The market outlook for today is positive, with the Dow Jones climbing by 1.56% or 537 points. Stocks rallied on Tuesday, and one of the notable performers is Tesla, whose stock is increasing by 5.29% to reach 235.55 USD. Another exciting development is that SpaceX is expected to receive clearance to attempt a second Starship launch this week. Additionally, Airbnb’s stock is also on the rise, increasing by 5.82% to reach 126.09 USD. This increase comes after the announcement that Airbnb has acquired an AI startup called Gameplanner.AI for just under $200 million. These developments indicate positive growth and potential opportunities in the market.

Dow Jones is climbing +1.56% (537 points) and Stocks rallied Tuesday

Stocks rallied Tuesday, building on their strong November gains, as Wall Street cheered new U.S. inflation data that raised hope of the Federal Reserve wrapping up its rate-hiking campaign.

The Dow Jones Industrial Average rose 537 points, or 1.56%, to 34,948.08. The S&P 500 gained 1.89%, to 4,034.23. The Nasdaq Composite climbed 2.43%, to 11,388.85.

The rally came as investors digested a report from the Labor Department that showed consumer prices rose 0.3% in October from the prior month, a smaller-than-expected increase. The data also showed that core inflation, which excludes food and energy prices, rose 0.2%, also below expectations.

The inflation data “supports the notion that the Fed may be approaching the end of its rate-hiking cycle,” said Ryan Detrick, chief market strategist at Carson Wealth Management. “This is helping to improve investor sentiment and drive stocks higher.”

In addition to the inflation data, investors were also cheered by a number of other positive developments. These included:

- A stronger-than-expected reading on consumer confidence.

- A report from the Institute for Supply Management that showed manufacturing activity expanded in October.

- A report from the National Association of Realtors that showed home sales rose in October.

The strong economic data and positive news from corporate America helped to offset concerns about the ongoing war in Ukraine and the potential for a recession in the United States.

“The market is looking past the near-term volatility and focusing on the longer-term outlook,” said Art Cashin, chief investment officer at UBS Private Wealth Management. “Investors are betting that the Fed will be able to engineer a soft landing for the economy.”

The rally in stocks comes as the market enters the final month of the year. Stocks have had a strong start to November, with the Dow up over 10% and the S&P 500 up over 8%. Investors will be hoping that the strong momentum can continue into December and lead to a positive finish to the year.

Here are some of the factors that are contributing to the stock market rally:

- The Federal Reserve is expected to slow down its pace of rate hikes.

- The U.S. economy is showing resilience.

- Corporate earnings are expected to remain strong.

Here are some of the risks to the stock market rally:

- The war in Ukraine could escalate.

- The U.S. economy could tip into recession.

- Inflation could remain higher than expected.

Overall, the stock market is off to a strong start to November. Investors are hopeful that the positive momentum can continue into December and lead to a positive finish to the year. However, there are a number of risks that could derail the rally, and investors should be mindful of these risks before investing in the market.

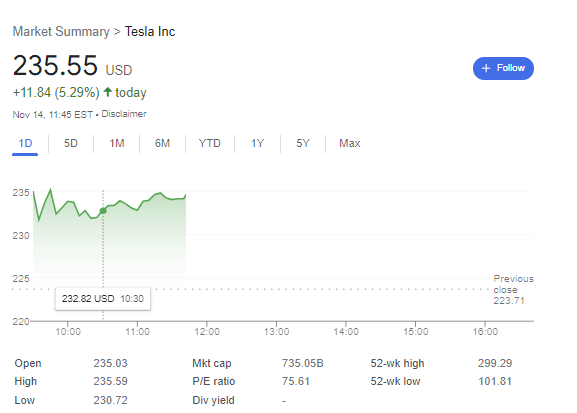

Tesla Stock is increasing today +5.29% at 235.55 USD and SpaceX should receive clearance to attempt second Starship launch this week

Tesla stock is up over 5% today, trading at 235.55 USD per share. The company’s stock price has been on a tear in recent months, up over 50% since the beginning of the year. The increase in Tesla’s stock price comes on the heels of a number of positive developments for the company, including strong earnings reports, new product launches, and an expansion of its manufacturing capacity.

In addition to the positive news on the stock market, SpaceX is also making headlines today. The company is expected to receive clearance from the Federal Aviation Administration (FAA) to attempt a second Starship launch this week. The first Starship launch took place in May of this year, and the second launch is expected to be even more ambitious. The company plans to send the Starship to orbit for the first time, a major milestone in the development of the spacecraft.

The success of Tesla and SpaceX is a testament to the innovation and entrepreneurship that is driving the American economy. These two companies are at the forefront of their respective industries, and they are helping to shape the future of technology.

Here are some of the reasons why SpaceX is expected to receive clearance to launch Starship:

- The company has successfully completed all of the FAA’s required reviews.

- SpaceX has made significant progress in addressing the FAA’s concerns about the environmental impact of the launch.

- The company has a strong track record of success with its other launch vehicles.

The success of Tesla and SpaceX is a positive sign for the American economy. These two companies are leading the way in innovation and entrepreneurship, and they are helping to create jobs and grow the economy.

Airbnb stock increasing today +5.82% at 126.09 USD after announced that Airbnb acquires AI startup (Gameplanner.AI) for just under $200 million.

Airbnb stock is up over 5% today, trading at 126.09 USD per share. The company’s stock price has been on an upward trend in recent months, and today’s news of the acquisition of AI startup Gameplanner.AI has further boosted investor confidence.

The acquisition of Gameplanner.AI is expected to help Airbnb improve its dynamic pricing algorithm, which is used to set prices for its listings. Gameplanner.AI’s technology uses artificial intelligence to analyze a variety of factors, such as demand, competition, and local events, to determine the optimal price for each listing.

The acquisition is also seen as a way for Airbnb to expand its reach into the vacation rental market. Gameplanner.AI has a strong presence in this market, and its technology could be used to help Airbnb attract more vacation rental hosts to its platform.

The news of the acquisition was met with positive reaction from analysts. Wedbush Securities analyst Daniel Ives raised his price target on Airbnb stock from $135 to $150 per share. Ives said that the acquisition of Gameplanner.AI is a “game-changer” for Airbnb and that it could help the company achieve its long-term growth targets.

Overall, the acquisition of Gameplanner.AI is a positive development for Airbnb. It is expected to help the company improve its dynamic pricing algorithm, expand its reach into the vacation rental market, and achieve its long-term growth targets.

Here are some of the reasons why Airbnb’s stock price is increasing:

- The acquisition of Gameplanner.AI is expected to help Airbnb improve its business.

- The company has a strong track record of innovation.

- Airbnb is benefiting from the growth of the travel industry.

Here are some of the risks to Airbnb’s stock price:

- The company faces competition from other online travel agencies, such as Booking.com and Expedia.

- The travel industry is cyclical, and Airbnb’s business could be hurt by a downturn in the economy.

- Airbnb is a relatively new company, and it has a limited history of profitability.

Overall, Airbnb is a well-positioned company with a bright future. The acquisition of Gameplanner.AI is a positive development, and the company is benefiting from the growth of the travel industry. However, investors should be aware of the risks to Airbnb’s stock price before investing in the company.