You don’t need to be a billionaire or own your own company to invest in stocks. Anyone can buy shares and see their value grow over time. It might sound scary, but investing in stocks is a great way to build your savings and get some additional returns on your money.

Investing in stocks comes with risk, but you can reduce that risk and increase your chances of success by following proven principles. The stock market is a volatile place that can see devastating downturns as well as meteoric upticks. To succeed at investing in stocks, it’s important to understand how the market works, identify the best time for you to invest, and follow smart strategies to make sure you’re getting the most out of your money.

Read Invest in ZGYH Stock and Get Ready to Soar with Yunhong International!

Best Strategies to Invest your Money in Stock Investing

If you are interested in investing and growing your money for a secure future, you might have heard about the stock market and its potential to offer high returns. However, most of us don’t know how to invest in the stock market. If you are reading this article, it means that you are eager to learn how to invest in stocks so that you can build a secure financial future. The stock market is a great way to grow your money while also supporting companies that you believe will grow and succeed in the long-term. With the right strategies, investing in stocks can be an excellent way to support businesses and get a return on your investment. Here are some tips on how to invest in the stock market:

Set a Goal for Your Stock Market Investment

Before you buy a single stock, it’s important to decide on your investment goals and how you’ll measure success. Are you saving for retirement? Do you want to make extra payments on your mortgage? Understanding why you’re investing will help you know when you’ve met your goals and when it’s time to sell your stocks. It’ll make you less likely to impulsively sell stocks at a loss and make rash decisions based on emotion. If you’re investing in stocks to meet a goal, you’ll also be less likely to panic and sell too soon if the market takes a nosedive. You’ll know that downturns are normal and aren’t a reflection of the strength of your investment.

Research and analyze your investments

Before you buy any stock, you’ll want to make sure it’s a good investment. Start by researching the company behind the stock and the industry it operates in. What is the company’s future outlook? Are there any major events on the horizon that could affect the company’s bottom line? How does the company make its money? Is it growing and expanding or contracting and struggling? What are the company’s strengths and weaknesses? Companies with a strong balance sheet, growing customer base, and a track record of innovation will often fare better during downturns. Before you buy a stock, make sure you’re familiar with its trading symbol and exchange. You can find all this information when researching and analyzing a stock.

Before you decide to invest in a company or fund, you need to do your research. Make sure that you understand the company’s industry and its potential for growth in the future. Make sure that the company is financially stable and has a sustainable business model. Investing in a company that is struggling to stay afloat is riskier. It is important to do your research to make sure that you are investing in a company that has a promising future and that you understand the company’s value. Researching a company can be time consuming, but it is an important part of the investment process. It is important to make sure that the companies you choose to invest in have a good track record and are financially sound. This will help you to reduce your risk and make smart investment decisions.

Diversify, Diversify, Diversify

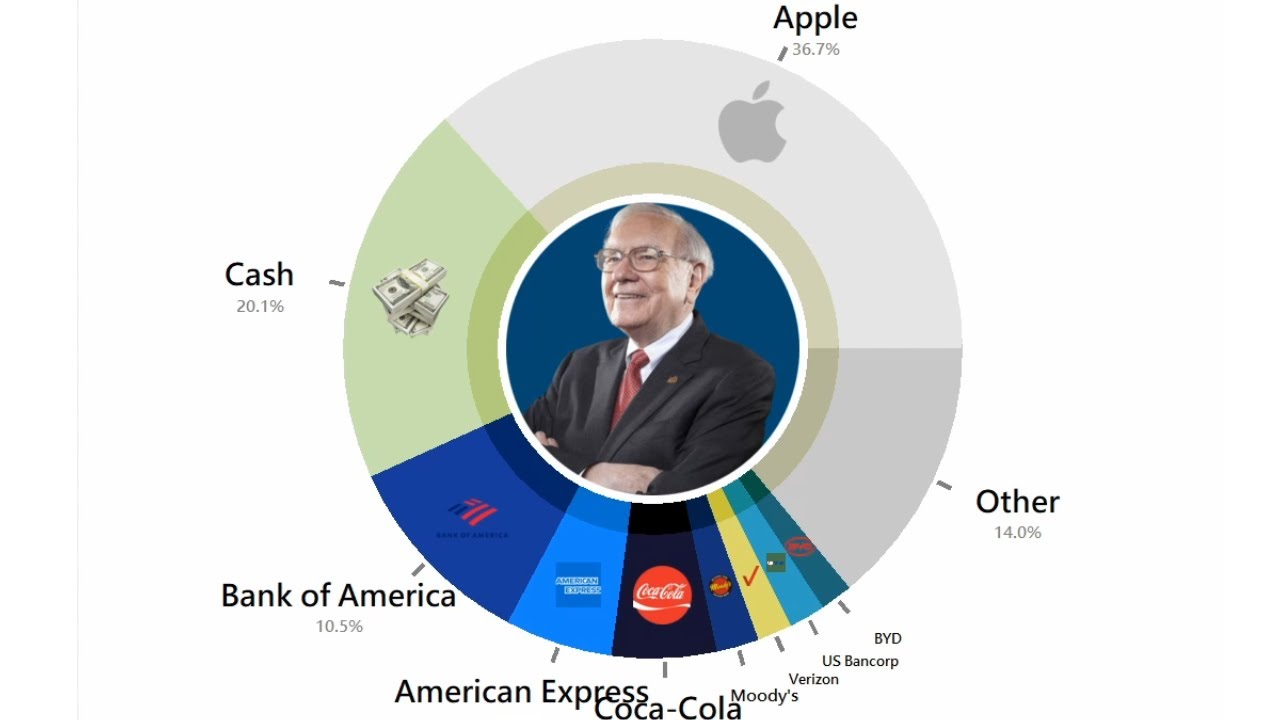

It’s important to diversify your stock portfolio. When one company’s stock crashes, you don’t want it to take a significant portion of your portfolio with it. A good rule of thumb is to own stocks in at least 10 different companies across a variety of industries. You can also diversify your portfolio by owning stocks of different market capitalizations. This is a good way to hedge your bets against an overall decline in the market. Large market cap companies tend to drop more than smaller companies when the market is in decline. You can diversify by investing in stocks in different sectors. You can also diversify by owning different types of stocks, like index funds and ETFs.

Don’t invest all your eggs in one basket

Just because you own a chunk of a company doesn’t mean you’re a part of their team. While it’s important to diversify and own stocks in different industries, don’t put all your money in one sector. Owning a piece of a large company is great, but don’t forget that the executives running that company are in charge of your money. Don’t put all your eggs in one basket.

Know your risk appetite and save enough money

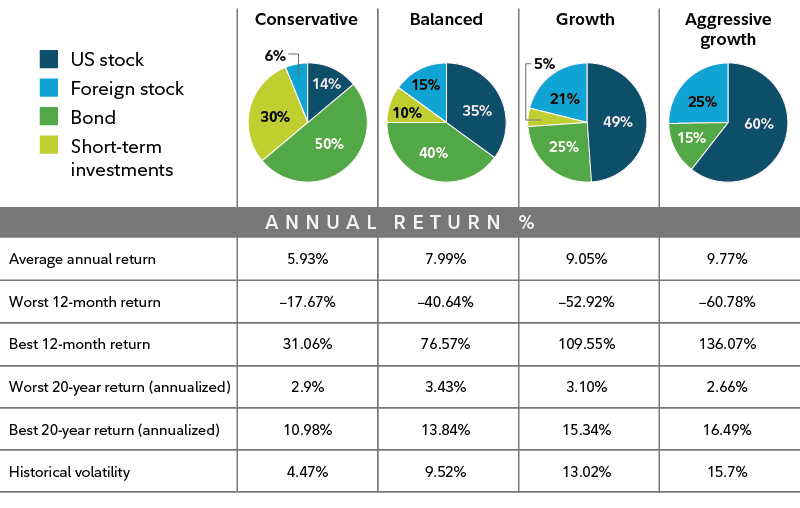

Before you start investing in stocks, you should know how much risk you are willing to take on. This will help you to determine how you will go about investing your money. Saving enough money for investing is a crucial part of the process. The more you are able to put into stocks, the more potential there is for growth. Investing enough to make a significant difference in your portfolio is key to making the most of your investments. It will allow you to diversify your portfolio, balance out your risk and make sound investment decisions.

Decide how you want to invest

There are several ways to invest in stocks. You can purchase shares of stock in individual companies, purchase stock in a mutual fund or invest in exchange-traded funds (ETFs). When you purchase a share of stock, you are purchasing a small percentage of the company. There are many advantages to investing in individual companies. You have more control and can decide what companies you want to invest in. However, this also means that you will have to do more research to find the right companies to invest in. Mutual funds are a type of investment that pools money from many investors and invests in many companies. A mutual fund could be a great way to diversify your portfolio and make it less risky. The downside is that you don’t have control over which companies you are investing in.

Tips to build your portfolio by investing in stocks

When you are first starting out with investing in stocks, it is important to diversify your portfolio. This means that you invest in a variety of stocks, industries and companies. This will help you to spread out your risk and make your portfolio less risky. When you are first starting out with investing in stocks, it is a good idea to choose a variety of stocks from different industries so that you can learn about different sectors. It is a good idea to choose companies that you know and understand. This will allow you to understand the company better, which will help you to make a better investment decision. By following these tips, you will be able to build a strong portfolio that is less risky and has great potential for growth.

Final Ideas

Stock market investing is an excellent way to grow your money while also supporting companies that you believe will grow and succeed in the long-term. There are several ways to invest in stocks, and you can also diversify your portfolio by choosing stocks in different industries and companies. Once you know your risk appetite and have decided how you want to invest, you can start researching companies and making sound investment decisions. Doing so will help you to build a strong portfolio with potential for growth by investing in the stock market.

How Can you Buy Stocks?

If you want to boost your returns and grow your investment faster, you may want to consider investing in stocks. Stocks are a type of security that represents equity (or ownership) in a company. When you own stock in a company, you have a stake in its success. When that company performs well and stock’s price rises, the value of your stock will also go up. So, do you want to buy shares from New York Stock Exchange? There are three ways to buy shares which include directly from the company, through an intermediary such as a broker or an online broker. FintechZoom will now discusses details about how can i buy stocks?

How to buy directly from the company

Buying stocks directly from the company is one of the simplest ways to invest in stocks, but it’s also the least common. Many companies issue stock, but not many let individuals buy it directly. Some examples of direct stock purchase programs include: Company-sponsored plans – Many companies let their employees invest in their stock via a tax-advantaged retirement plan. If you’re employed by a company that offers this, you can buy its stock in the open market and use those shares to fund your account. Employee Stock Purchase Plans (ESPPs) – ESPPs let employees buy company shares at a discount. If you work for a company with this plan, you might be able to use your future payroll deductions to buy shares. Direct public offerings – The company you want to invest in may offer shares directly to the public. For example, Tesla has sold shares to the public since 2010, and Uber offers investment opportunities through its app. You can buy shares directly from the company.

How to buy via a broker

When you buy stocks via a broker you’re actually signing a contract to buy shares at a specific price, on a specific date in the future. You can do this in two ways: Put in a buy order – You can sign a contract to buy a specific number of shares of a particular stock at a specific price. This is called a “buy order.” If you want to buy shares at a specific price, you can place a “limit order.” This means you’re only going to buy the stock if it falls to that price or lower. Sell short – To sell short, you have to borrow a stock from a broker and sell it in the open market. If you buy back the stock later at a lower price, you can return it to the lender and keep the difference.

How to buy stocks online

If you want to buy shares online, you can use an online broker: stock exchanges. These services let you buy and sell stocks online, often from your mobile phone using Stock Trading Apps. Many online brokers offer free trading, which means there are no trading fees. Some of the best online brokers for stock investors are: – E-trade – E-Trade is one of the most popular online brokers. You can open an account with as little as $500. – Charles Schwab – Charles Schwab has a $0 account minimum and no hidden fees. – Vanguard – Vanguard is a great option if you want to invest in a wide range of stocks. – Fidelity – Fidelity is another good choice if you’re a beginner looking to invest in stocks.

Tips before buying stocks

When you’re ready to buy shares, make sure you’re prepared to weather the market’s ups and downs. Stocks go through cycles of rising and falling prices, so know that if you buy during a “buy” period, your investment may go down for a while before rising again. You may lose some or all of your money. This is why you should only invest money you can afford to lose. Here are some other tips before buying stocks: Choose a company that interests you – You’re more likely to hold on to your stocks for the long haul if you love the companies you buy from. Start with a small amount of money – You don’t have to put all of your savings into stocks. Start small and see how you like investing in stocks before putting more money into the market.

What Kind of Stocks you can Buy?

If you’re new to the stock market, then you might be wondering which stocks you can invest in. Once you know what stocks are and why they are important, the next step is choosing which one(s) to buy. That’s where many people get stuck. In general, there are three main types of stocks that you can buy as an individual investor: common stock, preferred stock and exchange-traded fund (ETF). Each type of stock has its own set of risks and benefits. Here’s a breakdown of each one and how they can fit into your investing strategy.

What is common stock?

Common stock is essentially an ownership stake in a company. When you purchase common stock, you are buying a percentage of a business. The common stock price will change based on supply and demand, as well as the company’s future prospects and financial performance. Common stock holders will receive any profits generated by the company as a dividend. Taxes on dividends are low compared to the taxes on capital gains, which is profit that comes from the rising price of a stock. Additionally, the company will also have to follow certain rules to repurchase shares from shareholders. If a company does repurchase shares, the value of the remaining shares will increase.

What are Preferred Stocks?

Preferred stock is similar to a bond in that it pays a fixed interest rate. However, it also has some features of common stock. Preferred shareholders cannot receive any profits generated by the company. However, they rank above common shareholders in terms of receiving any remaining assets in the event of bankruptcy. Preferred stock can be a good option for those who don’t want the risk of common stock but want a higher return than bonds. However, preferred stock is generally riskier than bonds.

What is an Exchange Traded Fund?

An exchange-traded fund (ETF) is a type of fund that owns a collection of assets, such as stock funds, bonds or commodities. When you buy shares of an ETF, you are buying an ownership stake in the fund. An ETF’s value will change as the underlying assets in the fund rise or fall in price. The main benefit of buying an ETF is that it allows you to create a diversified portfolio without having to actively manage it. You can simply buy into ETFs representing various sectors and geographic regions. This makes ETFs a good option for beginners who don’t want to actively pick and choose stocks. A disadvantage of ETFs is that they are more expensive than actively managed funds.

Should you buy a common stock?

Buying common stock is one of the riskiest investments you can make. Common stock is riskier than a bond because you have no guarantee that you will get your initial investment back. However, it also has the potential to provide the highest returns when compared to bonds and preferred stock. This is because a company’s profits are distributed among its shareholders. The profits you receive from your shares will depend on the level of risk you are willing to take. A riskier stock will provide higher rewards but also has a greater chance of failing. You should not buy a common stock if you cannot handle the risk of losing all of your money.

Should you buy preferred stock?

Preferred stock is a good way to invest in a company without taking as much risk as you would with common stock. Preferred stock investors receive a fixed interest rate from the company. Unlike common stock, preferred stock does not depend on the company’s profitability. This means that the amount of profit you receive from a preferred stock is guaranteed. However, you will receive a smaller return compared to common stock because the company has to pay a fixed dividend. At first glance, preferred stock may seem safer than common stock. However, it is important to note that preferred stock ranks above common stocks pay dividends in terms of receiving dividends and assets in the event of bankruptcy. Therefore, preferred stock takes on more risk than common stock but provides a lower return.

Should you buy an ETF?

ETFs are a good option for beginners who want to invest in a diversified portfolio. However, you should not invest all of your money in ETFs because they lack the ability to actively manage the portfolio. You should only invest a small portion of your portfolio in ETFs. The rest should be actively managed funds. This will allow you to take advantage of market fluctuations and increase your returns.

Watch Out For These Things When Investing in Stocks

– Volatility –

Volatility refers to the amount of uncertainty in a company’s stock. Some volatility is normal, but if the stock prices are wildly swinging up and down, it’s a sign that the market doesn’t have faith in the company’s future due to stock prices fluctuate.

– Debt –

Debt can be good, but too much of it can sink a company. It’s important to pay attention to a company’s debt ratio. A good rule of thumb is to look for firms with debt-to-equity ratios less than 3:1.

– Insider trading –

Keep an eye out for insider trading. If executives are selling off shares of the company, it could be a sign that they know something the public doesn’t.

Conclusion

The stock market can be a scary place, but it’s also a great way to grow your savings and diversify your investments. Before you make any investments, be sure to set goals for your portfolio and do your research to find great companies to invest in. To make the most of your stock market investment, follow these tips and stay disciplined when the market is volatile.