- Additionally, consumers who are tight on cash may spend their dollars on other things instead of movies and trips to Disney’s theme parks.

- Since the bear market isn’t over yet and the government isn’t able to control inflation, expect DIS to undergo a lot of pressure in the coming months.