Electric car giant Tesla (TSLA), reported its Q3 earnings after the bell on Wednesday, missing analysts’ expectations on revenue, but slighting beating on earnings.

- Third quarter revenue rose 55.9% to a record $21.5bn, with Automotive revenue rising to $18.7bn from $12.1bn the previous year. The increase reflected a year-on-year increase of 102,439 vehicle deliveries and an increase in average selling prices. There were significant increases in production across all vehicle types

- Operating expenses remained flat at $1.7bn, but the group acknowledged it’s experiencing raw material cost inflation. Operating profit rose to $3.7bn, up from $2.0bn the previous year

- Tesla’s hoping to reduce costs-per-vehicle by improving its delivery logistics. High delivery volumes are currently causing challenges with transportation capacity. The group also said it believes “battery supply constraints will be the main limiting factor to EV market growth in the medium and long terms”

- Tesla shares fell 3.9% in after-hours trading

Tesla Stock Price (TSLA)

Although Tesla stock has fluctuated significantly over the past several months, today’s earnings report shows that it is trending upwards once again. After a significant jump of +0.84% in just this one day, the stock is now up +6.63% over last week and -28.08% over last month. Despite these fluctuations, it seems that Tesla’s long-term prospects remain strong, with a drop of -31.83% since September 2018. Overall, investors seem to be optimistic about this innovative company as it continues to make ground-breaking advances in electric vehicles and other emerging technologies. With its recent developments and growing popularity, there is no doubt that Tesla will continue to be a major player in the world of technology for years to come.

Tesla Vehicle Software

Tesla is well-known for producing some of the most innovative and cutting-edge vehicles on the market today. Their vehicles are at the forefront of electric car technology, offering innovative features like self-driving capabilities and regenerative braking systems. To ensure that their vehicles perform at peak efficiency, Tesla has developed a proprietary software platform specifically for their line of cars and trucks. This software not only controls basic operations like navigation and infotainment features, but also provides access to real-time diagnostic data to help users troubleshoot any potential issues. Overall, the Tesla vehicle software helps to keep these high-performance vehicles running smoothly so that drivers can enjoy all of their advanced capabilities with complete confidence.

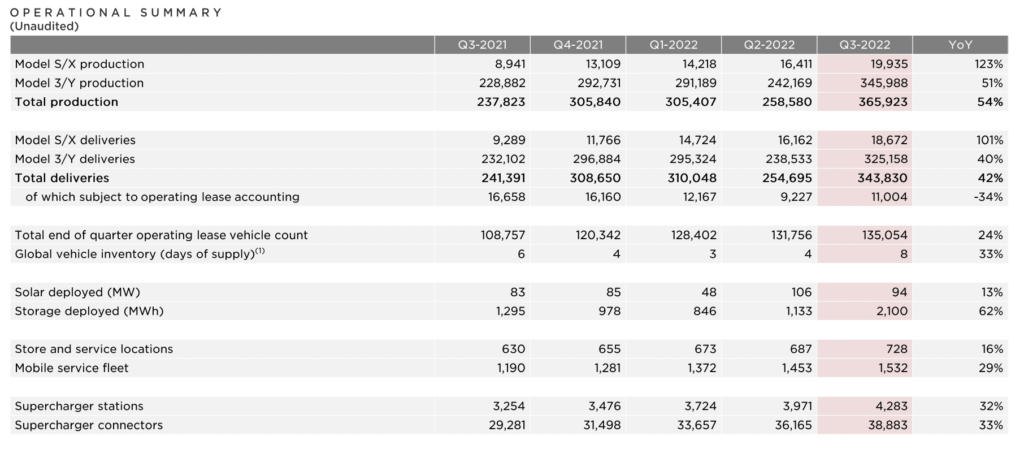

Operational Summary Tesla Q3 2022

In the third quarter of 2022, Tesla saw a marked increase in the production of its Model S/X and Model 3/Y vehicles. Over 19,000 Model S/X vehicles were produced during this period, up from just over 16,000 at the end of Q2. Similarly, the production of Model 3/Y vehicles increased significantly during this time frame, reaching almost 346,000 cars. These impressive numbers reflect Tesla’s continued commitment to innovation and excellence in the automotive industry. Thanks to its cutting-edge technology and forward-thinking approach, Tesla continues to set new standards for high-quality vehicle production. As more drivers look to invest in electric vehicles that offer both performance and efficiency, it is clear that Tesla will remain a leader in this space for years to come.

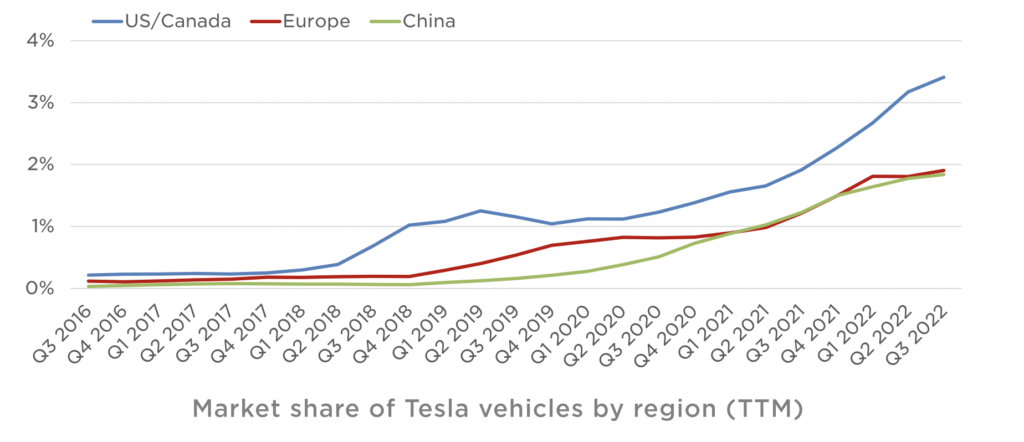

Market Share of Tesla

Over the past few years, Tesla has seen a steady increase in market share in the US, with their market share now sitting at nearly 3.4%. However, this growth has not been matched in Europe or China, where Tesla’s market share is hovering around 1.9%. As an investor, it is important to watch this metric closely over the coming quarters to see if Tesla can reverse this trend and start to gain ground in these critical markets. With strong competition from other tech companies like Google and Apple, it will not be easy for Tesla to win over consumers and carve out a lasting niche for itself in these regions. But if they manage to achieve that goal, it could mean great things for both the company and its investors over the long term.