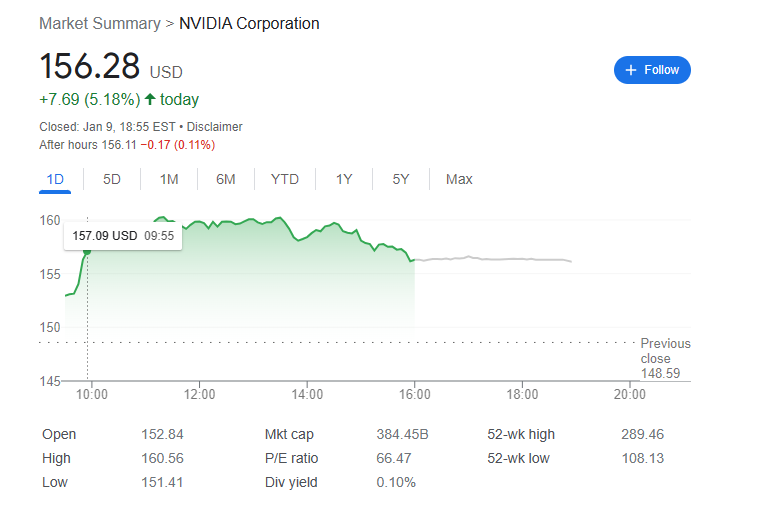

It has been an exciting day for the shareholders of NVIDIA Corporation with the stock gaining more than 5% in the Nasdaq Global Select Market. This growth has helped propel their stock to new heights trading at $156.28 USD per share.

Shares of NVIDIA Corporation, a computer technology company engaged in visual computing, have been on an upward trend for about two weeks, leading up to this peak moment today when it reached $156.28 USD per share and closed +5.18% from yesterday’s price.

This explosive increase in stock price is indicative of one thing; Nvidia is gaining traction in the long run and investors continue to pour confidence into it despite short-term fluctuations present in today’s market. In this article we will look at the contributing factors that caused such a swift rise in share prices and what it means for future investors.

NVDA and AMD have been the main driving forces behind a resurgence in chip stocks.

Analysts have an extremely positive outlook on both AMD and Nvidia’s success. Even though the stocks have decreased in value in the last year, analysts label them as “Strong Buys”. AMD stock has an estimated increase of 24.74% with an average price target of $84.70, while Nvidia Stock offers a 29.33% upside potential with an average price target of $203.88.

It wasn’t looking good for chip stocks not long ago, as companies and customers both cut back on their spending. But Nvidia and AMD are pointing the way to a comeback. It appears to be part of a larger tech sector rally, as the Federal Reserve’s plan to increase interest rates is losing steam. This is good news for the tech industry, since they require a ready supply of capital to fuel their investments.

Even if the federal funds rate goes up by 0.75%, it likely won’t affect earnings too much. Around the world, stock markets experienced gains, with Shanghai Composite and Hang Seng index leading the charge. Many analysts are confident in AMD and Nvidia’s potential for success, despite the fact that both stocks have lost value in the past year. AMD is predicted to have a 24.74% upside potential, with a target price of $84.70, while Nvidia has an estimated 29.33% upside potential, with a target of $203.88.