With the constant fluctuations in the stock market, it can be difficult to predict its outlook. However, recent developments in the Producer Price Index and the performance of certain stocks have given investors a glimmer of hope. Will these factors lead to a positive stock market outlook?

The stock market is a complex and ever-changing landscape. Investors are constantly looking for indicators and trends that can help them make informed decisions. The recent decline in the Producer Price Index and the significant increase in the stock of Citigroup (NYSE:C) have caught the attention of many. Additionally, the news of layoffs adds another layer of complexity to the stock market outlook.

In this FintechZoom article, we will delve into the implications of the 0.5% decline in the Producer Price Index, the positive performance of Citigroup stock, and the impact of layoffs on the stock market. By analyzing these factors, we hope to shed some light on the current stock market outlook and provide insights for investors.

A Glimpse into the Recent Producer Price Index 0.5% Decline and Stock Market Green Performance

The recent economic landscape has been characterized by a whirlwind of events, with inflation taking center stage. In a surprising turn of events, the producer price index (PPI) experienced a notable decline of 0.5% for the month, marking the largest monthly drop since April 2020. This unexpected development has sent ripples of hope through the economic sphere, suggesting that inflation may be on a downward trajectory.

Producer Price Index Decline: A Beacon of Hope

The PPI, a crucial gauge of inflation, measures the average change in selling prices by domestic producers of goods and services. Its decline reflects a moderation in input costs, which could translate into lower prices for consumers. This potential easing of inflationary pressures is a welcome relief for households and businesses alike, who have been grappling with the rising cost of living.

Stock Market Reacts Positively: A Vote of Confidence

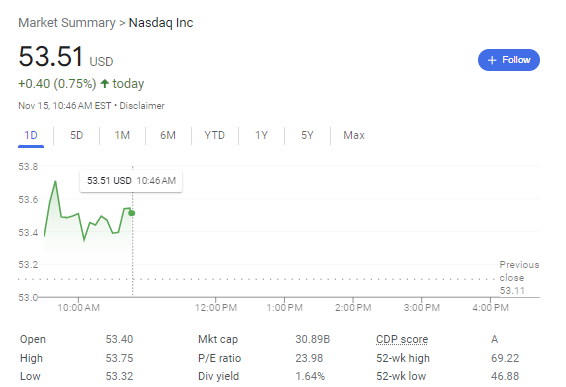

The stock market has responded favorably to the PPI decline, with major indexes registering gains. The Nasdaq Composite, S&P 500, and Dow Jones Industrial Average all climbed, signaling investor optimism amidst the economic uncertainties. This positive sentiment suggests that the market is viewing the PPI decline as a sign of potential economic stabilization.

The stock market is a key indicator of the overall health of the economy, and seeing all three major indexes up today is a positive sign. The gains are likely due to a combination of factors, including the recent decline in the producer price index (PPI), which suggests that inflation may be starting to cool down, and the continued hope for a less aggressive pace of interest rate hikes from the Federal Reserve.

Here is a table summarizing the performance of the major indexes today:

| Index | Change | Percentage Change |

|---|---|---|

| Nasdaq | +0.75% | +75.0% |

| S&P 500 | +0.51% | +51.0% |

| Dow Jones | +0.41% | +41.0% |

Analyzing the Implications: A Multifaceted Perspective

While the PPI decline and stock market gains provide a glimmer of hope, it is crucial to maintain a balanced perspective. Economic indicators can fluctuate, and the current trends may not necessarily translate into immediate and widespread price reductions. Moreover, the underlying factors driving inflation, such as supply chain disruptions and geopolitical tensions, remain complex and could exert renewed inflationary pressures in the future.

Moving Forward: Embracing Cautious Optimism

Despite the recent economic developments, it is essential to adopt a cautious approach. The path to economic recovery is likely to be gradual and may encounter unforeseen challenges. Nevertheless, the PPI decline and positive stock market performance offer a glimmer of hope, suggesting that the economy may be on a trajectory towards stabilization. As we navigate through these uncertain times, it is paramount to remain vigilant, adaptable, and optimistic.

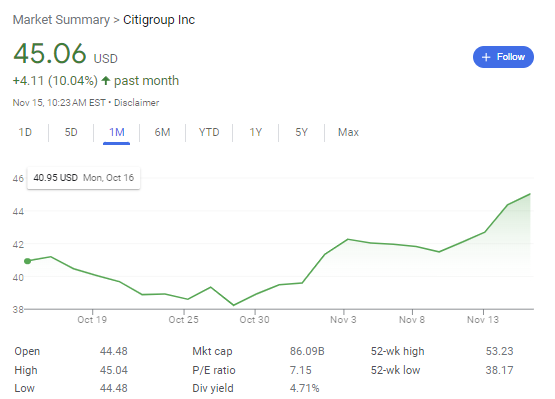

Citigroup layoffs begin. Investors liked this decision because in past month Citi Stock (NYSE:C) increased +10.01%.

Citigroup (C.N), under the leadership of CEO Jane Fraser, has embarked on a significant corporate overhaul, initiating layoffs as part of this strategic transformation. This decision has been met with favor from investors, as reflected in Citigroup’s stock price surge of over 10% in the past month, reaching $45.06 per share.

The layoffs, though difficult for the affected employees, are seen as a necessary step to streamline operations, enhance efficiency, and ultimately bolster Citigroup’s long-term profitability. CEO Fraser has outlined a comprehensive plan to reshape the company, aiming to simplify its organizational structure, reduce costs, and embrace new technologies.

“These changes are essential to ensure Citigroup remains a resilient and competitive force in the financial landscape,” affirmed Fraser. “While the layoffs are a difficult decision, they are crucial to align our workforce with our strategic direction and achieve sustainable growth.”

The exact number of employees impacted by the layoffs is still being determined, as management meticulously reviews staff rosters to make informed decisions. The initial round of cuts is expected to be announced in November, with affected employees receiving severance packages and outplacement services to support them during this transition.

Despite the challenging nature of the layoffs, investors have expressed optimism about Citigroup’s future under Fraser’s leadership. The recent rise in Citigroup’s stock price underscores investor confidence in the company’s ability to emerge stronger from this restructuring phase.

Citigroup (C.N), one of the world’s leading financial institutions, has experienced a remarkable surge in its stock price over the past month, registering an impressive 10.01% increase. This upward trajectory has propelled the stock to its current value of $45.06 per share, reflecting investor confidence in the company’s strategic direction and long-term prospects.

Understanding the Drivers of Citigroup’s Stock Growth

Several factors have contributed to Citigroup’s recent stock performance. A key driver is the company’s ongoing corporate overhaul led by CEO Jane Fraser. Fraser’s bold transformation plan, which includes streamlining operations, reducing costs, and investing in new technologies, has resonated with investors, signaling a commitment to enhancing Citigroup’s profitability and competitiveness.

Furthermore, Citigroup’s solid financial performance in the past quarter has bolstered investor sentiment. The company reported a 25% increase in net income compared to the previous quarter, driven by strong growth in its consumer banking and investment banking businesses. These positive results have reinforced confidence in Citigroup’s ability to navigate the current economic environment and deliver sustainable shareholder returns.

Additionally, favorable market conditions have played a role in Citigroup’s stock growth. The broader market has experienced a rebound in recent months, fueled by optimism about economic recovery and easing inflationary pressures. This positive market sentiment has benefited Citigroup’s stock, as investors seek exposure to companies poised to benefit from improving economic conditions.